Recommended

In July 2021, Ghana announced a plan to issue sovereign bonds of up to $2 billion. Proceeds would be used to pay for social sector initiatives, including the President’s flagship Free Senior High School program. A few months later, the plans were in tatters. Ghana’s rising debt burden has driven borrowing costs so high that it’s not feasible to issue new debt.

As education systems expand to reach universal primary and secondary schooling, so too do financing needs. The latest UNESCO estimate of what countries will need to spend to reach universal goals finds an annual financing shortfall of $148 billion across low- and lower-middle-income countries. Understandably, governments and international organizations are exploring new financing mechanisms to support greater social sector spending, including social bonds and earmarked concessional funds.

In this blog, we look at the experiences of Ghana, Benin and Mexico, three countries that have attempted to tap the social bond market in order to fund public spending initiatives. We discuss what it is going to take for governments to raise debt funding for education and what might be the role of earmarked concessional finance for those who cannot access international markets. We also touch on what might be needed to improve the credibility and sustainability of social bond markets.

Fiscal sustainability remains a necessary condition to access international markets

Building on the success of green bonds, governments of emerging countries have started issuing social bonds. Bond proceeds are being used to fund a wide range of eligible budgetary programs, often linked to the Sustainable Development Goals (SDGs). But entering the international market has some conditions.

Ghana paused its plans to issue a social bond last year when its debt burden became so high as to render borrowing costs unfeasible. To make things worse, the rating agencies (Moody’s and Fitch) then downgraded Ghana’s sovereign rating. With that, it became even more difficult to access external finance. The downgrade occurred despite Ghana’s insistence on its commitment to fiscal consolidation. But the budget in general already lacks credibility as demonstrated by the last PEFA assessment in 2018.

In contrast, Benin was able to successfully issue a 12.5 year ‘SDG bond’ worth €500 million making it the first Sub-Saharan African country to tap this particular market. And it did so with a coupon price of less than 5 percent, lower than Benin’s shorter-term bond issued in 2019 and low in general for medium-term debt issued by a middle-income country (Figure 1). Benin expects proceeds to contribute towards a broader €18 billion effort to achieve the SDGs.

Figure 1: the cost (coupon price) of international sovereign debt, by year of issuance

Source: Fitch Ratings for outstanding obligations and bond issuance notices. EUR or USD denominated issuances shown for selected emerging market economies.

The divergent fortunes of the two countries in being able to take advantage of these market instruments have been shaped by their fiscal conditions. Ghana’s looming debt problem caught up with it before it could buy time to give fiscal consolidation another try. Benin is in a healthier fiscal condition than Ghana as it kept its debt level significantly lower. Notably, Benin managed to keep its wage bill under control, demonstrating that additional revenues would likely be used to fund new investment projects rather than pay salaries. At a more fundamental level, Benin is subject to more stringent institutional constraints, inducing fiscal discipline by limiting the amount of domestic debt it can issue. Whereas, in Ghana, such policy choices are exposed to the vagaries of partisan politics.

Social and sustainable bonds might bring cost and refinancing advantages over standard debt

A major motivation for issuing social or sustainable bonds is the prospect of lower costs than conventional debt. Some countries have achieved a higher price and lower yield (a “Greenium”) for bonds with “Environmental, Social and Governance” (ESG) accreditation. For instance, Benin’s SDG bond sale was twice oversubscribed with an estimated Greenium of 20 basis points. Similarly, Colombia’s sustainable bonds issued in 2021 yield almost 20 basis points less than equivalent conventional notes. Other green bonds in Egypt (2020) and Chile (2019) were issued with yields slightly lower than rates of those countries’ standard debt with a similar duration. But while it’s possible that ESG bonds enable sovereigns to borrow more cheaply— i.e. borrow under their yield curve—there are still too few cases from which to assess where such bonds will trade relative to a country’s standard debt.

And even if there is no direct impact on the cost of debt, countries may use ESG bonds to reduce refinancing risk. There is a growing group of investors seeking ESG-linked securities. A 2020 World Bank survey of institutional investors and public debt management offices indicated that ESG factors are showing up frequently in the list of questions posed by investors (with 85 percent using it in credit risk assessment, 65 percent using it in security selection and 45 percent using it in asset allocation). Strong messaging around national initiatives and performance may therefore help governments to attract capital from a diversified group of investors, mitigating the risk that future demand may be severely affected by the behavior of any particular group.

But a credible strategy for social sector investment is needed

None of these potential benefits comes for free. Governments face additional costs when issuing ESG bonds. These can include the coordination of line ministries for annual monitoring or reporting and specific preparation and marketing exercises from the outset. As the first ever sovereign to issue a SDG-linked bond in 2020, Mexico’s approach can offer useful lessons for others intending to sell social bonds.

Mexico’s SDG Bond Framework reinforces the country’s credibility to achieve the SDGs through increasing social spending. The framework is clearly defined and explained with eligible expenditures identified for each sector and geospatial specificity included to address equity gaps. In the education sector, eligible budget lines include new school infrastructure and equipment, educational training centers and scholarships. Students from low-income families, indigenous backgrounds, or with disabilities are specifically targeted.

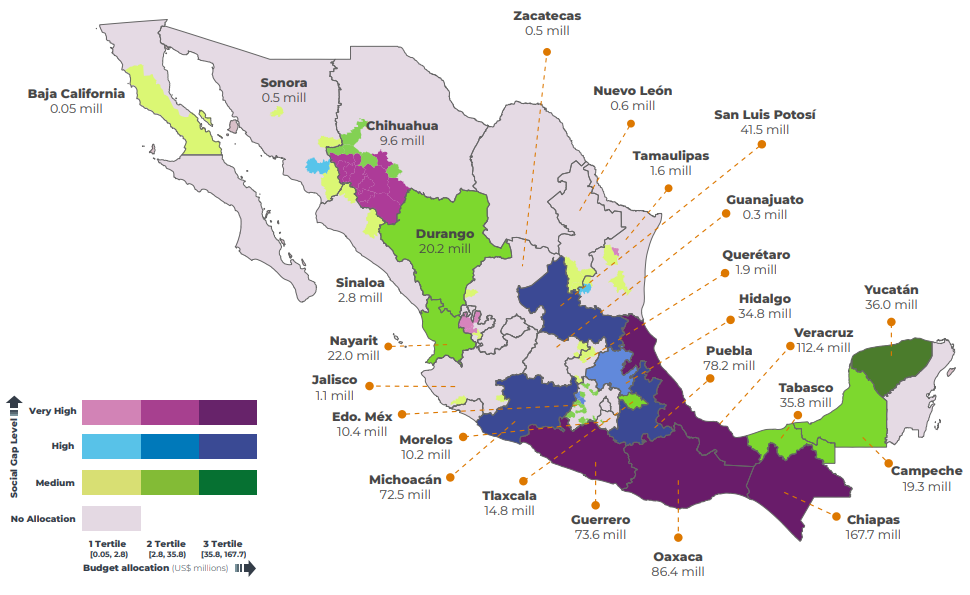

Budget transparency is also improved via an annual allocation and impact report. This process requires line ministries to monitor and report against allocations. For the education sector each eligible expenditure is detailed including, for instance, that 84,712 students from public schools received high-school scholarships in 2021. The report includes disaggregation of the allocation at the local level by the degree of social gap, demonstrating a serious effort towards transparency (Figure 2). Allocation reports are accompanied by UNDP assessments of how bond finance has been used to deliver against SDG targets.

Ministries of Education can also use social bond preparation exercises to make a case for increased education financing. The bond structure—being led by the Ministry of Finance with line-ministry input—incentivises certain types of spending and closer working between Ministries of Education and Finance. Careful project selection can help to tackle skepticism about the productivity of government spending on education.

Figure 2: nominal allocation of SDG-bond-financed expenditures in 2020, across Mexico’s states

Source: Ministry of Finance, Mexico: finanzaspublicas.hacienda.gob.mx

Issuers need to give a stronger signal of credible commitment as the market grows crowded

The increasing supply of ESG bonds coupled with the tightening monetary policies of advanced countries is driving investors to be more scrupulous. There is already some evidence that greeniums are shrinking in Europe’s corporate bond markets. There is also a growing realization that the lure of tapping this market could encourage window-dressing and opportunism which can eventually undermine the viability of the instruments for genuinely committed governments in need of funding for their social sectors.

To the extent that the ex-post yield differentials justify the effort, one way to maintain the integrity and sustainability of the market is for countries to create strong signaling mechanisms. These can differentiate those who are committed to deliver from those who are simply taking advantage of the ESG label. The emergence of forward-looking instruments holds some promise in this regard. For instance, sustainability-linked bonds increase accountability by penalizing the issuer with higher interest rate in subsequent years for failing to meet interim performance targets.

Such instruments would need rigorous performance monitoring and verification mechanisms that might be hard to establish for some sectors and in low-capacity environments. However, this could also provide further incentives for countries to build their capacities for monitoring and evaluation. In addition to helping governments signal their commitment, sound planning and performance monitoring can contribute towards alleviating the long-standing skepticism about borrowing to finance education in anticipation of uncertain returns.

Concessional financing can protect near-term social spending in highly indebted countries

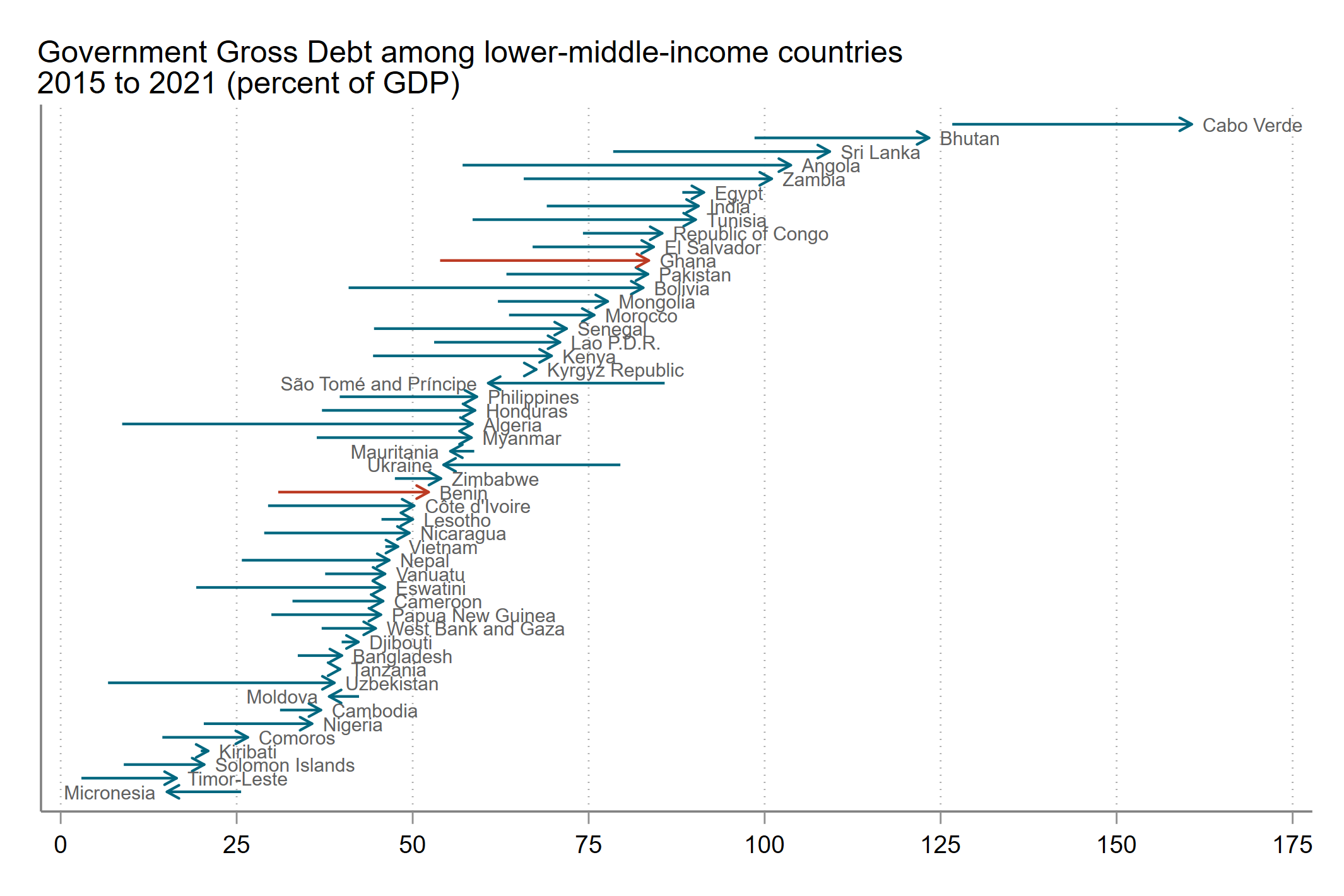

As Ghana’s experience shows, despite the promise of new market instruments, the impending debt crisis makes it difficult for many countries to take advantage of these opportunities. Out of the 69 low- and middle-income countries monitored by the IMF for debt sustainability, 38 (55 percent) have been assessed to be at high-risk of or already in debt distress as of March 2022.

Figure 3: Rising government debt across low-income countries

Source: IMF World Economic Outlook, October 2021. World Bank Income Classifications.

Highly indebted countries need to map out a broader strategy of education financing in conjunction with solving the debt crisis. Until countries are ready to enter markets, there is a window for concessional financing to open up fiscal space for protecting and improving social sector spending.

A good, if not uncontroversial, example of an approach that combines investing in education without undermining debt sustainability is provided by the International Finance Facility for Education (IFFEd). IFFEd is a financing facility that seeks to increase the capacity of the Multilateral Development Banks to provide additional lending from their standard non-concessional windows to support the education systems of lower-middle income countries. IFFEd will also make the terms of lending for education more favorable by providing $1 of grants to every $4 of loans—and lending is likely to come with complementary technical assistance which is not available in the case of private capital markets.

Although the facility is primarily intended for countries that can absorb more debt, it does not automatically exclude countries with weaker debt indicators who will be expected to undertake a debt sustainability assessment and consult with the World Bank and the IMF. The consultative approach to lending can offer highly indebted countries a pathway to access financing for education more quickly and cheaply once they have taken a set of measures to render their debt more sustainable. But, as in the case of social bonds, the differential in borrowing cost should be large enough to justify the earmarking of debt.

In summary, recent experiences of low and middle income countries show that access to social bond markets requires countries to get their fiscal house in order as well as map out a credible strategy for education financing. There is also a need to ensure the sustainability of the market by improving the credibility of the instruments. For highly indebted countries, new concessional models of financing such as IFFEd could provide a suitable stopgap.

Thanks to Mark Plant and Justin Sandefur for helpful comments.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.