By

July 22, 2011

Dr Kamal-Yanni of Oxfam and Daniel Berman of Médecins Sans Frontières have responded to my earlier post which called for caution in trying to drive down vaccine prices.They argue that vaccines which are developed for rich country markets should be available at the lowest possible price in developing countries:

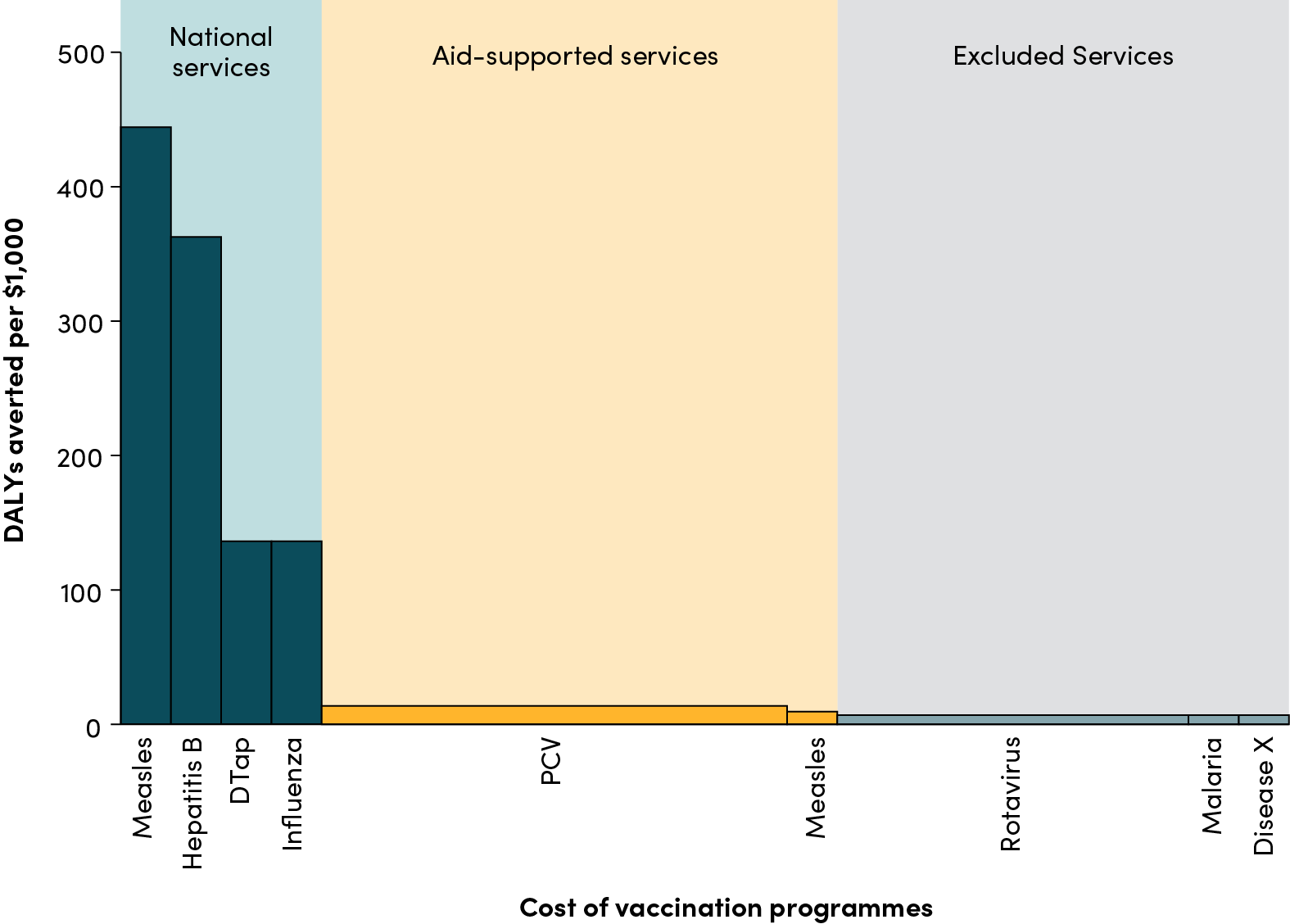

... the return on the cost of most new vaccines comes from wealthy countries, since research and development (R&D) is targeted to those markets. Rotavirus and pneumococcal vaccines-- two top priorities of GAVI were first developed for and have impressive sales in rich country markets. In 2008, Pfizer earned over $2.8 billion in annual revenue from the sale of its pneumococcal conjugate vaccine, Prevnar. A New York Times article notes Prevnar sales are expected to top $5 billion annually by 2015.For those vaccines that already earn multinational companies high returns on investments in the developed world, there is no risk to the viability of vaccine supply from low-cost production. In other words, companies will not necessarily abandon the market if the price is lower in developing countries if they are making healthy profits in rich markets. Indeed, market segmentation is already a core principle, well established in the orthodoxy of innovator companies, therefore it is difficult to see why vaccine prices for such products should not be as low as they possibly can in the poorest countries and for the poorest people.I completely agree with Dr Kamal-Yanni and Daniel Berman on the importance of the principle of 'market segmentation'. For products which serve people in industrialised countries and in developing countries we should encourage the practice of charging higher prices for richer consumers to cover the costs of research and development, so that the prices charged to poor consumers can be kept as close as possible to marginal cost. (I have written about that before, here and here.) There is scope for a lot more thinking about how public policy can support and enable firms to practice this kind of price differentiation more extensively (for example, by using regulatory restrictions to prevent arbitrage).But it does not follow, as Dr Kamal-Yanni and Daniel Berman suggest, that the prices of pneumococcal conjugate vaccines for developing countries should be 'as low as they possibly can be'. There are three reasons why it has been important to create additional incentives for private investment in pneumocooccal vaccines.First, it is not simply a question of rolling out Prevnar in Africa and Asia. Prevnar is a 7-valent vaccine which was developed for rich country markets and is not well adapted to preventing infection against the serotypes of pneumococcal infection which occur in developing countries. The vaccines now being purchased under the Advance Market Commitment (AMC) are 10- and 13-valent vaccines which are better suited to the serotypes in developing countries. Nor can vaccines which have been tested only in Europe and North America simply be distributed in other countries. The AMC has stimulated important research on the impact of pneumococcal vaccines in Africa and Asia (for example, gathering data for the first time on the impact on HIV-infected people). It accelerated the process of obtaining regulatory approval. It has also stimulated work on different 'presentations' (such as Pfizer's 4-dose vial) which bring down prices and make it easier to get vaccines to people in more difficult environments.Second, we want vaccine companies to scale up production very considerably to produce enough vaccines for people in developing countries. We don't have well-documented estimates of the cost of setting up a large-scale production facility, but informed speculation suggests that it costs somewhere between $100m and $400m. Companies face a significant risk doing this: namely the possibility that they will spend the money on a new plant, and then get hammered by purchasers intent on driving down the price (for example, under pressure from Oxfam and MSF). Once the plant is built, the producer has no bargaining power: they have capacity to produce millions of doses and nobody else to sell them to. This means the purchasers can force the price down to marginal cost, and so the producer won't recover the fixed cost of the production facility. To avoid that risk, the company may choose not to build the plant in the first place. (This is known in economics as the 'hold up' problem.) So if we want firms to build facilities to mass-produce the vaccines for developing countries, we have to agree a price in advance which covers this part of the fixed costs, and then resist the temptation to drive the price down once the plant has been built.Third, the idea that we should just roll out the vaccine at the lowest possible price ignores the substantial benefits of further investment in research and production capacity, which will result in better and cheaper vaccines for everyone. Merck is currently making a 15-valent vaccine for pneumococcal infection which - apparently because of the AMC - they plan to to produce at large scale at an affordable price for developing countries. The AMC is attracting companies from emerging markets, such as FioCruz in Brazil (who have done a technology transfer deal with GSK) and manufacturers in India and China who are in late pre-clinical testing of formulations designed to meet the needs of developing countries. Dr Kamal-Yanni and Daniel Berman compare the pneumo AMC with the Meningitis Vaccine Project, which has indeed been successful in many ways. But because the price has been set so low for the Meningitis A vaccine, there is (as far as I know) no private investment in new and better vaccines, in contrast to the efforts being made to develop better and cheaper pneumo vaccines.When governments and public authorities invest directly in developing and producing vaccines they need to manage carefully the possibility that there is, or may appear to be, a conflict of interest between these activities and their normative and regulatory functions such as licensing and recommending vaccines. It is possible that some pharmaceutical companies may have been put off developing a new Meningitis A vaccine by the prospect of having to secure regulatory approval from public authorities who are themselves investing in an alternative vaccine.We do not have to speculate too much about what would have happened if we followed the advice of Dr Kamal-Yanni and Daniel Berman and set the price of pneumo vaccines as low as possible. We can see what happened when vaccines for Hepatitis B and Haemophilus Influenzae Type b (Hib) were developed for use in rich countries. In principle, exactly the same 'market segmentation' principles should have applied in these cases. According to the view put by Dr Kamal-Yanni and Daniel Berman the firms could have recovered their investment in rich countries, and sold the vaccines at cost in developing countries. But in practice that didn't happen: it took at least fifteen years before those life-saving vaccines were available in developing countries.It does not reflect well on the pharmaceutical industry that these vaccines took so long to be produced for developing countries. But nor does it reflect well on public policymakers who failed to think about the incentives required to get them to do so. Somebody has to bear the costs of getting regulatory approval, sorting out appropriate presentations for developing countries, and building large enough plants for mass production. In some cases, such as pneumo, the vaccine itself may have to adapted. Firms are reluctant to bear these costs if they are unlikely to be able to recover those investment through sales, and if they perceive a risk that their high-price markets will be undercut by imports of low-cost substitutes manufactured for developing countries.About two million people die each year of vaccine-preventable diseases. Our reluctance to create incentives which make it profitable for pharmaceutical companies to serve these people is not "erring on the side of the poor": it is erring on the side of ideology at the expense of the poor.An alternative approach, favoured by Dr Kamal-Yanni and Daniel Berman, is to manage this work as a public sector led partnership like the Meningitis Vaccine Project. These kinds of partnership and the AMC share some important characteristics: public authorities determine the strategic health goal, provide a subsidy to the private sector to develop and produce the vaccine, and set the price of the product. But there are important differences too. In the public-private partnership the subsidy is paid in advance to the chosen private sector partners, whether or not the vaccine is delivered. In the AMC the subsidy is paid transparently though a higher price, in proportion to the amount of vaccines which are actually delivered and used. While the public-private partnership relies on the good sense and experience of the public authorities to choose appropriate partners and shape the vaccine development strategies, the AMC allows any firm - including pharmaceutical companies in emerging markets - to innovate and compete for part of the subsidy. The AMC places more faith in the benefits of diversity and competition than the public-sector directed approach, and it links the subsidy directly to results achieved. While the public-private partnership puts public authorities in the possibly uncomfortable position of being both a producer of vaccines and the regulator, the AMC keeps those roles separate.Dr Kamal-Yanni and Daniel Berman are concerned about "overly cosy relations" in GAVI, where pharmaceutical companies have 2 seats on the 27-member board, yet they seem less concerned about collaborations between the public and private sector which involve substantial grants to private firms, often with little transparency, which create a potential conflict of interest for public authorities.I don't have an ideological position on the respective merits of the private and public sector: each has advantages and disadvantages. (I do plead guilty to having a bias towards more open, diverse and competitive approaches.) You can make a case for developing medicines mainly in the public sector, based on the idea that the knowledge generated by R&D is a public good and ought to be free for everyone to share. But that logic applies also to the development of medicines for families in rich countries. I notice that, in practice, most rich countries prefer to engage the resources, innovation and energy of the private sector, working alongside the public and non-profit sectors, in developing and producing new medicines. Perhaps we want this kind of mixed economy because some people doubt that programmes directed by the the public sector alone will be able to deliver these products. I don't want to live in a world in which we have one level of aspiration for technologies for our own health needs, which we choose to meet by a combination of public and private efforts, and lower aspirations for developing countries in which we rely on programmes funded and managed by the public sector alone. But if we want the private sector to do this work too, we have to set appropriate incentives for them, rather than create conditions in which this cannot be a worthwhile business and then complain about their values when they don't participate as much as we would like.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.