As the private sector arm of the World Bank and the world’s largest development finance institution, the International Financial Corporation (IFC) is designed to catalyze investments in countries that investors might consider too risky to invest in alone. With loans and equity investments in the private sector, the IFC aims to make sure that developing countries get the financing they need, and provides a way for the private sector to play a major role in spurring growth and alleviating poverty in some of the poorest and most vulnerable countries in the world. But our recent analysis of IFC’s portfolio found that it is shying away from risky investments, raising serious questions about whether the IFC is focusing on the places where it can make the most difference.

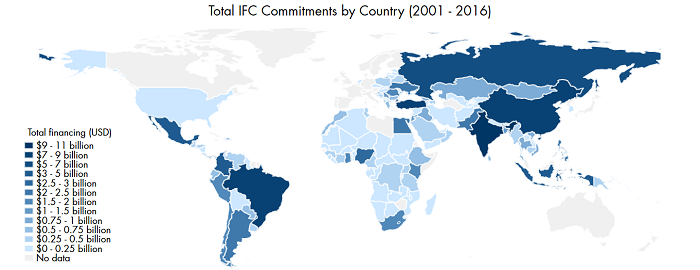

Over the past 15 years, many of IFC’s traditional partners—countries like China or Turkey—have become wealthier with more developed financial sectors, reducing their need for investments from IFC. Today, most of IFC’s portfolio is in middle income countries, and increasingly, upper-middle income countries. Turkey, China, and Brazil, for example—all upper-middle income countries—received $3.8, $2.9, and $3.0 billion in investments between 2013 and 2016, making them three of the top four recipients of IFC money. For all that makes these countries important to the IFC, it doesn’t make the IFC all that important to the development prospects of these countries. Turkey’s output averaged around $900 billion over that period, for example, so IFC’s investments averaged a little under 0.1 percent of GDP.

The IFC could have a far bigger role in promoting development in poorer countries

If the corporation had only invested in low-income countries in 2016, its investments would have equaled 2 percent of those countries’ GDP. That’s considerable. But the trend has been away from a focus on the poorest. In fact, in 2003, over 25 percent of IFC investments were in low-income countries, but by 2016, it was a mere 2.6 percent.

Examining IFC investments by country risk shows the same pattern. In the early 2000s, IFC mostly invested in countries with below-median domestic credit depth—those on the riskier end of the scale. But over the last decade and a half, that shifted to mostly above-median credit countries. In 2016, two-thirds of all IFC investments were in the top half of countries by credit depth. Again, it’s the same trend: IFC still invests in many of the same countries it has for years, but those countries have become less risky, and less in need of IFC money.

On a more positive note

Another measure is somewhat more positive to the IFC: the percentage of investments in countries that the Fragile States Index puts in its lowest “alert” category (35 countries in the latest Index) increased from 9 percent of investments 2005-8 to 16 percent 2013-2016. But still, the most fragile states, like Sudan, Chad, and the Democratic Republic of the Congo, continue to receive very little financing.

At its most effective, IFC can use its scale and position to make investments others can't or won't, helping developing countries build their economies and make their markets more attractive to the world. But that requires a portfolio that is focused on the countries where it can have the most impact: poorer, riskier, smaller economies. The Corporation has been heading in the opposite direction, and it is time for a change of course.

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.