Recommended

CASE STUDIES

The Nigerian tech sector is booming, as is their youth population. This blog outlines findings from a new CGD report with the World Bank, showing how skill building schemes and managed labor migration could provide opportunities for Nigerian youth while expanding the tech sector.

Understanding Nigeria’s tech sector

Currently, the information, communications, and technology sector (the “tech sector”) is one of the fastest growing in Nigeria. Despite the COVID-19 pandemic, in 2020, the sector contributed 15 percent of the country’s gross domestic product (GDP), second only to agriculture (figure 1). This continued a trend seen over the last five years, with the sector growing at 18 percent between 2016 and 2019.

Figure 1. The growth of Nigeria’s tech sector continued despite the COVID-19 pandemic

Source: World Bank calculations using data from the Nigerian National Bureau of Statistics (NBS), cited in “Expanding Legal Migration Pathways from Nigeria to Europe: From Brain Drain to Brain Gain.”

This growth has positioned Nigeria as the largest tech market on the African continent, with 90 tech hubs and a growing and vibrant customer base. Over 180 million people (72 percent of the population) now have access to a mobile telephone and internet penetration is projected to reach 65.3 percent in 2025, up from under 2 percent in 2001. The world’s largest tech giants—IBM, Microsoft, Google, and CISCO—all have presences in the country. Even Twitter, currently banned in the country, recognizes the importance of the market. Jobberman estimates that the sector is on track to add US$88 billion to the economy by 2027.

Yet this growth has not translated into jobs for Nigeria’s growing youth population. In 2017, the sector only employed 497,000 people, or 1 percent of the population. The main reason is a lack of digital skills among the youth population, leading to a low sense of job readiness. Despite this being a key pillar of the country’s new National Digital Economy Policy and Strategy 2020-30, the Global Competitiveness Report places Nigeria 122nd out of 140 countries in terms of digital skills development.

Despite the need for enhanced digital skills within the Nigerian economy, the tech training infrastructure is not adequately set up to provide them. Formal tech training courses are provided by universities and other higher educational institutions, at workplaces, and through traineeship programs. Yet it can be difficult for trainers to source training materials, often leaning on Nigerian diaspora abroad to provide these. This formal training is also often prohibitively expensive for the average Nigerian youth.

Instead, many turn to informal training methods, through computer repair shops and online platforms like Coursera and edX, but many employers find these skill backgrounds to be ineffective and disjointed. Trainees may be experienced in one programming language, say, but do not have a full array of digital skills.

According to a recent study conducted by CGD and ONE, this gap between employer needs and the training infrastructure set up to facilitate them comes down to funding. The government of Nigeria and local firms have not put in enough investment into supporting the human capital development of existing and new employees. This absence of investment might account for the low presence of universities and research institutes focused on supporting the tech sector.

Promoting managed migration partnerships with Europe

Despite the vast need for more qualified tech professionals within Nigeria, many instead seek to find opportunities abroad. There is no good data on tech worker migration, but certainly key countries of destination for Nigerian migrants see large numbers within their key employers.

That is not to say that such migration always leads to “brain drain;” indeed, it can have a positive impact on both the migrant and their communities of origin and destination. For example, in 2012, two Harvard Business School graduates from Nigeria cofounded Jumia, a Nigerian e-commerce hub and one of the first tech start-ups in the country. Several diaspora returnees have founded companies employing several thousands. Tech companies founded by diaspora returnees include IrokoTV, Flutterwave, and Bamboo. Yet this role for migrants, as drivers of human capital and job creation, is rarely discussed within Nigeria.

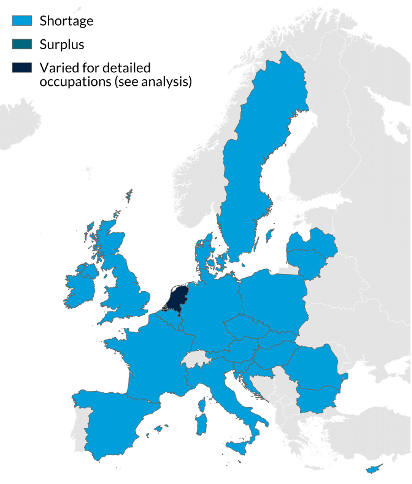

Europe is one region that is well poised to benefit from Nigerian tech talent. From 2005 to 2015, employment for tech professionals in the European Union (EU) grew by one-third, and a further ten percent growth is expected by 2025. The number of people available within Europe to take up these roles continues to decline, and (similar to Nigeria) the training and education sector has not been able to keep up with the needs of employers. Again, the sector has seemed impervious to the effects of the pandemic and skill shortages continue to grow. Today, the tech industry is a shortage occupation in 24 Member States (figure 2).

Figure 2. Tech professionals are needed in 24 European Union (EU) Member States

Source: Cedefop. 2016

In a new report released last month by CGD and the World Bank, we outline one way in which both Nigeria and various European countries could meet the needs of their tech employers: skill building and managed migration partnerships. High-income countries such as Germany, Belgium, Lithuania, and the United Kingdom (UK) could employ CGD’s Global Skill Partnership model: investing in building the stock of tech talent within Nigeria, and facilitating the migration of some of the trainees to Europe.

Such a model is not new. It builds on the success of other similar partnerships between Europe and Africa within the tech sector. Germany’s “Make-IT in Africa” supported the establishment of tech start-ups in Nigeria and Kenya. Lithuania’s Digital Explorers project brought 50 young Nigerian graduates to Europe for training courses and internships. Belgium’s PALIM project has developed the tech skills of 120 young, unemployed, Moroccans, intending 40 of them to move to Belgium. And the International Organization for Migration’s (IOM) MATCH project is a 36-month funded initiative by the EU to match high-skilled talent in Nigeria and Senegal with employers in Belgium, Italy, the Netherlands, and Luxembourg.

These projects demonstrate that there is an appetite for expanded tech migration between Africa and Europe, and that Nigeria stands to benefit. Such a project could leverage aid and private sector investment to improve the training ecosystem within Nigeria, improving job readiness among Nigerian youth and improving the competitiveness of Nigerian tech firms. It could also plug skills shortages, both in Nigeria and Europe. We’ve already charted out how such a partnership could be developed—now is the time to act.

For more information, please see Samik Adhikari, Michael Clemens, Helen Dempster, and Nkechi Linda Ekeator. 2021. “A Global Skill Partnership in Information, Communications, and Technology (ICT) between Nigeria and Europe”. Washington D.C., Center for Global Development (CGD) and World Bank. /publication/global-skill-partnership-information-communications-and-technology-ict-between-nigeria

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.