We are now a little more than a year into the World Bank Group’s experiment of using IDA (aid) funding to subsidize private sector investments in lower-income countries and fragile states—the $2.5 billion “Private Sector Window.” The PSW is being used to indirectly or directly subsidize projects financed by the Bank Group’s private sector investment arm, the International Finance Corporation, and its private sector guarantee arm, MIGA. The experiment comes at the same time that Philippe Le Houerou, IFC’s chief executive, is leading a reform process in the institution that focuses on development impact, making markets, and improving standards. “IFC 3.0” is a welcome and important initiative for a development finance institution that in the past has been accused of putting profits before impact. But the IDA PSW instrument is a throwback to the old IFC—opaque as well as inefficiently targeted on development results. Designing “PSW 2.0” should be an urgent priority at the IDA 18 Mid-Term Review in November.

Over the next year, in the lead-up to agreeing the 19th IDA replenishment, the World Bank Group’s shareholders will doubtless take a close look at PSW projects and the impact of IDA funding. But they’ll face an uphill battle: the PSW is designed in such a way that it is almost impossible to know if there was a development impact or if the money was well-allocated. In its current incarnation, the private sector window’s resources are allocated based on perceived need by IFC and MIGA staff as they develop investment proposals—which traditionally start with a client company approaching the IFC or MIGA unsolicited. That places the window in an awkward space in the spectrum between pure private and pure public finance.

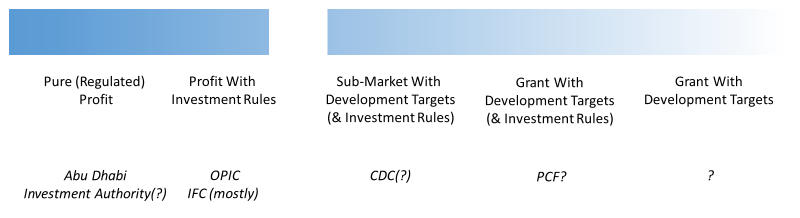

That spectrum runs from funds invested purely to maximize financial rates of return to funds invested purely to maximize (global) development impact. Along the way there are intermediate positions. One is maximizing financial rates of return subject to some constraints on investment types, locations, or sectors that are designed to increase net development impact. Another is setting the primary goal of maximizing financial rates of return while also clearing an ex-ante hurdle rate of development impact (this was broadly Todd Moss and Ben Leo’s traffic light proposal). Further along the spectrum is reversing those priorities: maximizing development impact according to a given metric while also meeting a hurdle financial rate of return. And a fourth point is abandoning financial rates of return altogether to concentrate only on development impact. To give some examples:

-

(Most) IFC operations have historically been designed to maximize risk-adjusted returns subject to constraints: investments have to be in developing countries, and they can’t back certain types of investment (in defense industries, for example, or particular kinds of power plant—at least that’s the idea).

-

The CDC attempts to maximize development impact while meeting a portfolio-wide rate of return hurdle. The CDC measures impact using an investment screening tool, which scores every investment on the difficulty of investing in the country where the investment is to be made and the propensity of investments in the relevant business sector to generate employment.

-

Prototype Carbon Fund (PCF) credits sought to maximize development impact (in this case measured as GHG reductions) given constraints including rules on investments.

But there is a break in the spectrum at the point where subsidies and development targets become involved. While additional constraints can be added to investments otherwise designed to add profits without fundamentally altering the basic investment model, moving to a system that is designed to maximize the development impact of grants in combination with market-rate finance requires formulating the development target(s) now seen as (amongst) the indicator(s) to be maximized.

This break is the gap into which the IDA PSW falls. IFC accepts sub-market returns on PSW projects—they are (effectively) subsidized. The rationale for that subsidy is to increase development returns. But the IFC doesn’t have an ex-ante measure of development impact that it is trying to maximize with that subsidy. It might want to use the Moss-Leo traffic lights, the CDC’s investment screen, or some measure of economic rate of return. Perhaps, at the least, it could use its new “Anticipated Impact Measurement and Monitoring” system to create a hurdle rate of development impact required for PSW support. But it needs some allocation mechanism beyond “first asked, first given.”

The social investment spectrum—where’s the IDA PSW?

The PSW has a related weakness, though this is one that it shares with nearly all approaches to using blended aid and market-rate finance through development finance institutions: the choice of investment is limited by client firm interest. IFC in common with other development finance institutions like the CDC rely on private project sponsors initiating deals. The actual achieved development return on subsidy resources used to back projects on such an ad-hoc and limited-information basis is likely to be lower than where subsidies are used to create deals or markets—through subsidy auctions, for example. And because development finance institutions used subsidies explicitly to offer better-than-market terms, subsidies considerably increase the risk that DFIs will crowd out available private finance. As development finance institutions do not have access to information on who else project sponsors are talking to about finance, this risk is considerably increased in a model of deal taking rather than market making. The IFC is using a doubly inefficient mechanism to allocate grants. In a world of scarce aid, that is a tragedy.

The World Bank Group’s Axel van Trotsenburg reports that “in its first year, the PSW made a strong start, committing $185 million of IDA resources and unlocking more than $600 million of IFC investment and MIGA guarantees. This further mobilized $800 million of private financing to the most difficult IDA markets.” This is a statement that needs parsing. Perhaps it is safe to say that the IFC and MIGA would not have guaranteed or invested in the involved projects without $185 million in IDA support—at least, we can ask World Bank Group staff that question. But it is impossible to know if the private finance would have been forthcoming absent the IDA and IFC resources because the private companies involved have every reason to suggest the implicit IDA subsidy was necessary even if it wasn’t. And we can’t know if this was a “strong start” in terms of development impact—a comparatively effective use of IDA resources—because there was no competitive selection or ex-ante screening process in place to ensure that a minimal use of ODA had the maximum development return. All we can know with certainty is that IDA resources that could have been far more rapidly disbursed under the traditional model are being disbursed considerably more slowly and potentially with a considerably lower development impact under the PSW.

Imagine a system where a government organization handed an undisclosed amount of cash to a private company selected on a secret, noncompetitive, unstructured basis for the delivery of a service of questionable value that it might have provided for free. That’s what the IFC is doing with the Private Sector Window. It isn’t a good look. IFC 3.0 and IDA 19 could both do better.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Preview image taken from a document by the World Bank