The World Bank Group Evolution Roadmap makes three financing asks of donors and shareholders: capital for IBRD, continued support for IDA, and grants to support climate projects. I think donors and shareholders should support a capital increase and strengthen commitments to IDA. But they should not provide more grants to support climate activities at least until (i) IBRD lending to support mitigation has been reformed and expanded and (ii) major cost-effectiveness and equity concerns of existing grant mechanisms are addressed.

The World Bank already acts as a trustee for twelve climate-related financial intermediary funds, which together have raised over $48 billion, mostly spent on grants for mitigation and in particular clean energy (see forthcoming work by my colleagues Clemence Landers, Nancy Lee, and Sam Matthews).

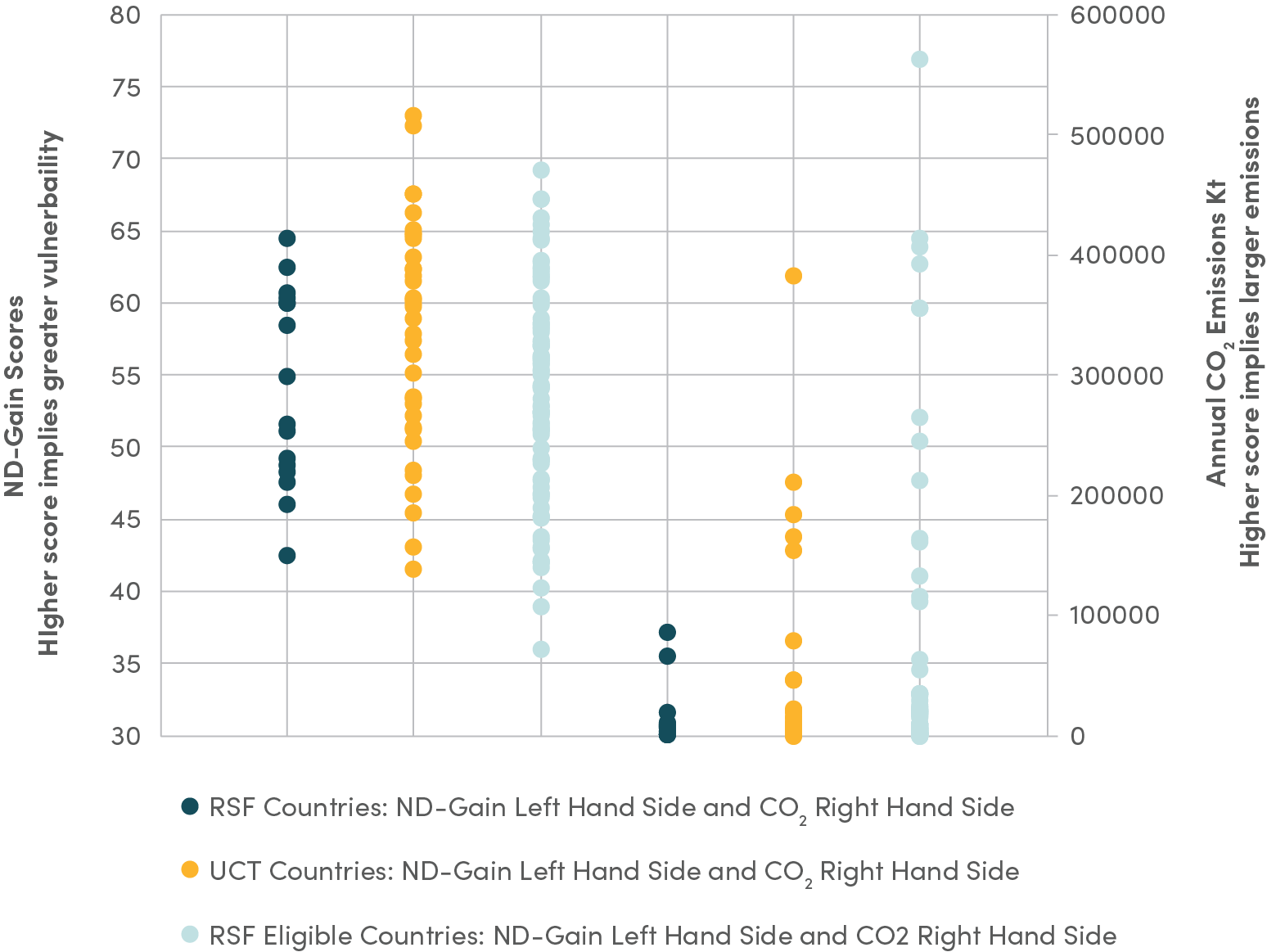

More than four fifths of this finance is used in middle-income countries, a proportion unlikely to change, given the mitigation focus. Zack Gehan and I have been developing scenarios for future economic growth and electricity consumption that suggest low-income economies will still be responsible for less than five percent of electricity consumption in 2050 even if they considerably outperform growth expectations. And mitigation subsidies in low-income countries have to be larger for the same reduction in emissions, because the cost of capital is higher.

Climate funds are not cost-effective tools of greenhouse gas reduction. Most funds do not publish any data on emissions avoided per dollar of subsidy, but available data suggests funded projects vary by more than 100-fold in terms of cost effectiveness. The Bank Group’s use of subsidies in general has led to minimal leverage (often 1:1 or less) and proven extremely difficult to scale. Even if they were be used more effectively, grants are the wrong instrument for mitigation. Given the aim is to shift countries along the abatement cost curve toward activities that have marginally unfavorable in local economic returns but positive global externalities, large volumes of marginally below market finance (i.e., IBRD lending) is a more appropriate tool than smaller volumes of grant finance.

Despite this, worldwide, official development assistance (ODA) is already being diverted to support the targeted $100 billion in (supposedly) new and additional climate finance, nearly all of it to subsidize mitigation projects. There is every reason to think this dynamic would be repeated by donors with regard to additional ODA provided through the World Bank Group.

Low-income countries will suffer the most from the effects of climate change, a problem they have played almost no part in creating. Development (and thus development finance) is a powerful force for adaptation. Redirecting effective development finance from low-income countries to subsidize ineffective mitigation activities in richer countries is a triple loss for mitigation, adaptation, and development.

Instead, donors and shareholders should support the IBRD to do more on mitigation through policy lending operations. Combined with using the financial value of callable capital to borrow more from the current base, an IBRD capital increase which leverages lending capacity 10:1 or more could significantly expand finance for mitigation. These resources can be made more attractive to borrowers if packaged as large-scale, low transactions-cost climate policy lending rather than project finance. Additional ODA funding to subsidize mitigation in middle-income countries should only follow increased support for IDA, reform, and expansion of IBRD climate mitigation lending, and the development of cost-effective grant models for climate funds.

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.