India just did something big for the climate: it announced that it will allocate $6 billion a year in tax revenue in a way that will encourage forest conservation. That’s more results-based finance for forest conservation than any other country in the world, including the current biggest spender Norway.

Here’s how it will work: every year India’s central government collects about $200 billion in taxes. From that sum it then passes along about $60 billion to the 29 state governments. Following recommendations by India’s 14th Finance Commission, Parliament this past week accepted a watershed reform that not only increases the size of transfers to states from $60 billion to $80 billion, but also changes how this tax revenue is distributed between states.

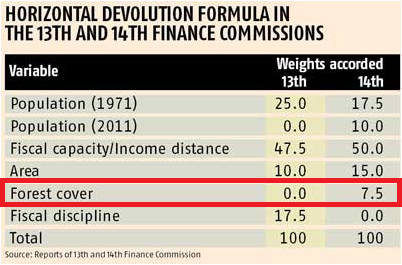

The reform changes the “horizontal devolution” formula so that the pie will now – for the first time – be shared between states not just on the basis of population, area, and income, but also forest cover. (My former CGD colleague Arvind Subramanian, who is now Chief Economic Advisor to the Government of India, explains the reform in greater detail here.)

Image source: Business Standard

States’ share of tax revenue will now depend on how much forest they’ve maintained, as monitored by India’s 2013 Forest Survey. When the formula is recalculated in five years, states can expect their share of tax revenue to go up or down based on how much forest they’ve conserved or replanted. This means that the tax revenue distribution reform is not only a radical transformation of center-state relations, as my colleague Anit Mukherjee describes. It’s also a big, albeit stealthy, climate move.

Why This Matters

Forests, as followers of CGD’s Tropical Forests for Climate and Development initiative know well, are a safe, natural carbon-capture-and-storage system for reducing climate change. Burning one square mile of tropical rainforest emits as much carbon pollution to the atmosphere as driving a typical American car to the sun and back, twice. And forests contribute to cleaner water, more food, more hydroelectricity, and safer towns and infrastructure (see my video below). So when India protects its forests, it protects the climate and promotes development.

And the incentive to protect and restore forests in India just went up—a lot. The amount of tax revenue going to Indian states on the basis of forest cover works out to roughly $6 billion per year. This means that India’s central government just surpassed Norway as the world’s largest results-based funder of forest conservation, by an order of magnitude. Since 2008 the generous Norwegians have offered around $3 billion total for reducing emissions from deforestation (REDD+), through international agreements with Brazil, Indonesia, Guyana, and others. Finance for REDD+ from other rich countries has been lower and slower. India’s impressive financial commitment hardly lets rich countries off the hook for their promised finance for REDD+; rather it raises the bar.

India’s new tax revenue apportionment formula has the potential to become quite a potent climate instrument. India reports that its regrowing forests remove more than 200 million tons of carbon dioxide from the atmosphere every year, offsetting about 15 percent of its greenhouse gas emissions from other sectors. We can expect this number to grow under the new fiscal arrangement.

India’s has around 50 million hectares of forest, so the forest-based revenue transfer works out to about $120 per hectare per year. That’s a meaningful amount. $120 per hectare per year is in the neighborhood of farmers’ potential earnings from agriculture, so it provides economically viable support to states seeking to grow their agricultural output without clearing forests. And $120 per hectare per year is larger than the payments other countries make through payment-for-ecosystem services (PES) programs to successfully incentivize individual landowners to conserve forests.[1]

Furthermore, the new tax revenue distribution formula will coalesce politicians’ and bureaucrats’ attention on forest cover. Shared focus on a single indicator may matter as much or more for success as the financial incentive itself, according to new research on government-to-government performance-based payments by my colleagues Bill Savedoff and Rita Perakis. A $6 billion pie for forest cover ought to get a lot of politicians’ attention.

The tax revenue distribution reform accepted by Parliament recognizes climate protection as a public good and fiscal policy as a tool for balancing this public good with economic growth:

We recognise that States have an additional responsibility towards management of environment and climate change, while creating conditions for sustainable economic growth and development. Of these complex and multidimensional issues, we have addressed a key aspect, namely, forest cover, in the devolution formula. We believe that a large forest cover provides huge ecological benefits, but there is also an opportunity cost in terms of area not available for other economic activities and this also serves as an important indicator of fiscal disability. We have assigned 7.5 per cent weight to the forest cover.

India has shown that smart tax policy can be smart environmental policy. The gauntlet has been thrown. Countries with similar tax revenue distribution systems and high rates of deforestation, like Indonesia, should look closely at India’s example of fiscal reform as an environmental instrument. And so, for that matter, should the United States: putting a price on carbon using a carbon tax or cap-and-trade system can fight climate change while reapportioning the tax burden more efficiently.

In the mean time, India has just given climate, forests, and everyone who depends on them something big to celebrate.

[1] Costa Rica pays landowners $60-80 per hectare per year for forest protection and $200-300 per hectare per year for forest restoration. Ecuador pays landowners $10-30 per hectare per year for forest protection; Mexico pays $27-36 per hectare per year; Vietnam pays about $15-20 per hectare per year.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.