The “Addis Ababa Accord”will be the main outcome of the upcoming Addis Financing for Development Conference in July, billed as the event where we figure out how to pay for the Sustainable Development Goals.

The draft accord is wide ranging and ambitious, and it contains enough specifics to suggest it really would make a difference to global development. The co-chairs have done a wonderful job. For all that, there are some places where the draft could be stronger still with more in the way of specifics. In this collection are some specific thoughts from CGD experts on making it stronger.

There are 20 pages covering the Addis Ababa Action Agenda. And while they are inevitably bubble-wrapped in diplo-speak and hat-tipping, there is a solid package of proposals nestled within. They cover domestic public finance, private finance, international public finance, trade, debt, technology, data and systemic issues. Amongst many other things, the Agenda calls for more tax and better tax (less regressive, more focused on pollution and tobacco). And it is long and specific on base erosion, tax evasion and competition and tax cooperation. It calls for financial inclusion and cheaper remittances. The draft discusses blended finance and a larger role for market-based instruments to support infrastructure rollout, as well as a new measure of “Total Official Support for Sustainable Development.” It calls for Multilateral Development Bank reform including new graduation criteria and scaling up. And it suggests a global compact to guarantee a universal package of basic social services and a second compact covering infrastructure. Finally, the draft has a good section on technology including the need for public finance and flexibility on intellectual property rights.

If the draft was agreed as it stands, it would be a good start to the year of big sustainable development conferences. But it could be better, of course. Here are a few initial suggestions:

- There is boilerplate language (and then some) on the quantity of aid in the draft — the 0.7 percent target is given its due. But there is less on the specifics around quality and targeting. Why no targets around the percentage of ODA on country budgets, or results-based aid or ending tied aid? Why not a numerical target for aid supporting delivery of global public goods like research and development, evaluation, climate, and international cooperation on infectious disease monitoring and reaction? Why not something on making sure that when a tree doesn’t fall in the forest, somebody pays for that?

- The draft calls for international financial institutions including the World Bank to start a process examining their ‘role, scale and function.’ Why not get specific and call for a regular Bank Resource Review as part of that? And the call for “Total Official Support for Sustainable Development” could come along with a targeted percentage, perhaps? (Also: a better name and acronym. This one should be TOSS’D).

- Transparency makes multiple appearances including under the domestic resource, private finance and aid sections. And there is a recommendation for every country to join the Open Government Partnership, but more specific actions could help. For example, the draft could support signing up to the IMF Fiscal Transparency Code and Open Contracting, perhaps even specifically to government contract publication, that is vital to improving the quality of public investments, public-private partnerships and aid.

- There is a call for a global initiative to help scale up investments in sustainable infrastructure. It would be good to add some specifics. Not least, for infrastructure (and energy in particular) to be both financially and environmentally sustainable, it should be priced at cost wherever possible. Financial sustainability is also key to attracting private sector providers. The global initiative should promise to significantly increase support for market rate and market-based long-term finance for infrastructure in return for sustainable pricing that will make market-rate financing fiscally sustainable.

- The draft makes the important statement that migration is a development issue but is short on specifics. What about encouraging global skill partnerships or proposing national treatment in terms of college costs for students from LDCs or increasing LDC migration as a percentage of total migration flows?

- The language on technology and innovation pushes for public finance of R&D — why not a target, perhaps specifically on ODA towards technology development in areas like neglected tropical diseases or off-grid energy? And why not a commitment to work together to increase the quality of patents and allow tiered pricing of technology, making it more affordable in LDCs?

The pieces collected here outline some of these ideas and others in greater depth.

Let’s Mobilize the Right Domestic Resources for Development

The top one percent of Americans get 21.0 percent of total income, pay 21.6 percent of total state and federal taxes. So much for a progressive tax system. But if US taxes are only just barely redistributive, some developing countries have systems that are even more unequal. They rely much more heavily on sales and trade taxes that are often regressive — taking a larger percentage of poor people’s income than from richer people.

That raised concern around original language in the Addis Financing for Development draft on Domestic Resource Mobilization setting a goal of government revenues worth at least 20 percent of GDP. While that language has gone, there’s still scope to add specific language on broadening the tax base. The Addis accord is right to focus on domestic resource mobilization, which will by far the largest source of funding to meet development goals. But it should focus more on where those resources come from, and ensuring more taxes don’t deepen inequality.

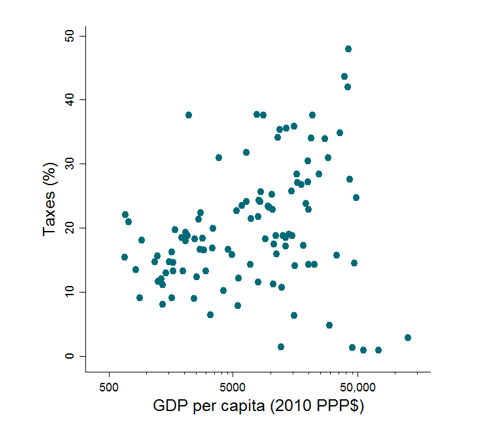

No country which has world class income, health and education outcomes has government expenditures that aren’t many multiples of those in the poorest countries. Again, cross-country evidence suggests that more developed countries tend to see higher tax revenues as a percentage of GDP. Using data from the International Center for Tax and Development on taxes to GDP and World Bank income data, Figure One displays the relationship between the two using all countries with non-zero tax reports. The four outliers with very low tax and very high incomes are the United Arab Emirates, Saudi Arabia, Kuwait and Qatar.

But we only want more tax revenue if it is equitably raised and efficiently spent. While poorer people tend to receive a larger share of the transfers that governments distribute than their income share, even allowing for that, the net effect of government on poverty income inequality in developing countries can even be to increase it. The extreme poor are net payers to the fiscal system, on average, in Armenia, El Salvador, Ethiopia, Guatemala and Peru. The incidence of poverty after transfers, taxes and subsidies is higher than market income poverty in Armenia, Bolivia, Brazil, El Salvador, Ethiopia, and Guatemala, according to work by CGD’s Nora Lustig and colleagues at the Commitment to Equity (CEQ) project.

The Addis draft already suggests the importance of fairness in taxation: “while recognizing that optimal tax policy is necessarily reflective of a country’s economic and social situation, we will work to improve the fairness and effectiveness of our tax systems. Our efforts will include broadening the tax base.” But that language could be considerably strengthened. I would suggest adding: “relying less on general value added other indirect taxes that tend to be regressive and more on income taxes alongside ‘sin’ taxes on pollutants, tobacco, alcohol and other harmful consumption. We will work towards the goal of ensuring that government tax and transfer programs do not reduce the consumable income of those under national poverty lines.”

Developing countries need more revenues if they are to achieve the incredibly ambitious SDG agenda. And most of those revenues will be domestic. But if the development goals around equitable development in particular are going to be met, taxation has to be progressive and spending considerably more effective. Any language on revenue levels should be matched with equally specific and ambitious language in those areas.

The Perfect Proposal for the Addis Ababa Accord: Tobacco Taxes

In July, countries will gather in Addis Ababa to adopt an agreement on Financing for Development (FFD). A recently issued “Zero Draft” for an Addis Ababa Accord lays out a framework that goes beyond looking at funding sources to reaffirm the goals, principles, challenges, and policies that are required to meet the Sustainable Development Goals (SDGs).

Yet the one financing source that meets all of the FFD’s aspirations has so far been left off the table: tobacco taxation.

Omitting tobacco taxes is a big mistake because it addresses key aspirations stated in the Zero Draft to improve health and mobilize more domestic revenues. Raising tobacco taxes also addresses the document’s other proposals related to efficient regulations; official development assistance for improved tax administration; and protecting public health measures from abuse of trade agreements.

On health, the draft supports funding modalities that “guarantee social protection and essential public health services” (para. 11) as well as calling to “guarantee access to essential health care” (para. 31). Tobacco taxes are themselves an essential public-health service because they reduce the incidence of smoking-related diseases. In turn, this reduce demands on health-care systems, making it easier to address other illnesses.

On Revenue Mobilization, the draft calls for countries to raise at least 20 percent of GDP for public goods and equity-promoting policies that form the core of national sustainable development strategies (paras. 17–20). Tobacco taxes generate proportionally more health benefits for the poor than for the rich, while most of the revenues come from the rich instead of the poor. Currently, countries generate US$145 billion each year from tobacco taxes — mostly in the OECD — and spend barely US$1 billion annually on tobacco control efforts. Increasing tobacco taxes by 50 percent would raise an additional US$101 billion. Countries such as Brazil, the Philippines, and South Africa already demonstrate the health and revenue benefits of higher tobacco taxes.

On efficient regulation, the draft commits governments “to regulate harmful activities and incentivise behavioral change” (para. 15). The measures that 180 countries have endorsed in the Framework Convention on Tobacco Control are perfect examples of coherent and cost-effective measures that would fulfill this commitment — if countries were to adopt them more comprehensively.

On tax administration, the draft calls upon countries to improve the fairness of taxes and to strengthen tax administration (para. 20). It also calls for international cooperation to combat tax evasion (para. 25) and for using overseas development aid to help countries improve tax administration (paras. 19 and 58). Poor tax administration and enforcement is the only real obstacle in the way of making tobacco taxes an effective instrument for reducing smoking-related diseases and raising revenues. Harmonizing tobacco taxes regionally and strong enforcement make smuggling less attractive and give tobacco taxes more punch.

On trade policies, the draft calls for a range of measures to facilitate trade. But the document also indirectly acknowledges that some corporations try to abuse international agreements and infringe on domestic policies that address social and environmental protections. The Zero Draft calls for “governments to support and assist WTO members who use flexibilities in these agreements” to assure access to medicines and respond to climate change (para. 78). The possibility that corporations will abuse intellectual property protections and investor-state dispute settlement mechanisms is nowhere more apparent than in the anti-social behavior of tobacco companies, and the draft should specifically add tobacco control measures under the FCTC as worthy of supporting through flexible provisions.

The one place in the Zero Draft that mentions tobacco taxes places them in a category of innovative modalities (which they are) but also within a list of international taxes (which until now they have not been). Increasing participation in taxes on international financial transactions, carbon emissions, and transportation fuels (para. 62) are good ideas; but tobacco taxes should be treated as their own innovative modality — something set by domestic policies but coordinated and supported internationally.

If I could have my fondest wish, it would be for a new paragraph to be added to the Addis Ababa Accord, stating:

Recognizing that, without concerted action, tobacco consumption will lead to 1 billion premature deaths in this century; that 180 countries are parties to the Framework Convention on Tobacco Control; that proven cost-effective measures exist to reduce the prevalence of tobacco use; and that tobacco taxes are a financial instrument which is extremely effective at reducing tobacco consumption while mobilizing revenues for public action to address health and other social needs; we commit to support and assist countries in raising inflation-adjusted specific excise taxes to at least double the price of tobacco products by 2020.

But I would be happy with even a few smaller changes such as those below (additions are indicated by bold lettering; deletions are in brackets):

Para 62: We encourage additional countries to voluntarily join in implementing the agreed mechanisms and to help develop and implement additional innovative modalities, including a widening of countries participating in a financial transaction tax, carbon taxes or market-based instruments that price carbon, or taxes on fuels used in international aviation and maritime activities [or additional tobacco taxes]. We further commit to support and assist countries in raising inflation-adjusted specific excise taxes to at least double the price of tobacco products by 2020.

Para 78: “We support and will assist WTO members to take advantage of the flexibilities in the WTO Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPs) to further the public interest in sectors of vital importance for sustainable development, including public health, in particular to provide access to affordable essential medicines and vaccines for all [,]and implement tobacco control measures, and responses to climate change. All countries should ensure that they provide these flexibilities in their bilateral trade and investment agreements as well.”

Para 25: “We thus commit to a global campaign to substantially reduce international tax evasion through more concerted international cooperation. We agree to work together to strengthen transparency and adopt pending policy innovations, including: public country-by-country reporting by multinational enterprises; public beneficial ownership registries; regional agreements to raise tobacco taxes in neighboring countries; and multilateral, automatic exchange of tax information, with assistance to developing countries, especially the poorest, as needed to upgrade their capacity to participate.

Para 58: An important use of ODA is to catalyze additional resource mobilization from other sources, public and private. ODA can support improved tax collection — including from taxing “bads” like tobacco and carbon — and help strengthen domestic enabling environments.

What better way to demonstrate the commitment to good governance and rational policies that promote human welfare on a global scale while generating the very resources needed to sustain that future? Yes! tobacco taxes are the perfect fit for the Addis Ababa Accord!

Addis Has Lots on Raising Finance, Less on Targeting It Well

Any language on revenue levels should be matched with ambitious language on spending the money well. But it is technically hard to set meaningful targets on the efficiency of government spending. That suggests the best fallback position is likely to be more language on categories of spending that are clearly less efficient at delivering on the SDGs as well as approaches to improve the overall quality of government spending.

Existing efforts to rate efficiency take particular outputs like school enrollment and immunization rates and compare those outputs to related government expenditures. But we care more about government delivery of outcomes than outputs (learning rather than enrollment, for example). Many of these outcomes are very poorly or partially measured and they are often the (partial) result of many different kinds of expenditure. Again, the SDGs care about outcomes in a lot of different dimensions. Developing a good overall “government efficiency at delivering SDGs” measure is probably technically impossible — and that is to say nothing of the politics.

You could imagine instead an exercise in trying to calculate the costs and benefits of particular actions to meet SDG targets — along the lines of the Copenhagen Consensus exercise. The Addis accord might suggest prioritizing interventions that have particularly high (and well measured) net benefits towards meeting specific targets.

At the same time, the consensus outside of Copenhagen — and particularly within the G-77 — is that all of the targets matter. And the nature of a long development goal list is explicitly a multidimensional exercise (as opposed to reducing everything to a money metric, implied by a cost-benefit approach). So, for all of its worth, this approach appears to run against both the politics and the philosophy of the SDG process.

Nonetheless, there are two things that the Addis draft could do better when it comes to efficiency: singling out notably ineffective areas of government expenditure and improving the framework for delivering governments’ services efficiently.

Two examples of spending that are widely accepted to be unfriendly to sustainable development are unsustainable subsides and defense spending.

The Financing draft has only weak language on the first: “We will work to gradually eliminate harmful subsidies, where they exist, including fossil fuel subsidies for production and consumption, minimizing possible adverse impacts in a manner that protects poor and disadvantaged communities.” And it says nothing about the expenditure diverted from delivering public services to buying weapons of war.

Why not significantly strengthen the language around poorly targeted expenditure: “We will work to gradually eliminate harmful subsidies, where they exist, including elimination of fossil fuel subsidies for production and consumption by 2025, reducing towards elimination subsidies to fleets fishing in international waters and for agricultural production by 2025, and move towards pricing at long-run cost for delivery of networked utility services including electricity and water by 2025, minimizing possible adverse impacts in a manner that protects poor and disadvantaged communities. As military expenditure is a drain on resources that could be productively used for development, We will continue the current rate of global progress on reducing worldwide military expenditure as a percentage of global GDP so that it is lower by one third in 2030.”

With regard to improving the framework for efficient delivery, there is stronger language in the draft as it stands, including commitments to better and more open data, as well as transparency and participation in the budgeting process and procurement. But at least one more commitment could be made: “We call on countries to implement Open Contracting and meet the Open Contracting data standard.” Government procurement worldwide is worth $9.5 trillion a year. Oil, gas, and mining profits amount to around $5 trillion. A number of countries publish the full text of these contracts and see stronger competition, lower prices and improved governance as a result. It is time for the rest of the world to follow suit.

It may be impossible to set targets on the full efficiency of government spending. But at least Addis can do two things: target the Hippocratic commitment that government spending should do no harm; and ensure the broad framework for efficient spending is in place.

A Global Social Floor at Addis: Should Aid Embrace the Kink?

A “global social floor” implies that everyone in the world should be supplied with some basic public services and live above a minimum income. I think this may be a good way to give Official Development Assistance an ongoing rationale in the post–Millennium Development Goal (MDG) period. But there is a significant caveat: the goal should be service provision, not resource flows. That suggests the importance of clarifying what donors should sign up to at Addis.

Homi Kharas and John McArthur’s original idea for the social floor was for Addis attendees to “commit to ensure, by [2025], that public spending targeted to individually consumed essential public services reaches at least [$300] per person per year in 2011 PPP terms, or [10 percent] of GNI, whichever is higher.” An ODI paper by Romilly Greenhill, Paddy Carter, Chris Hoy, and Marcus Manuel paper provides some (more) meat to those bones. It suggests $42 billion per year would fund a cash transfer scheme calibrated to the gap between the $1.25 poverty line and the average income of poor people in in each least developed country, $74 billion per year would provide a basic health package, and $32 billion per year would extend universal primary and lower secondary education to all in low-income countries. Some of that $148 billion could be met by low-income countries. But the authors estimate that if developing countries collected revenues in line with capacity and allocated half of their total resources to the social sectors, a total financing gap of around $84 billion per year would still be left, $73 billion of which is in low-income countries. That’s where aid comes in.

I think this is an interesting idea. The MDGs, with their focus on issues of the world’s most disadvantaged (living under $1.25, with high child and maternal mortality and low primary school completion) provided a framework for prioritizing aid flows. The post-2015 Sustainable Development Goals (SDGs) can’t do that: they cover far too much to provide focus on anything. Meanwhile, the role of aid in delivering development is rapidly shrinking simply because developing country economies are growing so big that aid is an increasingly marginal part of overall finance ($134 billion compared to developing country domestic resource mobilization closer to $10 trillion). And the discussions at Addis will (rightly) cover a whole set of issues beyond aid that, together, are considerably more important to achieving national development and the broad SDG agenda than aid flows. Nonetheless, the need for a framework and focus for aid impact is greater than ever.

One framework for aid could be an increasingly tight focus on what Lant Pritchett has coined “kinky development”: delivering on the social floor. That’s not because once everyone has completed primary schooling or reached $1.26 per day we can declare development success — far from it. It is because it is plausible that aid could still make a big difference in this area. For all the progress we have seen in income, health, and education over the past 50 years, hundreds of millions of people still live lives of such deprivation that even a fraction of a percentage point of the GDP of the world’s industrialized countries, if well spent, could provide a considerable bump-up to their quality of life — even if only as palliative, not cure.

But it is vital that the focus be on delivering services rather than delivering a particular amount of money. The overall link between health and education outcomes and spending in developing countries is weak, as is the relationship between aid expenditure and “kinky development” outcomes. Costing the MDGs was at best a very partial exercise for that reason (Shanta Devarajan says it was simply wrong), and the same applies to “costing the social floor.” It is good to know that in theory, with efficient delivery and political goodwill and so on, aid could plausibly fill a notional financing gap to meet the costs of delivering basic services, but any Addis commitment should be around delivering and paying for actual services — or, even better, outcomes such as kids fully immunized and able to read by fifth grade, households plausibly near or under the extreme poverty line provided a transfer equal to $1.00 per day per member and so on. That translates into language for Addis that looks something like this:

As part of a global commitment to end extreme poverty, low- and lower-middle-income countries commit to introduce a transparent and efficient transfer system to their poorest citizens, mobilizing domestic resources equal to at least one percent of GDP to fund it. Between 2020 and 2030, industrialized countries and multilateral institutions will finance the additional incremental efficient costs of transfers to ensure no person lives on less than $1.25/day, with payment made on the basis of verified completed transfers.…

[…]

As part of a global commitment to reduce child and maternal mortality alongside access to education, low- and lower-middle-income countries commit to putting in place universal health and education systems that ensure efficient delivery of basic learning and health services to all. Between 2020 and 2030 industrialized countries and multilateral institutions will finance the incremental efficient costs of a provision of a basic package of health and education services in low- and lower-middle-income countries sufficient to meet the commitments that cannot reasonably be met from domestic resources, with a considerable portion of the payment made on the basis of verified achieved mortality reductions and literacy improvements.

I’d argue the other important focus for aid should be the provision of global public goods, another area where billions in ODA can make a really significant difference. So it would be great to see industrialized countries at Addis making commitments to increase their aid support for technology development, knowledge and data, infectious disease and global environmental issues, for example. If the Financing for Development conference helped give two points of focus for aid around fostering the provision of global public goods and achieving the social floor, that would be a useful achievement.

In dollar terms what would this global partnership be worth? The IMF estimates global (pre-tax) subsidies for petroleum products, electricity, natural gas, and coal in the developing world reached $480 billion in 2011. Recent proposals to scale up multilateral financing alongside guarantees and bilateral lending don’t reach that scale, but could add tens of billions of foreign finance to annual infrastructure investment in the developing world. The G-20 meetings in Brisbane later this month could provide the impetus for a concrete and significant financing proposal to be developed in time for the Addis meetings.

A global partnership agreement on sustainable infrastructure financing would guarantee Addis was a success and set the stage for a strong post-2015 declaration in New York. And because of the impact of higher energy prices on greenhouse gas emissions, the Addis partnership might even spark hopes of greater progress at the December UN climate negotiations in Paris. Most importantly, it could help extend basic infrastructure services to the billions who currently lack them.

How Much Scope for Private and Market Rate Finance at Addis?

The estimated cost of meeting the SDG targets for infrastructure in developing countries is around USD 1 trillion a year — that in addition to the $0.8 to $0.9 trillion already spent today. Compare that to ODA of around $150 billion, other official flows of $27 billion and investment in infrastructure with private involvement of about $181 billion, and it is clear that the majority of infrastructure finance will have to come from: the $9.2 trillion worth of domestic resource mobilization each year in developing countries.

That said, there is some reason to hope for more official finance as well as greater leveraging of international private finance in order to help meet the SDGs, especially with a few reforms in the financing and operations of multilateral institutions like the World Bank.

Infrastructure is a particularly complex sector to finance: investments are lumpy (with single projects often accounted in the billions), payback periods are long (often in the decades), and markets function poorly (most infrastructure sectors are natural monopolies). In addition, the political economy and practicality of infrastructure pricing is complex — it is often provided at below cost or no cost. This limits the potential for private provision even in well-regulated infrastructure markets in countries with a robust financial sector capable of supporting long-term debt.

This is why development Finance Institutions like the IFC face considerable difficulty in finding private partners for investment in fragile and low income states in particular. In its FY2013-15 roadmap, the IFC reports it committed $515 million in 43 investment projects in countries and territories on the World Bank Group Fragile Situations List in FY2011. That amounts to just 4% of total IFC commitments, down from 6% in FY08.

Nonetheless, the declining pool of IDA-eligible countries does present an opportunity to build up flows of non-concessional long term official lending as well as support for private sector financing to back infrastructure. CGD’s Scott Morris estimates that IBRD capital contribution leverages about fourfold the Bank’s ability to borrow in capital markets —this is considerably better than IDA’s highly concessional model, in which one dollar of donation leads to about one dollar of IDA support. The 17th IDA replenishment provided $52 billion in additional resources in low income countries. If one quarter of IDA’s replenishment amount in future rounds was repurposed to increase the IBRD’s lending capacity, this would increase that capacity (one time) by approximately $50 billion, or a little more than $15 billion per year. Morris proposes a quadrennial ‘Bank Resource Review’ for the World Bank in which donations to IDA alongside capital increases to IBRD are discussed by shareholders at the same time, to allow for more frequent capita increases and greater flexibility between contributions to IDA and IBRD.

There’s a similar calculation to be made with the IFC and related development finance institutions and their support for private investment. At the moment, the institution hands over much of its profits to run free advisory services in areas like regulatory reform or to IDA. An alternative model would be to keep those resources and use them to increase the Corporation’s tolerance for risk — backing investments in harder markets, and providing more support to put together deals in those same markets. And the World Bank Group could be doing more to support guarantees. The operations (and capital base) of MIGA should be absorbed back into the World Bank and IFC, allowing the two institution’s considerably larger balance sheets to underpin larger per country guarantee operations, currently capped at less than the cost of a single mid-sized power plant.

Donor reforms could be packaged with recipient reforms to increase the political and financial viability and sustainability of infrastructure rollout. This is intimately linked to the question of infrastructure pricing. Energy is perhaps the most significant example: the IMF estimates Ethiopia spent 7% of government revenues on supplying underpriced electricity to the lucky quarter of the population connected to the grid. The same number for Bangladesh is nearly three percent of government revenues. Those subsidies are bad for the environment (encouraging energy consumption) and they are regressive (they don’t help poor people who are unconnected but help most rich people who consume the most). But subsidies are also bad for the sustainable provision of infrastructure. For example, selling electricity at less than cost means that power companies lack money to operate and maintain their plants and power lines — let alone roll out services to the millions denied modern energy access. Repealing fossil fuel subsidies (replacing them where needed by targeted financial support to the poorest consumers) could produce the necessary funds to pay back infrastructure investors or loans and reduce inefficient energy use in the bargain.

Energy pricing is an issue that the G-20 has addressed: pledging to remove ‘inefficient’ fossil fuel subsidies. And the drafters of the Sustainable Development Goals suggested a global target to, “rationalize inefficient fossil-fuel subsidies that encourage wasteful consumption.”

The potential for increased non-concessional support combined with the worldwide recognition that energy pricing needs reform suggests the basis for a global partnership agreement at Addis.

G-20 countries could sign up to a commitment to significantly increase investment guarantee and non-concessional bilateral and multilateral official flows to infrastructure priced to ensure financial sustainability. All countries, led by developing economies keen to access additional international finance for infrastructure, would commit to removing energy subsidies, pricing energy at long-run cost and generating sufficient revenues from transport fuels or other use-related charges to cover the cost of transport infrastructure construction and maintenance. They would also commit to open processes to select and operate privately financed infrastructure including procurement transparency, operation according to guiding principles on business and human rights, and tax transparency.

How does this translate into language for Addis? I suggest the below:

- We will agree on a series of reforms to increase net non-concessional and blended resource flows from multilateral development banks by end 2016, including support for pooled approaches and those that attract private institutional investors, including regularly scheduled [quadrennial] capital resource adequacy reviews for MDBs beginning in 2017.

- Multilateral and national providers of official finance commit to work together to considerably ramp up provision of guarantees, market-rate loans and investments in infrastructure in developing countries requesting such support in order to roll out infrastructure services that are priced to ensure financial and environmental sustainability.This commitment will support total annual gross resource flows worth 0.2 percent of aggregate provider country GDP by 2025.

- We will increase the sustainability and transparency of public-private partnerships and private investment through Open Contracting, the and wider adoption of standards including the Equator Principles and implementation of the UN Guiding Principles on Business and Human Rights. By 2020 we will ensure universal country-by country public reporting by multinational businesses including the development of rules and relationships sensitive to the needs and capacities of LDCs. We will ensure the outcomes of the Base Erosion and Profit Sharing process are useful and relevant to all countries.

Let’s Dump Technology Transfer from the Agenda

New technologies are central to the kind of global progress outlined in the Sustainable Development Goals. And those technologies need to reach people in the developing world who can benefit from them. But ‘technology transfer’ is a terrible way to think about the issues involved — so let’s dump ‘transfer’ from the Addis accord and think of a more constructive framework for technology in development.

The last few decades have seen the development of an immense number of technologies useful to development from mobile phones and the Internet to the pneumococcal vaccine. They have spread around the world at an unprecedented pace. But we need more: if we are to sustainably feed a planet of nine billion, we need new crops and tools for water and nutrient efficiency. If we are to preserve and extend health gains across the world we need new vaccines and antibiotics. If we are to get to a planet where everyone has access to plentiful modern energy and are freed from the massive health burdens of indoor air pollution alongside the risks of catastrophic climate change, we need the development of new, cheap and robust renewable technologies.

To deliver these technologies, the international innovation system should be better geared to the needs of the great majority of the planetary population who live in developing countries, and should be more efficient at getting technologies into the hands of those who can use them to maximum effect.

That doesn’t mean ‘technology transfer’ — the great thing about technology is it can be in two places at once. My use of the technology of the measles vaccine doesn’t stop you using the same technology at the same moment on the other side of the world. Instead we want to see more technology development — new solutions to development challenges—and technology sharing —spreading those technologies worldwide.

We have three main recommendations for the Addis negotiators around technology. In order to improve technology creation we need more ‘push’ — support for more research in sectors like agriculture, environment, energy and health that are central to sustainable development, and for international research and development organizations that focus on developing those technologies specifically for poor countries like CGIAR. But we also need more ‘pull’ — backing for efforts like prizes and advance market commitments that can spur innovators to focus their efforts on developing particular technological solutions to specific problems — a new vaccine against a neglected tropical disease, for example.

In order to improve technology sharing, there is a lot of work to do on improving the international patent system. People wanting to roll out new technologies in countries from the US to China are drowning in a sea of junk patents that hold up product rollout, add to costs, and do nothing to foster real innovation. The effects spill over borders through the international patent regime. The world would be better off if the countries home to most of the global innovation effort came together and agreed mutually beneficial reforms to ensure patents only rewarded real innovators developing products with real value.

In addition, technology would flow more easily if firms could transparently and effectively price technology at different levels according to the market. It is profit-maximizing for a company with an intellectual monopoly to charge lower prices where consumers can afford to pay less because they are significantly poorer. Charging thousands of dollars for a course of drugs with a marginal cost of production of a few cents does not guarantee big sales or large profits in a country where total per capita drug expenditures are a few dollars a year. But the international system is not set up to support so-called tiered pricing — Addis could launch a process in support of open, differentiated drug prices. Here is the language we would like to see:

We will increase the share of global and national R&D expenditures that support innovation in agriculture, environment, exploration, energy and health. Industrialized economy contributions to international research and development institutions with a focus on development issues will double as a percentage of global GDP by 2025. We will invest substantially in pull mechanisms for new technologies of particular value to developing countries, including pharmaceuticals, agriculture and clean energy.

Countries funding the bulk of global research and development will move toward multilateral agreement on policy reforms to reduce the problem of low-quality patents and patent thickets by 2020.

Countries home to the majority of pharmaceutical research and development will work with major pharmaceutical companies to develop approaches which allow tiered pricing of drugs and treatments as well as lower-cost regulatory approaches to bring drugs for neglected diseases to market by 2020.

Let’s dump ‘technology transfer’ from the Addis declaration and substitute development and sharing — they could be two of the most important components of post-2015 development success overall.

This Is It on Migration?

Lant Pritchett and Charles Kenny

If we want a just, equitable, and inclusive world, the most powerful tool at our disposal is migration. And yet theAddis Financing for Development draft is very weak on the subject. It suggests: “Recognizing the positive contribution that well-managed migration and mobility can play for inclusive growth and sustainable development we will make efforts to enable the orderly, safe and regular migration and mobility of people, while protecting the rights of migrant workers in compliance with the ILO’s [International Labour Organization’s] fundamental conventions, as well as the rights of displaced persons.”

That’s fine as far as it goes, but it hardly goes at all. In the spirit of diplomatic constructive ambiguity, both of these formulations leave it open to interpretation whether it is the nouns (“migration” and “mobility”) or the modifiers (“orderly, safe and regular”) that are the priority. That is, migrant-sending countries can read “facilitate” and “enable” to mean “encourage more” while the reluctant recipients of “irregular” and “disorderly” migration can read “facilitate” and “enable” to mean that about “orderly, safe and regular”—even if that means less migration in total by eliminating the “disorderly” while keeping their “planned” migration at the same levels.

Without specifics around levels of migration, education, skills portability, and ensuring migrants can send money home to friends and family, the text is only a little better than no text at all. While we are hardly the pair to come up with the language, we’ll take a stab at some possible concrete proposals, and a brief rationale so others can help this along:

Industrialized economies commit to [double] the proportion of all migrants admitted that come from low- and lower-middle-income countries by [2025].

There has to be something in the text that indicates that “facilitate” or “enable” means more migration of a development-friendly type.

Each industrialized country will have launched at least one development-friendly, rights respecting, policy program that addresses its needs for labor through greater labor mobility by 2020.

While all agree that no language is going to force countries to lower barriers, there are bilateral schemes out there, like the New Zealand-Pacific Islands Recognized Seasonal Employer Program, that are delivering a “triple win” for migrants, sending and recipient countries — getting countries to highlight what they are doing and talking about how to do it better can encourage more experimentation.

The Multilateral Development Banks will calculate the income gain and poverty reduction at global and national poverty lines from allowed migration for industrialized countries and as many other countries as possible to document the link between labor mobility and inclusive growth.

As Michael Clemens has shown, 80 percent of all Haitian naturals (born in Haiti) who do not live in poverty live outside of Haiti. The current methods of measuring poverty at national levels completely misses the gains to people who cross borders to move out of poverty. Some measure of that, however crude, can put the income gains of movers onto the development agenda.

We commit to work toward agreeing stronger international standards governing professional and technical qualification to improve the portability of skills worldwide by 2020.

The rich world is going to need many more workers in medium-skill occupations (e.g. plumbers, electricians, home health-care assistants) but currently there is no way to make skills, particularly those acquired on the job, pay off to movers and make it easier for host countries to recruit those with the skills they need. Promoting common standards that countries can use as benchmarks is a public good produced with international cooperation in many areas of life — the International Civil Aviation Organization has helped created international air travel safe enough that people will go to Addis for a meeting about development finance. It is time for a set of global standards around skills.

Partner countries will develop skill partnerships where migrant-destination countries provide finance and technology to train skilled migrants in their countries of origin, helping those origin countries share in the benefits of high-skill migration.

Given the massive cost differences in training in poorer versus richer countries, proposals for visa-linked training schemes can be win-win-win—more trained people in the sending country (as less than 100 percent of the trained move or stay abroad), a win for the movers (who get skills and an improved quality of life), and win for host countries (who get qualified workers).

National and multinational regulatory bodies will work to ensure national and global financial regulations including those governing anti–money laundering efforts allow competitive, affordable remittance and correspondence banking services especially with least developed countries and fragile states by 2020. We will ensure regulatory and policy reforms to ensure the cost of remitting funds to low- and lower-middle-income countries is reduced to below [5%] of remittance value by 2020 and below [3%] by 2030. We will develop international regulatory solutions to allow for international direct transfers via mobile finance applications by [2020].

There is already a goal for lowering remittance costs in the SDG draft, so something concrete in the financing accord about facilitating flows — given the magnitude of remittances versus other finance — is a natural extension. Both the potential of mobile finance and the risk of anti–money laundering rules for those flows are considerable.

We will increase the share of students from least developed countries (LDCs) out of all foreign students enrolled in tertiary education. Industrialized countries commit to end tuition fee discrimination against LDC students by 2025.

International students are an important linkage in the world, promoting subsequent trade, investment and migration flows; and the higher education industries in many countries see an opportunity to provide services — but hopefully not for exploitation. Providing tuition to LDC students at the same price as to nationals will facilitate this exchange.

Perhaps what we have suggested won’t fly, but everyone should be looking to help find goals on labor mobility that will. If the financing for development draft is going to deliver on the most expansive and ambitious development agenda in history, it can’t afford to ignore the most important tool for human development that we have.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.