Recommended

As the coronavirus spreads across the globe and claims an increasing number of victims, calls have been made for the international community to raise and disburse huge sums of money to protect poorer countries, whose poverty and weak health systems make them especially vulnerable.

Amidst these funding calls, one particular finance instrument has drawn a lot of criticism: the World Bank’s Pandemic Emergency Financing Facility (PEF)—in particular the insurance window known as pandemic bonds, which is supposed to pay out when developing countries face a pandemic. The world is clearly now facing such an emergency, and it seems likely that the bonds will pay out imminently. Yet the bonds have been described by various critics as “designed to fail” and “an embarrassing mistake,” and accused of “waiting for people to die.”

This blog explores the potential role of these pandemic bonds, and these criticisms. Are pandemic bonds a good idea that has been poorly implemented? A bad idea? Or a good idea but better suited to different circumstances? And crucially, should they be renewed in May as currently planned? We argue no: pandemic bonds are an expensive way to remove risk that the World Bank is perfectly able to bear. However, parametric insurance more generally—the principle underlying pandemic bonds—is nonetheless a sound idea.

What are pandemic bonds?

Essentially this instrument is an insurance contract. If everything goes well and no pandemic occurs, they act as normal bonds. Investors provide capital to the World Bank, earn a pre-determined return each year, and when the instrument matures, the World Bank returns the principal. In the event of a pandemic that meets certain criteria, instead of repaying the principal to investors, the World Bank gains control of some or all of the funds, and disburses it to the affected countries to help deal with the outbreak (or replenishes their own reserves, having already disbursed funding).

The pandemic criteria—determined by the World Bank in conjunction with the World Health Organization (WHO) and the private sector—are detailed and intended to strike a balance between being a good indication of the severity of the crisis, and a reasonable investment proposition. (Contrary to what some have claimed, the criteria do NOT include any declaration from WHO.) If they trigger payments too often, it would be hard to get anyone to invest, and payouts may be made when not needed. If they trigger payments too infrequently, severe crises may receive inadequate funding (scenarios jointly referred to as “basis risk”). Each disease covered is subject to separate criteria and different maximum payouts from the PEF. For coronavirus, the PEF can pay out up to $195 million from its insurance window.

In principle, these criteria could increase the speed of response and take politics and uncertainty out of funding decisions. Disaster-affected countries needn’t wait until the international community has conducted a whip-round to know how much funding they have to respond to an outbreak, and what to do with it. Instead, countries can put plans in place for how to spend the particular sum should the conditions be met, allowing a faster and more effective response. It also takes time to raise funds from donors, whereas the PEF financing is basically ready to go on authorisation. The PEF brochure claims that the insurance window “will pay out quickly, within days of an outbreak”: this is crucial in pandemic outbreaks in which the cost of containment—and lives lost—rise exponentially. And the funding level is not contingent on donor generosity—a feature which could be particularly important in times where such donors are also facing problems.

How have they worked in practice?

In practice, pandemic bonds have not met this potential. Among other things, critics point to the length of time that needs to elapse before the criteria are even assessed. A payout is only considered after the epidemic/pandemic has run for 12 weeks. After that, one of the criteria involves the growth rate of the pandemic over a two-week period, and a few days are apparently needed to analyse the data, meaning the minimum period before financing is disbursed is more than 14 weeks. This is why despite the start of the coronavirus outbreak being declared 31st December (the day China informed WHO of the new virus outbreak) for the purpose of the bonds, funds still have not been released. This is despite the fact that these bonds originated from a recognition of the need to respond quickly to pandemics: in the 2014 Ebola outbreak, WHO estimated that the cost of responding effectively was $5 million in the first month. Three months later, this had risen to $71 million, and then to $490 million a single month after that. Roughly, in the same period of time it takes for a PEF payout to occur, the cost of tackling Ebola increased a hundredfold. Even with a big margin of error around these numbers, it is clear that the speed of payouts would not have been ideal.

The criteria for payout also include “numbers of recorded deaths” from relevant diseases, which is problematic in countries with limited ability to accurately track and record cases. Pandemic bonds failed to pay out in the 2019 Ebola outbreak in the Democratic Republic of Congo because the criteria required 20 people in a neighbouring country to die from the virus. In neighbouring Uganda, a few people died, but not enough to meet the criteria. But it is not beyond the realms of possibility that more people died than were recorded.

However, if it looks inevitable that the criteria will be met (as in the case of COVID-19), the World Bank could disburse the funds beforehand and then be reimbursed. This happened in the current outbreak: even though the bond hasn’t yet paid out the World Bank had already committed funding (around $10 billion of which was new) to IDA-eligible countries to fight the virus. In this case the PEF is not insuring the potential recipient against a pandemic, but the World Bank itself. The World Bank can either re-divert other IDA funds, or raise additional capital on the markets to facilitate a surge in expenditure, and then be repaid later.

Does this make sense from the World Bank’s perspective? The primary purpose of insurance is to smooth consumption: those who are risk averse pay a premium to ensure that potential losses are mitigated. When the insured and insurer have the same information about the possibility of future scenarios, this premium means that in expectation, the insured party loses money. Generally, for this to be worth it, the potential loss insured against has to be considerable: we insure our houses because we don’t hold enough ready cash to replace them if they burn down, but we don’t insure our stationery because it would not be burdensome to replace, and so it is not worth paying to have the risk of their loss removed.

In the case of PEF, the World Bank is paying around $36 million per year to remove the risk of losing (insure) $430 million. Far from being an onerous loss for the World Bank, this is a drop in the ocean for an organisation with such a high credit rating, and one that regularly raises and disburses financing an order of magnitude higher. One ratings agency was clear that the World Bank could double it’s borrowing without its credit rating being adversely affected.

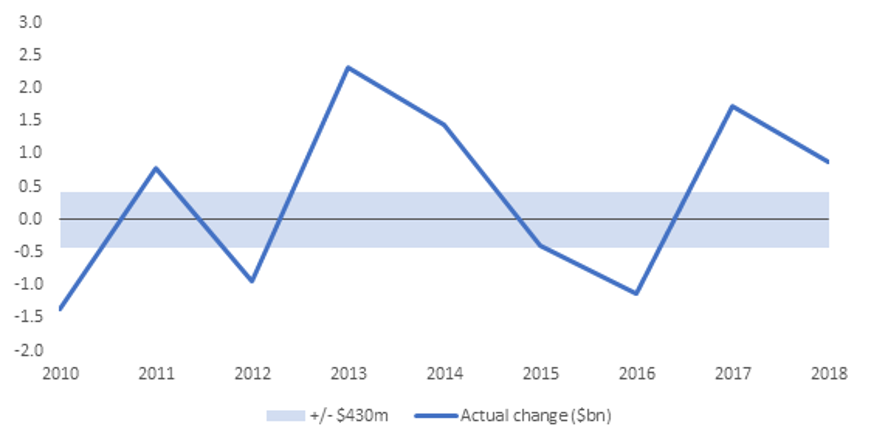

It might still be worth it if the World Bank simply has a strong preference/need for smooth year-to-year changes in borrowing/disbursements. But this is hard to reconcile with actual World Bank disbursements: over the last nine years, the change in disbursement was larger than $430m in every year but one (whether positive or negative).

Annual change in World Bank disbursements ($ billion)

Source: OECD stats, Creditor Reporting System

At the time the bonds paid out, the World Bank would have paid around $100m to reduce the increase in disbursement from $10.4bn, to $10bn, a reduction of about 4 percent. This is in the context of market debt during the IDA18 round of around $22 billion, and near-zero borrowing costs that are predicted to change little even with big increases in borrowing. This emphasises another key criticism: the amount raised by these bonds is tiny in comparison to what is needed. Calls have been made for the World Bank to frontload IDA replenishment commitments and raise additional funding in the markets to mobilize $130 billion in financing. In this context, the $195 million paid out will largely go unnoticed.

Of course, COVID-19 is not the only scenario for which the pandemic bonds were intended, and possible scenarios could have been much smaller in scale. And the PEF is intended to be one contribution to disaster response among others. Nevertheless, there is a tension between the strict criteria—the pandemic must be affecting several countries and be growing rapidly after already having killed thousands—and the size of potential financing.

Obviously, things may not pan out exactly as envisioned by those signing the contract, and it may be that ex-post, a lot of that money represents additional financing that wouldn’t otherwise have been raised. But in expectation, that doesn’t mean it was originally a good idea, just as winning the lottery doesn’t mean buying a ticket is a good bet on average. If all parties were equally informed, then the expected benefit of receiving the additional finance was more than cancelled out by the cost of the premiums. This is particularly relevant to the question of renewal: it is very possible that the coronavirus episode leads to a re-evaluation of probabilities and an increase in premiums demanded. Perhaps the World Bank had a better idea of the chance of criteria being met and payments being made, but the divergence must have been wide given that the bonds were hugely oversubscribed.

Where does this leave parametric insurance and innovative finance more generally?

A lot of the criticism of the PEF therefore looks justified: it’s odd for the World Bank to pay out such large premiums for the transfer of risk that it easily could have borne. Ideal funding would be quick, predictable, and commensurate to the size of the disaster. However, the money raised by pandemic bonds was slow, uncertain, and tiny in comparison to what was needed.

But critics would be wrong to seize on this failure to claim that the principle of parametric insurance is fundamentally unsound. Several risk-sharing mechanisms exist that have paid out quickly following disasters and helped mitigate the damage, including the Caribbean Catastrophe Risk Insurance Facility, (CCRIF), and African Risk Capacity (ARC). As explored in a previous CGD working group “Payout for Perils”, these mechanisms are deemed to have been successful when they have the following characteristics:

- Parametric triggers are immediate: With costs escalating rapidly, any delay in evaluating criteria is costly. The Haiti 2010 earthquake is a good example: Broadly, the trigger for payment was the magnitude of the earthquake, which could be assessed as it happened. Consequently, CCRIF announced hours after the event that payments would be disbursed. Occasionally it may even be possible for payouts to be confirmed before the disaster has claimed lives. This is in stark contrast to pandemic bonds, whose minimum period before paying out is months.

- Premiums provide incentive to plan: The higher the bill is expected to be when disaster hits, the higher the premium demanded by insurers will be. Therefore, when those paying the premiums also have some capacity to reduce the expected cost of disaster (perhaps by developing health monitoring systems) they have an extra incentive to do so. With pandemic bonds, incentives are not so obviously aligned. The World Bank can encourage a higher focus on preparedness, but ultimate responsibility lies with client countries.

- Parameters are well calibrated and risks are well understood: There is a reason why parametric insurance has tended to be limited to physical natural disasters such as hurricanes and earthquakes: there is a much longer history of modelling these risks, and so they are much better understood. By contrast, pandemics are harder to model partly because their effect is so dependent on human behaviour. Different models of how coronavirus might spread have yielded vastly different results. Some decisions were taken on the basis that it would behave similar to the flu, which turns out not to have been the case. This is not to say that superior modelling is not possible, but arguably, we aren’t yet sufficiently good at pricing these risks. This may be why it takes so long to determine whether criteria have been met: this is how long those drafting the criteria anticipated it would take to be sure that an outbreak reached pandemic proportions.

In short, parametric insurance is an idea that is already beginning to realise its potential, even if there is scope to dramatically scale up. And there are clearly countries and institutions that would benefit from removing catastrophic risks, even if it came at a cost. But pandemic bonds clearly did not work as intended: they didn’t speed up payments to recipient countries, didn’t provide certainty about when and how big the payments would be, and so didn’t help countries plan for them better. They were an expensive way of removing risk that the World Bank was easily capable of bearing.

So even if pandemic bonds could have potential for smaller organisations/countries in the future as our ability to measure risks associated with pandemics improves, the insurance window of the PEF should not be renewed. Instead, the World Bank could use the money saved to assist other, more successful risk-sharing mechanisms (such as CCRIF) that it helped to create.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Center for Global Development