Recommended

Unless you have checked out of Earth, you must have heard phrases like, “data is the new oil,” “software is eating the world.” and “AI will disrupt everything.” Similar claims are bandied about as if they mean the same thing and as if they all point to the same trends, with little attempt to dig into their actual significance.

“Disruption” is the best catchall example of this, especially in relation to technology, innovation, and the so-called “new economy” powered by fast-growth entrepreneurship. Everything about the future is supposedly held hostage by disruption. Its core ideas power the leapfrogging concept (which I have discussed previously); drive the ongoing boom in venture capital (increasingly propelled by the idea that a motley crew of “disruptive technologies” invented by “visionaries” will remake the world economy in short order if only investors pump in tons of money and bet on the right wave); and animate anxieties surrounding the future of economic activity, and with it, beliefs about upcoming structural employment changes.

Yet, the only really elaborate, and by far the most analysed, framework for how disruption is supposed to happen is the one contained in the works of Clayton Christiansen. Although his framework has not been without controversy, others simply lack its clarity.

Christiansen’s model remains the most practical and useful way to link disruption to the many important areas of socioeconomic development touched by technology, innovation, and entrepreneurship. Still, the model deserves many of its critiques and is, in fact, increasingly obsolete. And if that isn’t depressing enough, what is replacing Christiansen’s model of disruption is snuffing out many of the lights that have long pointed weaker players in the global economy in the direction of hope.

Which is sad because disruption has lately enjoyed enthusiastic reception in some quarters as the path forward for start-ups and poor countries, and especially start-ups in poor countries, to circumvent serious ecosystemic and infrastructural problems and grab larger pieces of the global pie of prosperity right from under the nose of large incumbents. After all, the argument goes, companies like Google, Facebook, Apple, and Netflix did this in Silicon Valley; and countries like Singapore, South Korea and, now, China have shown that it can be done at any scale and from anywhere in the world.

This essay is a bearer of distress, a disruptor of comfortable narratives, with a dire song called: hyper-integration meant to serve as a reality check for all upstarts hoping to tread well-worn paths to dominance. But in the same seeds of woe are sparks of an alternative framing that may yet save the day.

A refresher on the classical disruption model

The standard model of disruption starts with an incumbent—a successful, large, and powerful producer of some well-received good or service. As this happy maker grows and specialises in serving its customers with better product features, it keeps an eye on the competition and seeks to block their way with the sheer specialised complexity of what makes customers loyal to its brand.

Over time, however, such conduct overloads the incumbent’s offering with features that add less and less value at higher and higher cost. Emerging needs are poorly addressed by the incumbent as its loss of agility in the marketplace accelerates.

Enter the upstart. Through two key processes I call compactification and flexibilization, the upstart removes extraneous features, focuses on the most value-adding elements (compactification), and makes it easier for customers to mix and match in more flexible ways (flexibilization).

The total costs of acquisition and of ownership start to drop, attracting whole new classes of customers ignored by the incumbent. As the ability to mix and match grows, the upstart is able to upgrade, upscale, and upsell to even customers of the large incumbents, and in no time the incumbent is in trouble. If you are thinking of Salesforce and the large CRM companies before its arrival, you are on the right path.

With minor modifications of specific sequences and threads, one can generalise this core idea to a great many phenomena, from the rise of Taiwan and Korea as electronics giants, to the ongoing Chinese effort to overtake America in internet innovation. Closer to my own neck of the woods, you can visualise pathways through which some African upstarts aim to supplant international suppliers of all manner of services, first in the home market, and then eventually on world markets.

What happens though when it becomes harder and harder to optimally simplify the form in which technology-enabled products are presented to neglected portions of the market? What should the aspiring disruptor do when the task of offering flexible options of usage and ownership to broaden the appeal of the reimagined good or service across a range of potential customers with varying levels of purchasing power hits a roadblock? Is the path that Japanese automobile manufacturers took in the sixties and seventies to successfully upend American and European domination of the auto markets still available to African fintech innovators aiming to go international?

I argue that the answer to all these questions is not encouraging. Mostly lots of “Nos” and “Nothings.”

A typology of modern technologies

No one disputes that all industries are becoming cyber-enabled, and that all business models are being rapidly digitalised in terms of how value is delivered, or produced, or both. But from there, two paths branch out. There are those who believe that the data generated on account of this digitalisation will determine the pecking order in all industries, dictate the flow of margins to value chain players, and even confer monopoly power. Another faction holds that the owners of the most sophisticated algorithms, usually taken to mean “artificial intelligence” (AI), will rule the roost.

But in the words of the old Tolkienian idiom, “they have all of them been deceived, for another ring exists.” In the coming decade, at least, the real determinant of industry pecking orders shall be those who connect the most diverse data sources to the most powerful, most specialised, and most diverse algorithms, wherever those data repositories or super-algorithms may reside, including in the bosom of competitors.

In short, there are three main determinants of power in the unfolding techno-economic order: data, algorithms, and integrations, but integrations is king. It is the one “ring” to rule them all.

Figure 1. Among the three main forces of techno-economic power, “integrations” rules

This emergence of integrations primacy is the result of a megatrend, in the course of which the axis of power within digital value chains has shifted steadily—power to influence pricing, affect margins, dictate volumes, and even constrain new business models.

In any digital-enabled ecosystem, the parties positioned where the most heterogenous techno-legal integrations traverse and/or transect shall acquire more power regardless of where data or algorithmic power is initially hoarded.

It is important from the outset to emphasise the term techno-legal. “Integrations” as used in this essay is not confined to Application Program Interfaces (APIs), a popular generic term for the links connecting computer systems together. The term as I use it here encompasses any connection or partnership or linkage between two or more nodes where periodic consensus is required to deliver quanta of transactional value to another node on an ongoing basis.

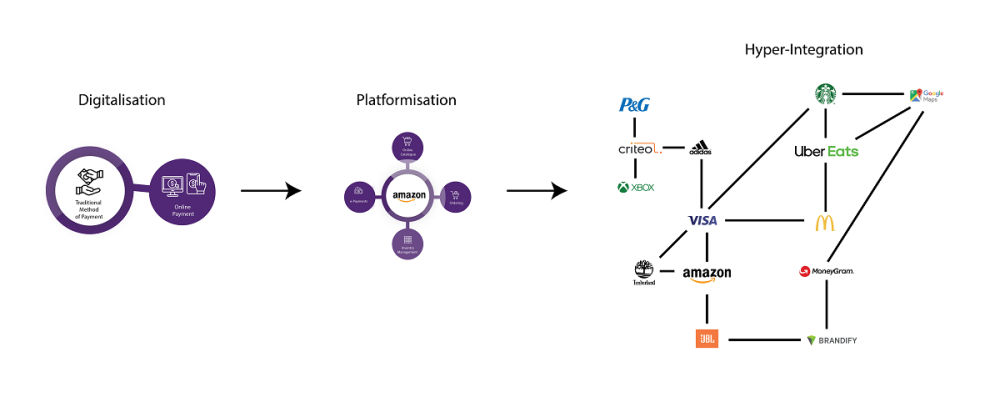

A bit of history should help to clarify. There was, at the turn of the current millennium, the age of pure digitalisation, where all business models that could benefit considerably from cost-cutting and performance enhancement through digital means were digitalised using powerful, novel, algorithms like search indexing (Google) and social graphing (Facebook). Call this the First Age of the API economy, characterised by simple connections and the primacy of algorithms for transforming offline transactions in the emerging online environment.

Figure 2. The First Age of the API economy

Then more and more hard-to-digitise business models were forced into communion with purely digital systems because of the data dividend generated by such meshes between the offline and online worlds. This age of broader but partial digitalisation sustained by intense data consolidation gave birth to the platformisation trend, where platforms penetrated every nook and cranny of the enterprise, government, and civic order. Call this the Second Age of the API economy, characterised by the increasing meshing of offline and online business models and the primacy of data in creating value and setting power hierarchies. In this era, we witnessed the primacy of data.

Figure 3. The Second Age of the API economy

These data-consolidating platforms did make use of integrations, but, for the most part, they were simpler connections characterised by the basic needs of technical interoperability, with limited concern about legal, regulatory, and ergonomic complexities.

In the First Age of the API economy, the issue was almost entirely about the construction of basic rules for data interchange such that data could flow easily between two points in cyberspace. They had little to do with solving the intricate calculus of inter-institutional collaboration. At best, they were useful for the open-sourcing of algorithms being facilitated by cloud computing. So much so that international technical committees could broach boilerplate legal frameworks like “Creative Commons” to simplify the governance of these relations.

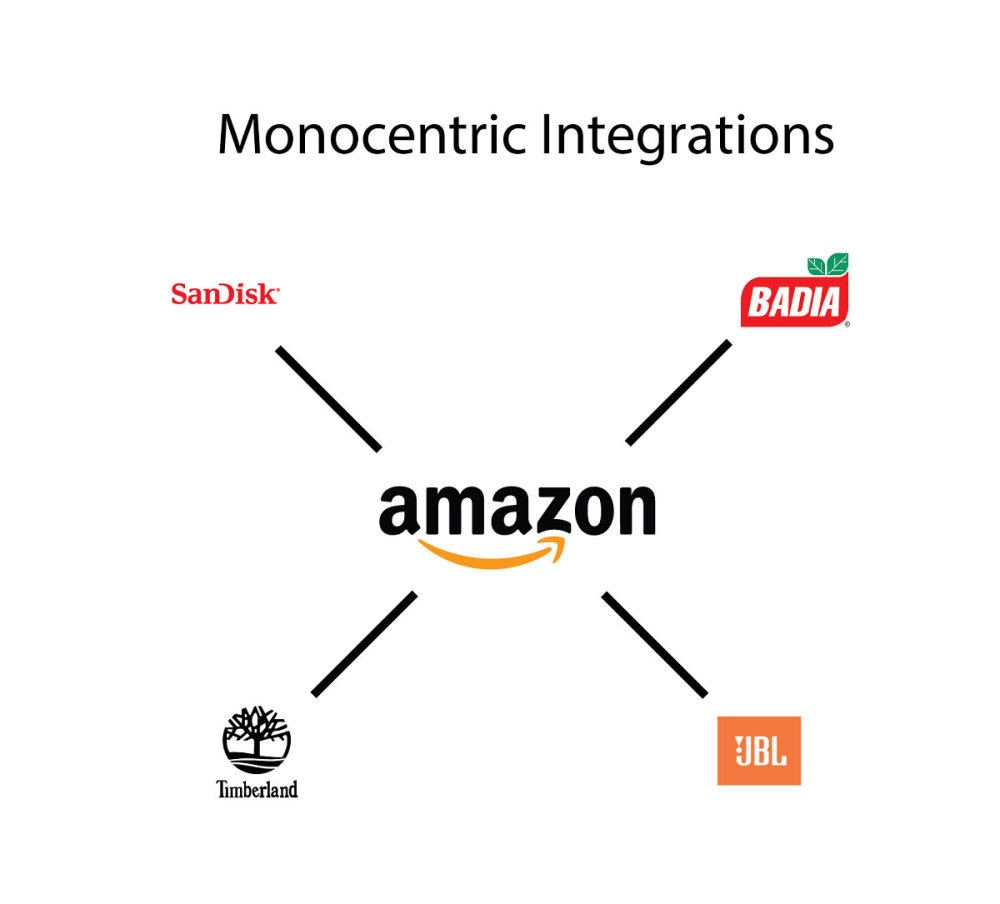

Efforts to standardise basic data interchange connections were nonetheless highly successful, culminating in a profusion of uniform relations across transactional nodes that I call monocentric integrations, partly because they were largely based on reducible principles of uniformity, but also (and more importantly) because they were highly compatible with the data consolidation trend, where the distribution of data tended to skew towards fewer and fewer nodes.

Figure 4. Monocentric integration in the First and Second Ages of the API economy

Established protocols like XML, SOAP, SMPP, REST, and a host of newer data flow standards were churned out by the dozen, allowing unprecedented accumulation of data in hoards managed by smart and prescient companies who first discerned the most compelling needs of the first generation of mass internet consumers.

Data consolidation was greatly enabled because large behemoths could spin off these monocentric integrations by the thousands to connect many “minions” in generally identical ways without exorbitant costs of gatekeeping and customisation.

Platform behemoths, like mediaeval lords in their manors, became bloated on this cheap data, and eventually started to suffocate the minions feeding it to them, reducing them to mere appendages.

By design, these behemoths are always better off in environments where the side effects of such massive data consolidation and control could easily be externalised.

When the vast majority of entities in the monocentric system are stunted, risk and burden sharing simply cannot happen. This leaves the behemoth, just as it enjoys all the cream, to also deal with the negative spillovers by itself, unless it can dump them into the commons.

We have all seen this logic at play in the wanton refusal to take responsibility for the massive privacy abuse, hate speech, screen addiction, and other social problems caused by the intense algorithmification of social life through data consolidation by the global internet giants.

The Hyper-Integration Megatrend

The most consequential techno-economic megatrend is the one in which hyper-integration has replaced disruption as the dominant motif, riding on the back of the triumph of integrations over data and algorithms.

Blockchain thinking is in many ways both a reaction to and a reinforcement of this logic. It seeks to entrench the notion of monocentric integrations at the same time that it is aiming to displace platform behemoths.

Because of this inherent contradiction, blockchain has been doomed to never become the dominant integration model for some time now, hype notwithstanding. Where it has made modest progress, it is because the original principles of “monocentricity without oligarchy” have been ditched for oligarchic models such as the IBM-dominated Hyperledger Fabric protocol, which downplays the fundamental egalitarian logic of the blockchain system, to the chagrin of purists.

But blockchain or no blockchain, the unchecked reign of platform behemoths was bound to crack—partly because ignoring externalities is increasingly hard if a platform wants to grow or even survive, and partly for other reasons that I elaborate below.

To grow or survive in a world where the early fruits of the digital economy—telecom, media, entertainment, fintech, and e-commerce—have mostly been harvested requires an ability to navigate hidebound segments of the economy where the process of integration is not limited to data flow. Where consensus requirements often entail an alignment of values, processes, and logistics. And where, occasionally, algorithms have to be split among contracting parties to ensure these alignments. All trends that warrant deeper integrations.

The Age of Hyper-Integration

Thus began in earnest the Age of Hyper-Integration, one that is eclipsing the digitalisation and platformisation eras that dominated in the First and Second Ages of the API economy. It is a world that calls for Institutional Alignment Interfaces (IAIs) over and above APIs. I call these new interfaces polycentric integrations and I have a bit more to say about them later.

Figure 5. The Third Age of the digital economy has shifted inter-entity transactions to denser and deeper integrations

The hyper-integration megatrend supersedes other trends that get far more attention in the popular press and specialised literature, such as automation. In fact, some days, hyper-integration suppresses forces like automation, and some days it enables them, whilst constantly, when it is not missed altogether, being mischaracterised as these lesser forces. So, what really is hyper-integration then?

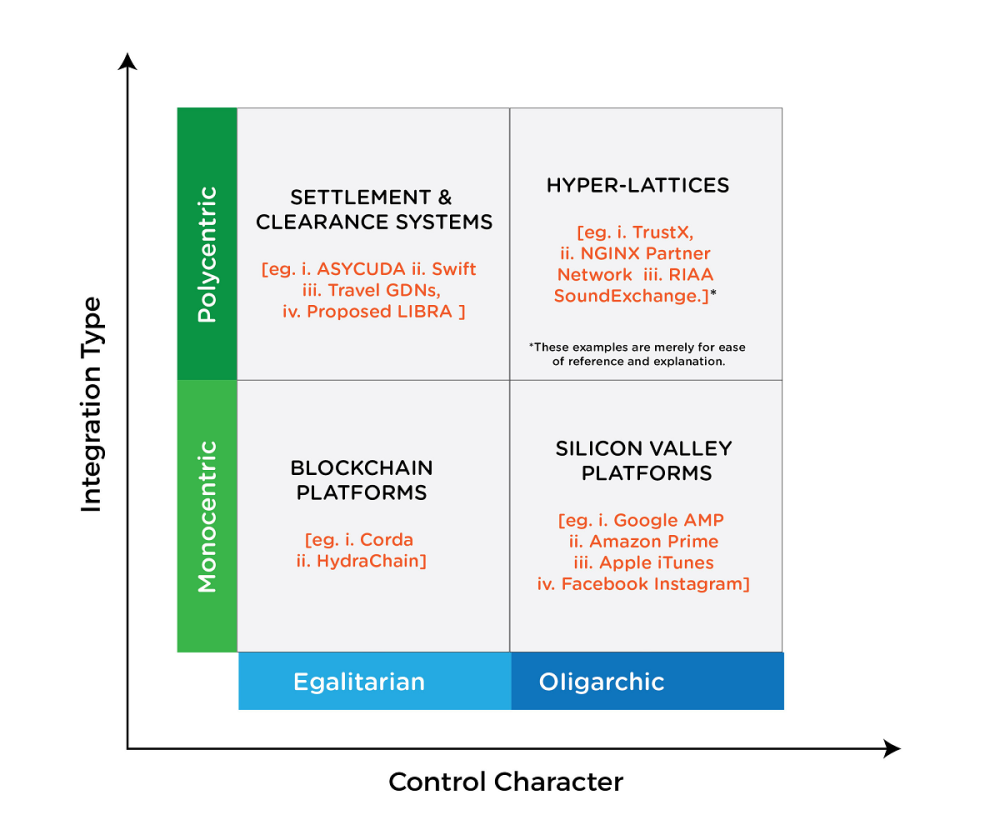

The term refers both to the growing number of legal-cum-technological protocols connecting different transactional nodes (sites, domains, legal statuses, points, or coordinates) needed to generate value in the new economy, and to the heterogeneity of those connections and nodes. Its primary measure is the number and variety of connected nodes required to deliver the minimum viable product or service experience to a single user or class of users. As the figure below suggests, a new typology of how power/control distribution defines the character of the integrations compressing nonadjacent business models and dissolving industry boundaries is required.

Figure 6. Techno-economic relations are now ordered along two axes of “control and consent,” defining a new form of “cyberhegemony”

Note: The “hyperlattice” examples are purely illustrative. In practice, hyperlattice edges are blurred and interpenetrate different consortia and value chains.

In simple terms, hyper-integration captures a development whereby, to deliver a unit of value, more connections to more data sources and algorithmic repositories outside the four walls, or span of control, of the value producer are required. But more critical is the fact that the more diverse those algorithms and data sources—the more polycentric they are—the better. But why?

Drivers of Hyper-Integration

Four main trends in the digitalised new economy are pushing the world’s techno-economic infrastructure deeper into hyper-integration.

They are risk (due to compounding externalities); fraud (due to the increasing speed, scope, and scale of transactions); performance (due to the growing complexity of requirements); and coverage (due to the desperate search for top-line revenue growth and market ubiquity).

Risk

One of the most important things that ongoing efforts to seamlessly mesh high-digital and low-digital operational models to create new business models does is to make it harder for platforms to externalise their risks.

By subsuming fraught political advertising and research under models designed originally for business advertising and research, Facebook entered a minefield of inalienable obligations from which it has not yet escaped. Its standardised processes for ad management and oversight have required considerable review. Though all the reviews point to a greater need for diversification and customisation of the policies governing its integrations to better accommodate the radically diverse third parties it now connects with, the legacy behemoth refuses to fully countenance the extent of change ahead.

Recalcitrance notwithstanding, Facebook’s nearly 30,000 human platform vigilantes (of which a full 50 percent handle just content moderation) is a cost and a burden few could have imagined a decade ago—algorithms and data were supposed to take care of the vigilance. Google’s far less frequently reported “human bots” program of gig-raters relies on an even looser brigade of integrations with contractors and provides even more emphatic evidence of the limits of algorithms in managing externality risk.

In a similar vein, Airbnb finds itself having to plug more and more into municipal systems in order to satisfy zoning requirements, and into identity management solutions to minimise safety concerns.

Cybersecurity today, another fraught domain, is virtually defined by the use of shared databases of threats signatures, attack vector traces, and complex abuse patterns, some of which have been identified using AI-enabled tools. Defending digital assets using onboard algorithms, in the old way, or even large threat perception datastores controlled by any one security company is, however, no longer feasible, let alone prudent.

It is the same for spam, or advertising integrity. Today, no one email marketing platform can deliver on the level of trust required for seamless email marketing. Platforms must plug into dense networks to activate the necessary whitelisting protocols or see their customers leave because of super-high bounce rates in email marketing campaigns.

Premium publishers are creating networks like TrustX in response to the fact that the proprietary bot-detection and anti-spam engines of the big distribution platforms, such as Facebook and Google, are no longer trusted by advertising buyers and their agencies to produce reliable brand safety analytics and statistics.

Risk management has thus become a powerful justification to hyper-integrate and move farther along on a post-platform curve to safeguard brand assets and also to fight fraud. The “fraud” point is indeed so important, it deserves additional treatment.

Fraud

The digital economy is susceptible to very high levels of fraud. In digital advertising for instance, estimates suggest that fraud may contaminate as much as 70 percent of all transactions. Since travel management solutions were heavily digitised, fraud levels have reached an estimated $6 billion a year.

It didn’t take Uber drivers long to realise that they could install GPS spoofing apps to lie to Uber about the relative distances they were covering in each ride, thereby cheating the ride-sharing behemoth of its due share of proceeds. To fight fraud, Uber has had to integrate with the likes of Slice Intelligence and other networks to fingerprint devices, detect gaming, and circumvent spoofing. In the case of GPS spoofing, for instance, cheating drivers still need to use accurate location services for other purposes; exposing them in that way, however, requires triangulation across apps.

There are dozens of examples of how multi-app triangulation helps to detect patterns of cheating and fraud and offer the only path to mitigating both. It is not surprising then that more and more companies are integrating into the most diverse sources of data and the most heterogenous algorithms in order to stay ahead of the fraud threat.

Performance

Then there is the issue of keeping up with the growing diversity, frequency, and scale of demands in the digital network. Doing so counsels dispersal of different components within what were once compact systems across multiple nodes, many managed by external parties, some of whom may even be competitors. The result has been intense data fragmentation (a situation that can only be exacerbated by the growing popularity of end-to-end encryption) and algorithmic specialisation.

There are now service providers who specialise in high-performance billing alone, like Chargify, allowing companies to unpack what was once a core component of most digital platforms in order reduce downtime.

Food delivery apps rely on specialised point-of-sale integrators to access their client restaurants’ billing systems even though they connect to the restaurants directly for booking and, in some cases, logistics.

Algorithmic trading platforms plugged into stock exchanges are also heterogeneously integrating into “sentiment engines” feeding off Twitter chatter, Reddit subthreads, and Facebook newsfeeds, as well as specialised chatrooms, in order to beat platforms that connect more narrowly to market intelligence portals.

All of these developments point to one fact: to create a coherently high-performing service, one needs data hosted across some very diverse repositories and, increasingly, also specialised algorithms developed by third parties. Hyper-integration enables the assembling of the best and most relevant across legal, sectoral, technological, and domain boundaries to enable seamless delivery superior to what can be achieved by even the best resourced giants.

Then there is also the fact that product and service unbundling and re-assembly over hyper-integrated networks is every now and then the only way to efficiently aggregate the necessary volumes of transactions in these high-speed transactional systems.

In the aviation industry, hyper-integration is the only reason why seamlessness can still be teased out from the specialisation and fragmentation of port logistics information systems; travel agent networks; a daunting array of consolidators, inventory, and reservation nodes, franchises, and concessionaires; and eventually the re-aggregation plays by the multiple “global distribution networks.”

Coverage

As scale-hungry legacy behemoths run out of low-hanging fruits in industries like telecoms, payments, advertising, and dispatch, they must enter industries with a high proportion of low-digital operations and try to brute-force their way via dense meshes of low- and high-digital models.

The high-tech sector’s search for “coverage” in such harder-to-penetrate areas as health, education, energy, defence, transportation, and agriculture, is encouraging greater and greater comfort with what we referred to earlier as polycentric integrations.

Unlike monocentric integrations, where a behemoth rules the roost thanks to its size and compels a standardisation of connection parameters, polycentric integrations brings to the fore the converse phenomenon of heterogenous contracting and connection protocols that allow operators in very dissimilar domains to transact with one another with something approaching seamlessness.

Table 1. Five parametric dimensions of integrations

| Parameter/Attribute | Polycentric Integrations | Monocentric Integrations |

|---|---|---|

| Cross-Jurisdictional | Frequent | Infrequent |

| Cross-Institutional | Diverse | Limited |

| Values Divergence | Intense | Muted |

| Legal Framework Harmony | Low | High |

| Data Standardisation | Complex | Simple |

| Protocol Volatility | Downside Risk* | Upside Risk* |

*Changes in how positive margins are shared as a result of changes in the contractual and technical rules of joint operations are seen as a greater source of risk in polycentric integrations whilst changes in how losses are shared dominate the risk perception in relationships defined by monocentric integrations.

Global incoterms in the international shipping industry, for instance, acquire their coherence not just from APIs that enable freight forwarders and customs officials, port health authorities and phytosanitary standards inspectors, and road cartage operators and insurance brokers to all align around the most pragmatic arrangements for distributing the value accreted by a successful goods container delivery transaction, but far more from complex conventions underlying the diverse algorithms that flow in and out of each handshake.

These same polycentric models also enable hospitals to partner multilaterally with banks and retailers, as well as entity holding companies and investment trusts, on such intricate issues as employee health benefits. All the while also opening the door for specialised benefits networks to engage with restaurant chains, who, in turn, are keen to hook up with “financial wellness” companies. In short, synergy is being willed into existence through the sheer intensity of the push for integrations. No marriage is too weird to consider.

Google’s lacklustre integration with the Royal Free Hospital (RFH), which was hobbled by data siloisation, was a typical move in a polycentrically promiscuous world. It still did not make it any less baffling for observers used to a more traditional mode of defining comparative advantage, complementarity, and synergy.

One group of scholars, for instance, wondered about the Google-RFH mesh-up in these words: “Why DeepMind, an artificial intelligence company wholly owned by data mining and advertising giant Google, was a good choice to build an app that functions primarily as a data-integrating user interface, has never been adequately explained.” But the answer is pretty straightforward: the search for coverage. The very same impetus behind the Silicon Valley giant’s failed effort to digitally transform public transport in Nairobi using NFC smart tags.

The hunt for coverage is brutal. Increasingly the path to growth for every company runs through heterogenous partnerships where the synergy is literally induced by a mashup of protocols, conventions, and a slew of APIs.

Some people believe that the way to harness this growing need for heterogenous connectivity is to double-down on blockchain, but unfortunately that notion is deeply misconceived. Blockchain’s core monocentric model is precisely the kind of strategy designed not to fit the contractual complexity of these types of apples-to-oranges marriages.

A growing convergence

The sum effect of these drivers is the growing convergence across industries, and the rapid dissolution of boundaries.

The emergence of hyper-integrated platforms such as WeChat in China that fuse financial services, retail, general commerce, insurance services, gaming, etc. into a unified interface is leading to high osmosis across once sacrosanct industry barriers and making hyper-integration even more dominant over pure platformisation.

In the past, start-ups like Google could birth whole new industries, such as personalised digital advertising, due to large gaps and niches between industries. Today, such industries emerge in the interstices of convergent networks, and largely beyond the capacity of any one behemoth, much less a start-up, to actuate.

Whilst the convergence trend has been widely noted, other dimensions of the effect of hyper-integration have not received the same degree of attention.

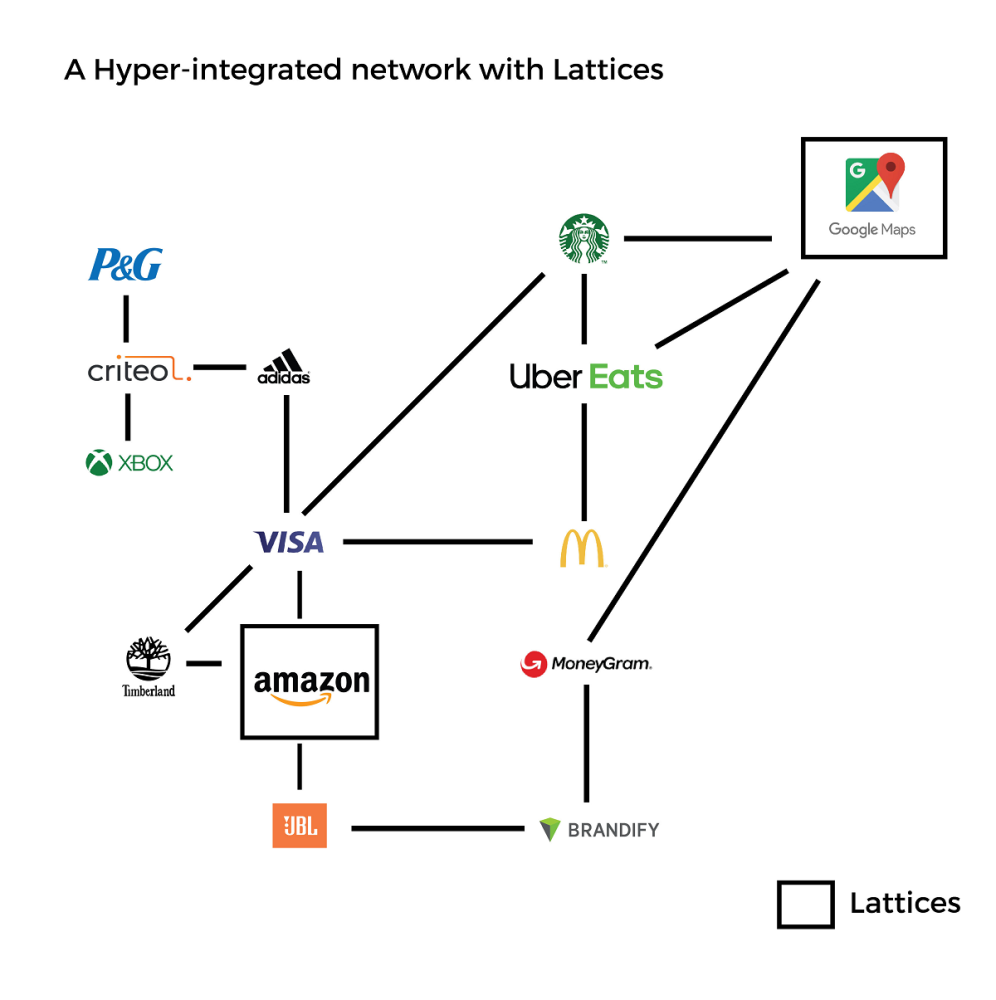

The most important of these are: viscosity and lattice-power, the two consequences of hyper-integration most responsible for the slow but steady crippling of the disruption narrative due to, among others, the declining profitability of start-ups, a decline in customer-centricity, an increase in rent-seeking orientation, and a slowdown of agility. The figure below illustrates how “customer-centricity” is giving way to positionality within hyper-integrated value networks, as emphasis shift to “land rents” instead of profits at the edge of the network. This highlights the emergence of “lattice power” as a block to upstart disruption.

Figure 7. A hyper-integrated network with lattices

Viscosity

Convergence is a powerful reality. Still, it is important to note that whilst the nuts and bolts of value delivery are growing indistinguishable and making highly unified interfaces possible, the economics of different industries are not necessarily converging.

Stickiness and friction arise in hyper-integrated business-society ecosystems as a result of the very nature of polycentric integrations.

Firstly, the value of single integrations falls as more are required to deliver the same amount of value than was the case yesteryear.

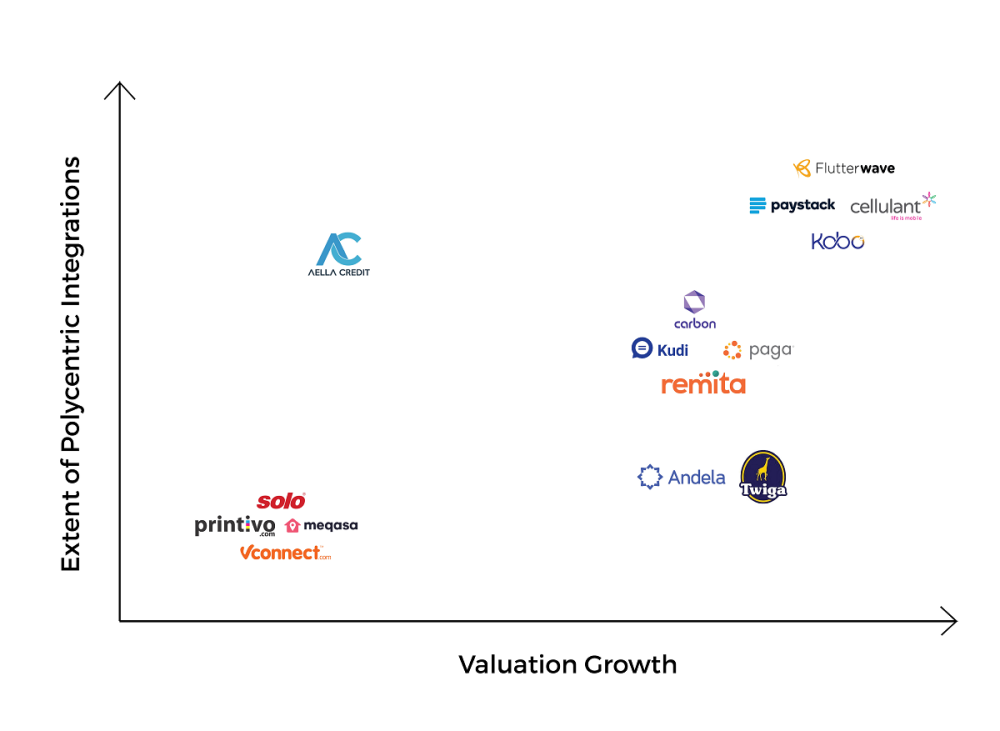

My tracking of major start-up incubators such as YCombinator, MassChallenge, and 500 Startups over the last five years shows clearly that far more polycentric integrations—orders of magnitude more, each demanding more time- and resource-consuming synchronisation (from, among others, a legal-contractual, risk-management, technological and cybersecurity standpoint)—are now required by new ventures to attract the same level of valuation than was the case in the recent past. As illustrated in the figure below, a preliminary study of valuation growth among a selection of venture-backed start-ups shows a strong correlation between valuation growth and integrations density growth in line with a growing business model emphasis on integrations.

Figure 8. Enterprise value growth is increasingly correlated with the speed, variety, and depth of their integrations with partners and counterparties

A dramatic illustration of integration value is expressed in the Google – AOL AdWords integration in 2002 then managed by just four Google engineers (a measure of intrinsic “cost to build and maintain”). This integration generated, by my estimate, roughly $2 billion in valuation growth over its useful lifecycle.

Contrast that with the situation where an African start-up Cellulant, one of the very few African companies to attain the $100 million capitation mark, had to accumulate as many as 250 integrations, many of which are polycentric, before it could reach that valuation. As already suggested, this burden has nothing to do with Africa’s unique environment, though, as I argue later, the burden may well be felt disproportionately in the developing world.

The main point is that an “integration inflation” is currently underway and companies seeking to generate value must expend considerable resources building and managing integrations just to sustain their prevailing level of performance.

Secondly, the costs of maintaining multiple polycentric integrations are rising considerably as heterogenous companies and other entities seek to encode more and more complex legal and social norms into the connection protocols, in the process generating friction and raising the costs of starting-up and upstart innovation.

As start-ups spend more and more time configuring their operational systems to align with complex hyper-integrated networks—lattices or hyperlattices—they become increasingly more conformist and less focused on revolutionary breakthroughs. The deeper the level of conformism required for alignment within the lattice, the harder it becomes for start-ups entering the ecosystem to truly break free of dominant trends, much less to upend them.

A growing number of trend-spotters are beginning to observe this, though not many have linked the declining quality of breakthrough innovation to the falling productivity of the dominant Silicon Valley model.

Lattice Power

A fascinating consequence of the hyperlattice mode of ecosystem organisation is the steady displacement of customer-centricity as the primary mode of competitive advantage by “lattice power,” a phenomenon whereby ecosystem actors calibrate and recalibrate their positioning within the complex mesh of integrations as the prime source of their market advantage.

Whether through a legacy role in the mesh that created the lattice, or just because of smart calculations of where the density of integrations in the lattice is shifting, some companies become strategically positioned and begin to benefit more from creaming off rents due to their favourable position in the lattice. Efforts to achieve this very frequently can distract from the focus on generating profits from delivering high-margin, high-value, services to consumers.

I argue that incumbencies generated by lattice power are harder to dislodge than the customer-loyalty based advantages of yesteryear for three reasons:

First, the upstarts in the network are themselves far too busy weaving and bobbing through the interstices of the system to avoid being hit by the train of convergence and rendered redundant in the configuration.

Second, in many hyper-integrated networks it is not always clear where one should focus one’s disruptive energies. Where does one begin to disrupt the highly heterogenous global digital advertising arbitraging and distribution system, and its appended networks, for instance?

Third, unlike platform-based incumbency behaviour which can easily be called out through antitrust proceedings and other regulatory checks and balances, it is much harder to bring the regulatory scalpel to bear on hyper-integrated networks, as US politicians are discovering in their attempts to disrupt the medical pricing super-networks in America.

On top of all this, acquiring their own nice little stock of lattice power is a far more expensive undertaking as a path of growth for start-ups than customer obsession. In a world where lattice power dominates the attention of founders and managers, instead of customer delight, upstart breakthroughs are much harder.

In fact, a major feature of hyperlattices is the almost counterintuitive fact that they can easily degenerate into consumer welfare abating systems. Abatement in this manner may come from choice narrowing, perks removal, and higher pricing. Sometimes, at the onset of hyperlattice logic, even anti-loyalty behaviour is possible, such as the bizarre notion of Uber punishing frequent customers by charging them more for being too dependent and too attached to its services.

Nowhere though is the perks removal phenomenon more interesting than in the area of commercial aviation where, today, members of the highest tiers of American airlines’ loyalty programs have seen their access to lounges curtailed when travelling domestically and other benefits removed. The interesting point here is that airlines have decided to extend those courtesies instead to holders of certain credit cards due to new integrations with financial services companies.

At first sight it appears like an absurd decision to sacrifice the goodwill of one’s customers in favour of customers of another company, or to reward uptake of a peripheral product (like co-branded credit cards) instead of your core product That is until one pays attention to the interconnections among these companies from supposedly different industries and the blurring of brand ownership lines in hyper-integrated products.

By fusing credit card data with travel history data across the very different nodes of airline reservations and credit processing, and by blending the algorithms of credit limit determination with those of travel perks ordering, a superior, polycentric, integration emerges. One that is far more valuable than the more monocentric integrations among airlines within their code-sharing networks.

In order to understand how the logic of rent-creaming works, one must pay very close attention to the rewriting of synergy rules that has made it possible for a company’s location in the hyper-lattice to supersede customer-centricity as a key revenue enabler.

However, companies in hyper-integrated ecosystems who try to cling to the old platform-centric model without amassing lattice power tend to see, in time, an erosion of their position in the network. Expedia and other travel booking sites, for instance, have seen airline companies removing inventory from their platforms and aggressively upping the stakes during contract renewal as a condition of keeping the integrations between the booking sites and the airlines’ own platforms alive. This is their reward for trying to play a platform game in the hyper-integrated ecosystem of global travel.

Call to Action

So, what does all this mean for technology-entrepreneurship-innovation (TEI)- powered economic development?

For the individual entrepreneur or firm, the insights are obvious: formalise the documentation covering the integrations linking owned, controlled or leveraged applications and platforms to counterparties and partners. In doing so, recognise these integrations as a new “asset domain” and “capability type” within the enterprise. Clearly parametrise these integration assets along the mono-poly axes described in these pages and map the value creation derivable from careful management of integration assets more strategically, using contingency planning tools liberally. Both the CFO and the CIO must have clear insight into these modelling and scenario-building activities, and the CEO must be responsible for overall strategy in determining lattice-positioning.

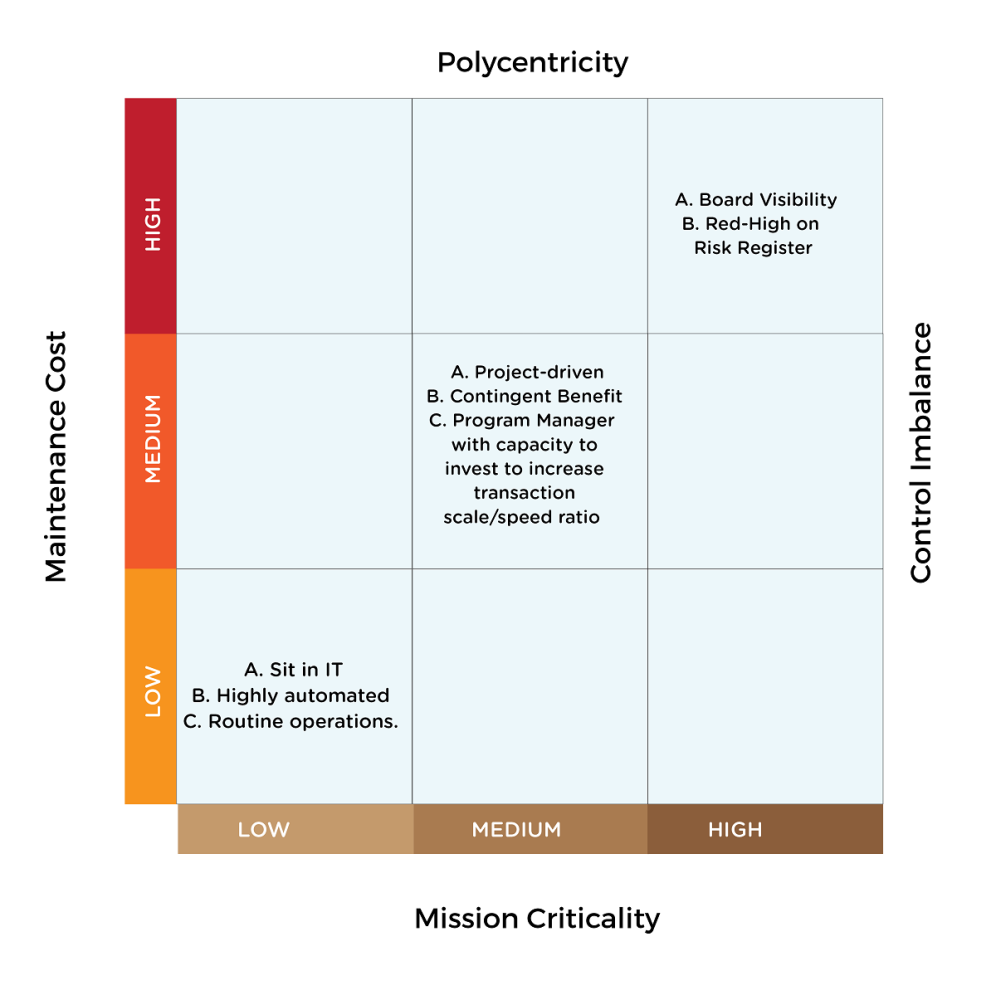

Figure 9. Integrations portfolio optimisation model for managing transactional partnerships

A simple tool like a portfolio optimisation matrix (IPOM) can be extremely helpful to corporate strategists as they navigate a business landscape increasingly defined by hyper-integration. Each business partnership in the organisation can be assessed and managed through a new “integration impact” lens.

Some partnerships, viewed in this framework, would be seen as primarily concerned with routine operations that belong to narrow functions within the organisation such as IT. Others would be highly polycentric, mission critical, and costly to maintain, with control skewed in favour of the counterparty. Such a partnership needs visibility at the highest corporate governance level possible and must be in the “red” columns of the corporate risk register. Between these extremes are project-oriented partnerships requiring strong program management and a new highly rigorous understanding of the determinants of scale and speed.

At a societal level, however, the lessons are more nuanced. The disruption of the disruption narrative also amounts to a quiet and worrying unravelling of interrelated narratives about how TEI cultures can grow to transform the societies in which they nest.

If hyper-integration is erasing niches, raising the costs of start-up innovation, and undermining strategies by means of which upstarts have in the past used to grow and match or even displace incumbents, then there is some cause for alarm given how many people are banking their hopes on a massive TEI tide that lifts all boats in places like Africa.

The twist in the tail is the opportunity that hyper-integration also offers to build public-private-civic platforms more effectively than was ever possible in the past, and by so doing to create and sustain social good initiatives that really only make sense at a hyper-integrated level.

Our growing skill at polycentric integrations offer the first real solid prospect of integrating the public, private, and civic domains, and their key actors, to solve problems that only such multistakeholder networks can solve.

Fintech in Africa is an obvious example. Deep and broad partnerships of a sort never before contemplated are necessary to move beyond the surface-level innovations of transactional micro-payments, like m-Pesa type systems. To approach the true transformative layers of financial innovation such as can lower the cost of credit; or power informal sector pensions, micro-mortgages, and unemployment insurance, a serious rethinking of policymaking in the wake of hyper-integration is required. To escalate even further to macrofiscal innovations such as right-sizing public sector debt for retail investors using digital means, novel institutions are required. And for efficiency sake, these new institutional arrangements would have to be embedded into the technology protocols themselves. That is, if they are not to be held hostage by weak infrastructure and institutions.

Take the plight of Ghana’s highly promising, yet chronically delayed, financial services interoperability framework as an example. For many years, the banks have refused to enable full cross-platform debit functionality among themselves and other operators within the ecosystem due to an unmitigated spectrum of risks. A whole host of start-up and new venture driven innovations have been suspended in limbo on account of this. Other similarly powerful prospects are blocked by a demand for high floats.

The end-to end-payment rails ecosystems that the likes of Mastercard and Visa are able to deliver across the globe should theoretically be feasible at local levels to serve distinctly local needs at lower transactional cost. The national switches are in place and policies have been made. What has been missing is the polycentric integrations into other institutions such as identity management platforms, escrow platforms, arbitration platforms, credit referencing platforms, collateralisation and securitisation platforms, state guarantee and insurance platforms, and other heterogenous nodes to take care of high residual risks and the fear of fraud.

And those fears are valid. There are instances of payment platforms being hobbled on account of fraud. Mobile money systems have now been so contaminated by fraud that telecom operators have had to mount special communications campaigns to address them.

Some banks have been blocked from interoperability frameworks for taking advantage of settlement loopholes left by incomplete integrations. No wonder then that banks are willing to endure slower growth than ride all the massive promises of new business promised by a wide swathe of potential suitors in domains as diverse as informal pensions mobilisation and microgrid micro-subscription platforms.

In the area of microinsurance, weak integrations caused the failure in late 2014 of a major multi-stakeholder collaboration platform set up by Micro-ensure, a highly successful microinsurance broker; various government of Rwanda agencies; and regional and local agribusiness players, when the burden and costs of trust maintenance fell disproportionately on Micro-ensure. A similar fracture led to Micro-ensure’s pull-out from Uganda.

Whilst Micro-ensure has done what theory predicts by anchoring its value delivery model on more than 200 integrations, the disproportionate burden of sustaining those integrations affects its agility and introduces fragility when partners fail to pull their weight.

Instead of a single start-up, no matter how visionary its founders, seeking to build out a hyperlattice all on its own, I argue that national, regional, and, eventually, even global, hyperlattices that spread the risks and burdens of trust management in order to deepen resilience are what is required to support the increasingly complex, multi-stakeholder, solutions we need to take promising innovations to their true scale, whilst ensuring inclusivity. Modular prefabricated integrations cutting across government, industry and NGOs, must be delivered as public resources to provide “escape velocity” for start-up driven efforts.

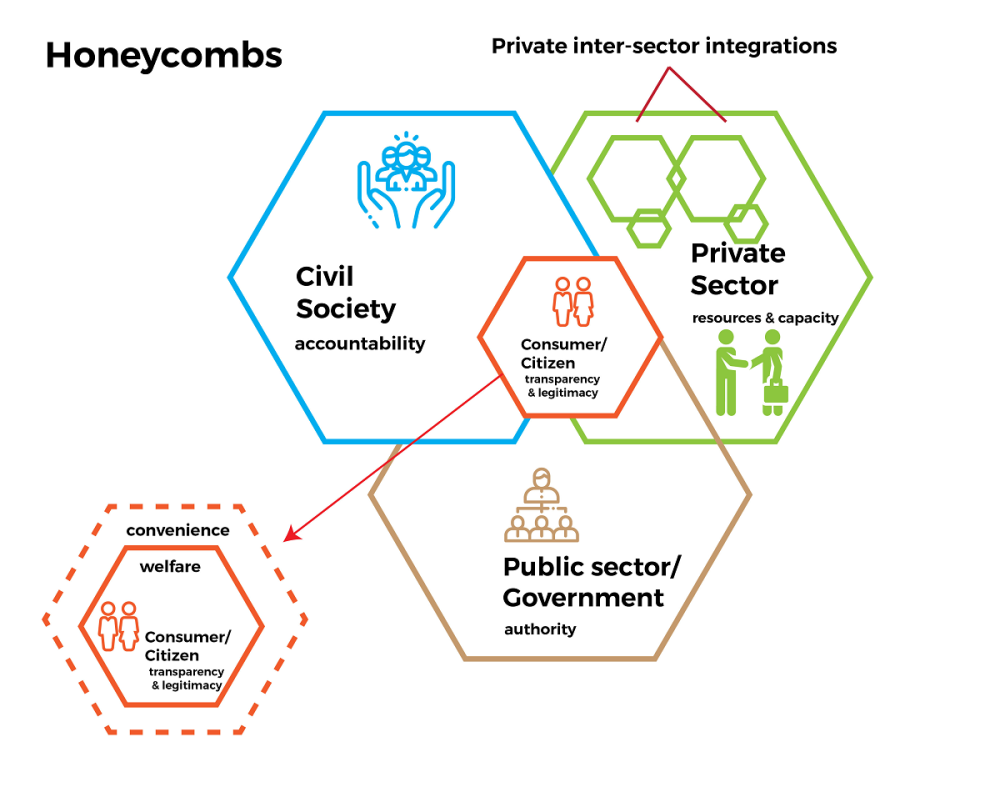

I call these types of multi-stakeholder lattices that, by means of polycentric integrations, can bind together governments as providers of authority; civil society as assurers of accountability and transparency; businesses as enablers with capacity; and consumers, as bringers of legitimacy, through their combined role as beneficiaries and citizens, honeycombs.

Public Good Hyper-Integrated structures (“honeycombs”) can reduce negative lattice power by offering a critical mass of useful integrations at low cost to upstart innovators and enable them to deliver real welfare benefits to the public in hard-to-platformise areas such as health and education beyond the mere “conveniences” created by digital solutions.

Figure 10. Public good hyper-integrated structures (“honeycombs”)

Honeycombs, as operating systems for hyper-integration, provide the scaffolding and exoskeletons for the hive of networks across society critical to building out the next generation of large-scale solutions to the fast-mutating problems of development.

Is the goal providing a wider class of innovators with access to data on biopsies collected in public hospitals so that they can construct genomic databases? Or is it facilitating exchanges of such genomic data to enable access by regional clinical trial contractors, whilst integrating specialised oncology medicine sourcing programs targeting patients who otherwise cannot afford to pay with credit? Whatever it is, the polycentricity implied by such models is often beyond the skill and resources of individual entrepreneurs in the multiple industries touched by these needs.

In African and other developing societies, where such solutions are often even more needed, the lack of capital and the shortage of talent, not to mention the weak institutions, make a decision to leave such poly-integration work primarily to visionary market-building private sector actors short-sighted, naïve, and, frankly, reckless.

Nowhere are ready-made scaffolding and exoskeletons more required than in developing countries, where they can provide the tensile strength individual actors and smaller groups of collaborators need to achieve escape velocity in their quest to bring new products and services to the market, invent new industries, and create millions of new jobs in the process.

So, to conclude, whilst hyper-integration makes the work of atomised start-ups trying to heroically upend the status quo and single-handedly cause disruptive change harder, it paradoxically also opens up the prospect of large national and supra-national exoskeletons for thousands of start-ups, nonprofits, civil society groups, and government agencies to interlock in the creation of more resilient and trusted structures.

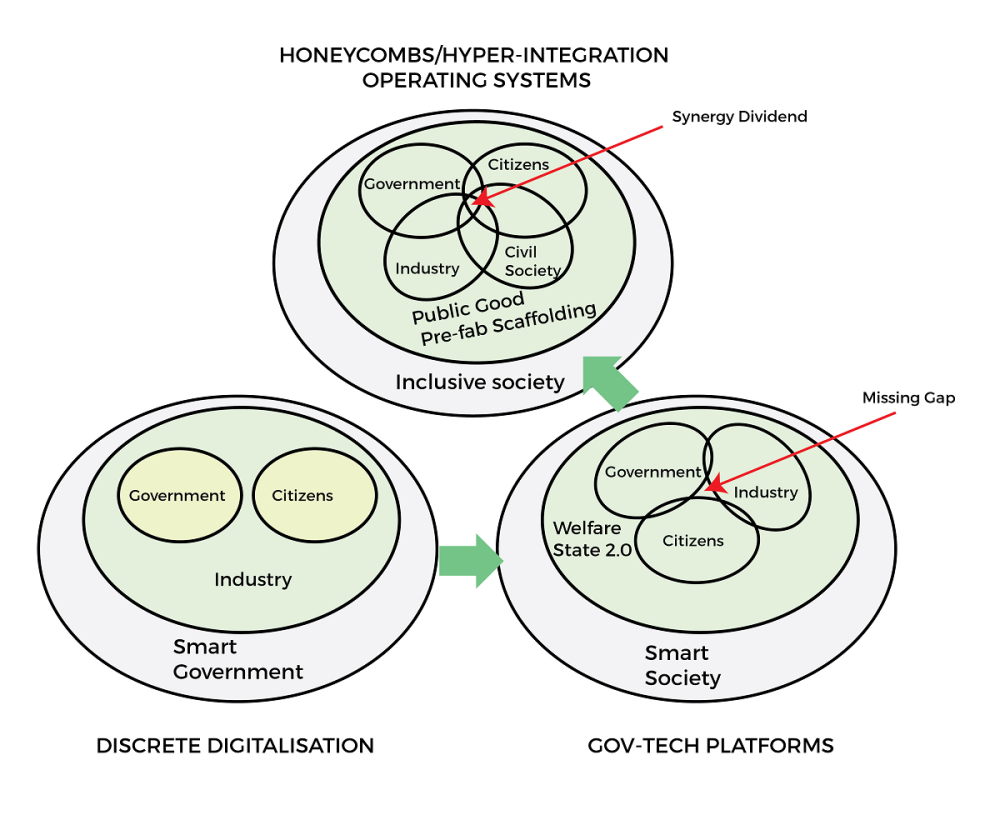

Already, there is a growing awareness of a need to shift government technology transformation thinking from discrete G2C (government-to-consumer) and G2B (government-to-business) applications for fairly standardised transactions like tax settlements and customs clearance to the more complex and intersectional welfare domains of health, education and the rest. We are in this essay advocating for an even more radical transition beyond the “smartness” criterion to “inclusive innovation multistakeholderism” as the dominant rationale for the development transformation aspirations of modern nation-building and nation-safeguarding.

Figure 11. Evolving beyond “smart government” service models to true innovation multistakeholderism

Given the growing distrust of behemoths from every segment of society, be they large corporations, big government agencies, or large foundations, and the growing intersectionality of both risks and opportunities, more and more of the development problems confronting the planet will in time only be addressable through such hyperlattice structures. And nowhere is the need more dire than in the developing world.

Bright Simons is President of mPedigree and a member of CGD’s Study Group on Technology, Comparative Advantage, and Development Prospects.

This note is part of a special series authored by members of CGD’s Study Group on Technology, Comparative Advantage, and Development Prospects. Learn more at cgdev.org/future-of-work.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.