Recommended

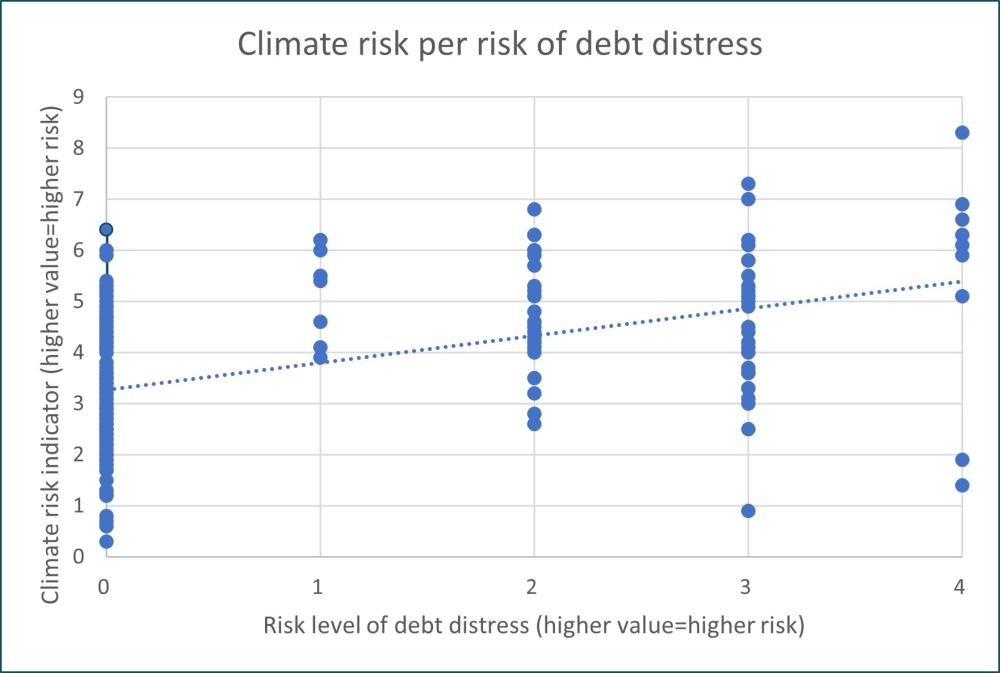

Developing countries are facing a pair of looming crises in climate change and debt. And while these are distinct crises, they are linked: countries more vulnerable to climate change are also facing higher debt risks (figure 1).

The idea of solving both crises simultaneously is appealing, and that’s exactly what debt-for-climate swaps promise to do—at least in theory. With interest in these swaps increasing, it’s a good time to look at what they are and whether they can help.

Figure 1. Countries’ debt risk categorization and climate vulnerability

Source: Authors.

Note: Risk Level of Debt Distress from IMF DSA, Climate risk measured using IMF Climate-driven INFORM Risk Composite Index. Each dot represents a country.

What are debt-for-climate swaps?

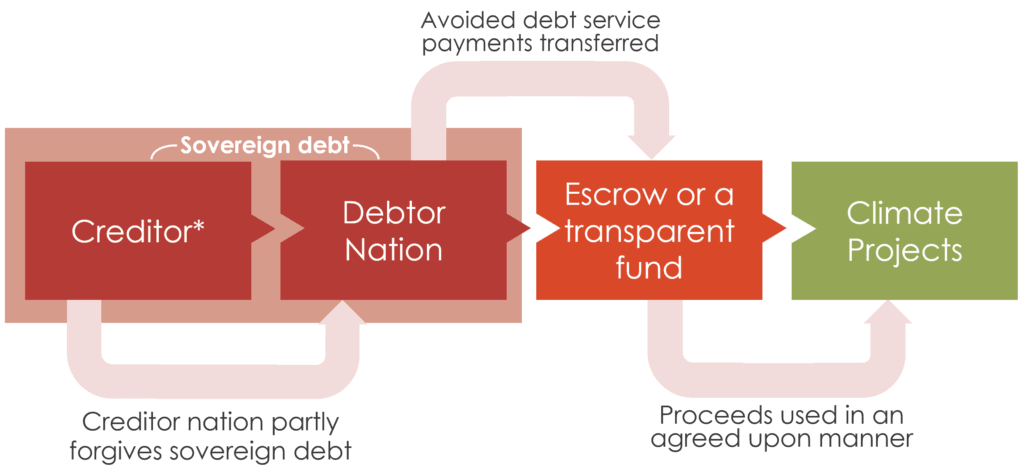

Debt-for-climate swaps are a form of debt relief that transforms debt into a grant committed to undertaking climate-related investments. Suppose a developing country is indebted to a bilateral creditor that wants to offer debt relief and encourage the developing country to pursue climate-friendly policies or projects. The creditor agrees that the developing country no longer needs to service its debt. In return, the developing country agrees with the lender either (i) to spend the money that would have been spent on debt service on climate-friendly projects or (ii) to adopt climate-friendly policies. The basic structure of a debt-for-climate swap is shown in figure 2.

Figure 2. Debt-for-climate swap structure, simplified version

Source: Climate Policy Initiative

Why won’t debt-for-climate swaps do much to solve the climate crisis?

Debt-for-climate swaps have received more attention over the last few months as the international community tries to reach the $100 billion-per-year climate finance goal set out in Copenhagen in 2009. These swaps would increase climate spending, but they are unlikely to have any impact at scale, for several reasons.

First, the countries that need debt relief are largely not the ones responsible for climate change: the 37 countries at high risk of debt distress or already in debt distress account for just 0.5 percent of total world emissions. That means that climate projects in these countries would be best focused on adaptation, not mitigation—which is valuable, but not likely to reduce global emissions or help the world reach the 1.5-degree climate goal any faster. (Swaps could be used in bigger carbon-emitting countries, like India or Brazil. But if their external debt is relatively low, other forms of support would be better, as we discuss below.)

Second, since the first debt-for-climate swap in 1987, the total face value of debt treated globally through these swaps has been $3.7 billion, according to recent analysis by the African Development Bank. However, the amount actually allocated to environmental projects was less than half of the debt relieved (around $1.5 billion—a total over 20+ years that is only 1.5 percent of the $100-billion-per-year climate finance goal). These swaps are simply not a very efficient way of mobilizing finance at the scale needed, because a substantial portion of the money relieved by the debt doesn’t go toward climate projects.

Why won’t debt-for-climate swaps do much to solve the debt crisis?

Debt-for-climate swaps also have had a minimal fiscal impact on the countries involved, according to the African Development Bank. The Heavily Indebted Poor Country (HIPC) initiative and related Multilateral Debt Relief Initiative (MDRI) programs relieved 37 participating countries of more than $100 billion in debt. And current debt of poor countries now amounts to some $200 billion according to some estimates. While debt-for-climate swaps could contribute some relief, so far they haven’t been able to reach the scale needed—to date only $3.7 billion—and the resulting budgetary space for poor countries has been small. Other treatments offer better ways to tackle the debt crisis including finding alternatives to borrowing, managing borrowing and lending better, increasing accountability to improve the behavior of borrowers and lenders, and introducing better ways of managing debt.

How can debt-for-climate swaps help?

While debt-for-climate swaps won’t solve either problem, can they help at the margin? To answer this, we need to compare this instrument with the other alternatives on the table, like climate-conditional grants and comprehensive debt restructuring.

An IMF working paper on debt-for-climate swaps finds that when a country’s debt is sustainable, debt-for-climate swaps are less efficient than just doing climate action through conditional grants, as swaps subsidize non-participating creditors. However, there are cases where they could serve a limited purpose: when a country needs a comprehensive debt restructuring, debt-for-climate swaps could provide an incentive for otherwise reluctant creditors to participate in debt relief. And they could nudge debt-ridden countries in a climate-friendly direction.

If debt-for-climate swaps bring new money or new actors into the development finance system, they may be worthwhile, even if they’re not the most efficient use of finance. But while they are an interesting and innovative idea, debt-for-climate swaps are likely to be only a small part of the solution to the looming debt crisis and the ongoing climate crisis.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.