Ideas to action: independent research for global prosperity

Multilateral Development Banks

More from the Series

Blog Post

April 11, 2018

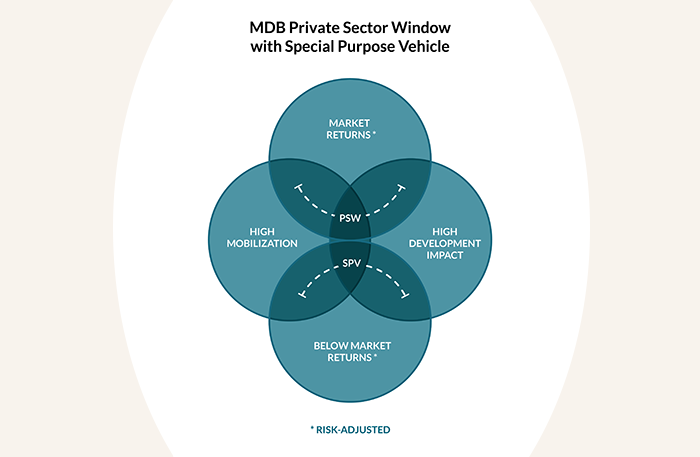

There is an urgent need to change PSW business models to maintain their financial sustainability while doing much better on mobilization and development impact. Two factors are critical for meeting this challenge: enhanced risk management capability and greater flexibility regarding risk-adjusted re...

Blog Post

April 09, 2018

The Eminent Persons Group (EPG), tasked with making the system of international financial institutions fit for purpose in the 21st century, recently gave the G20 Finance Ministers a preliminary report on its work.The report is a bit long on generalities and short on specifics and, as ...

Blog Post

March 05, 2018

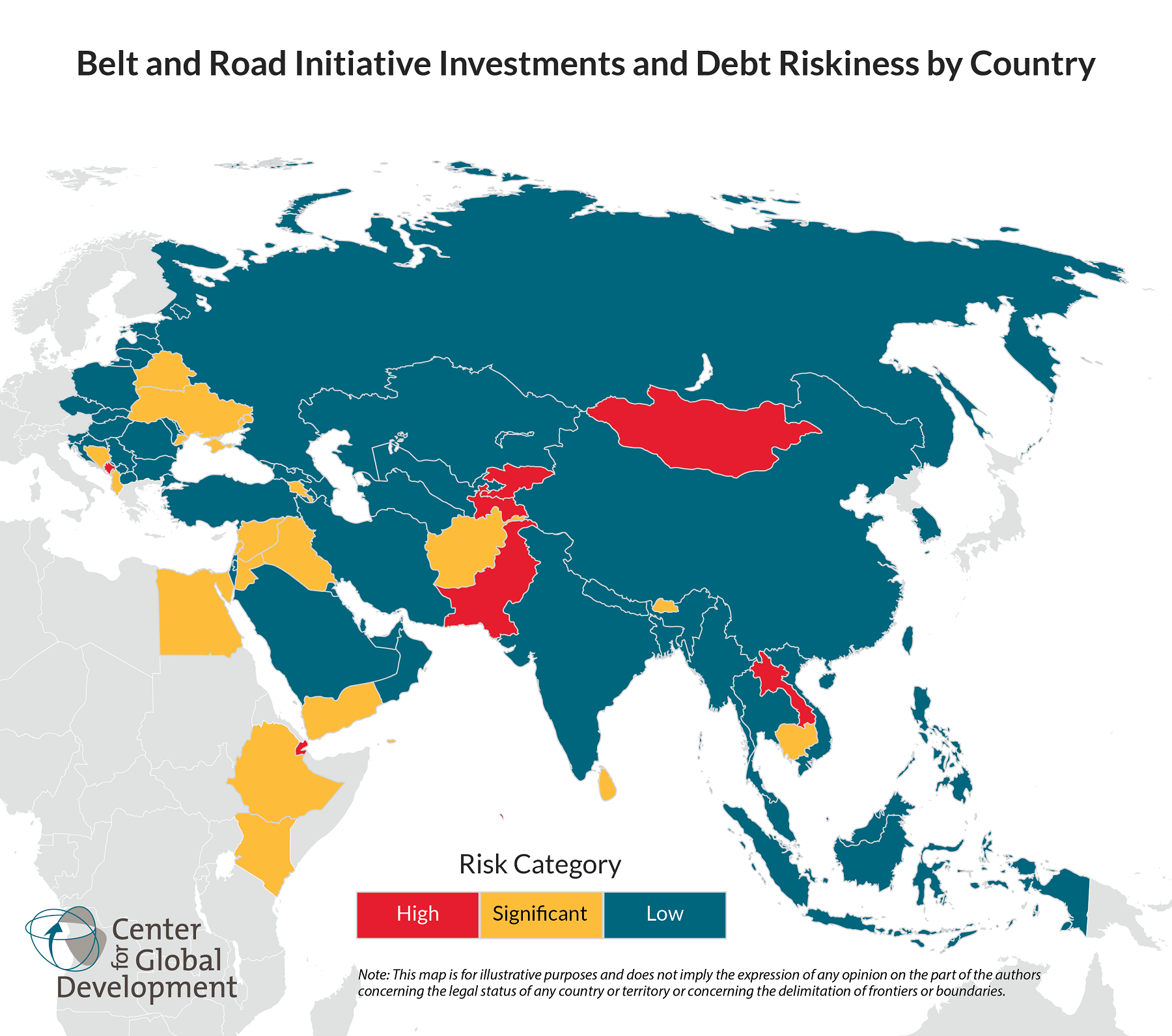

In a new CGD paper, we assess the likelihood of debt problems in the 68 countries we identify as potential BRI borrowers. The big takeaway: BRI is unlikely to cause a systemic debt problem, yet the initiative will likely run into instances of debt problems among select participating countries—...