Recommended

In mid-May, the Women Entrepreneurs Finance Initiative (We-Fi) announced its second round of funding allocations, totaling $129 million to support growth for a projected 70,000 women’s businesses. The announcement gives us an opportunity to take stock and make a recommendation: open up access to We-Fi funding to a broader range of actors.

As a refresher, We-Fi came out of the 2017 G20 Summit and was launched remarkably quickly in the following months by an intensive World Bank effort, strongly supported by the United States. The initiative is unique in mobilizing a wide range of global donors to target women entrepreneurs at the small- and medium-sized enterprise (SME) level, prioritizing growth-oriented or “opportunity” entrepreneurs. Traditional initiatives have typically equated women-owned businesses with those at the micro level, often run by “necessity” entrepreneurs who start businesses when faced with a dearth of quality employment opportunities. We-Fi was designed to address women-owned SMEs’ barriers to growth in a holistic fashion, not only focusing on access to finance but also on access to markets, networks, information, and technology. To our knowledge, it is the first fund that brings together country-level policy, legal, and regulatory reforms with private sector investments to support women entrepreneurs. For more detailed reflections from CGD on We-Fi during its earlier phases, see blogs here, here, and here.

Good signs in the second round

As in the first round, multilateral development banks (MDBs) were the only potential recipients of second round allocations. The new round of funding adds the Inter-American Development Bank (IADB), the African Development Bank (AfDB), and the European Bank for Reconstruction and Development (EBRD) as recipients, and also provides additional funding to the Asian Development Bank (AsDB).

Each project brings a new element to the table. The IADB will take an intersectional approach by focusing on underserved communities, including indigenous and afro-descendant entrepreneurs, given the unique vulnerabilities faced by women in the region due to gender and racial biases. The AfDB, through building out its “Affirmative Finance Action for Women in Africa” program, will focus largely on fragile and conflict-affected countries. The AsDB will make use of innovative financial tools, including performance-based lending in Vietnam and the first gender bond in Southeast Asia and the Pacific, to be issued in Fiji. Finally, the EBRD will take a holistic approach to tackling demand-side, supply-side, and environmental constraints, including by reforming gender-discriminatory laws and regulations to remove system-level constraints on women entrepreneurs.

Overall, we are glad to see that the second round of funding expands the first-round emphasis on low-income and fragile/conflict-affected countries and underserved communities, and allows for the use of innovative tools and comprehensive approaches that engage at both individual and systems levels. The second round also expands We-Fi’s geographic reach and allows for a broader range of MDBs to be engaged in supporting growth-oriented women entrepreneurs with the initiative’s support.

Opening up competition for We-Fi funds

What would make We-Fi even better—perhaps much better? Casting the net wider for project and investment proposals. We believe the private sector should compete, along with the MDBs, for direct access to its funds. This has been under discussion among We-Fi donors, but agreement on a way forward has been delayed.

Why open up access to the funds? Three reasons: innovation, scalability, and accountability. No one would argue that the challenges We-Fi confronts are easy. One only need look at the scarcity of evidence to realize that the problems are complicated and simple solutions are not necessarily effective. Gender gaps in entrepreneurship pervade rich and poor countries alike, so we can’t just take a solution from the developed world and transplant it to the developing world. For this reason, innovation and market-disciplined adaptation for successful scaling are particularly important here.

Innovation in this context encompasses new goods and services, new distribution channels, new business models, and new technologies that support or create opportunities for women entrepreneurs. The private sector, of necessity, has a natural advantage in speed of adaptation to market feedback, essential for successful scaling of innovation pilots. The MDBs are increasingly open to innovation, but it is mostly sourced from the private sector. In our view, it would be more efficient if We-Fi had the opportunity to source promising innovations directly from the private sector, as well as through MDB partnerships with the private sector.

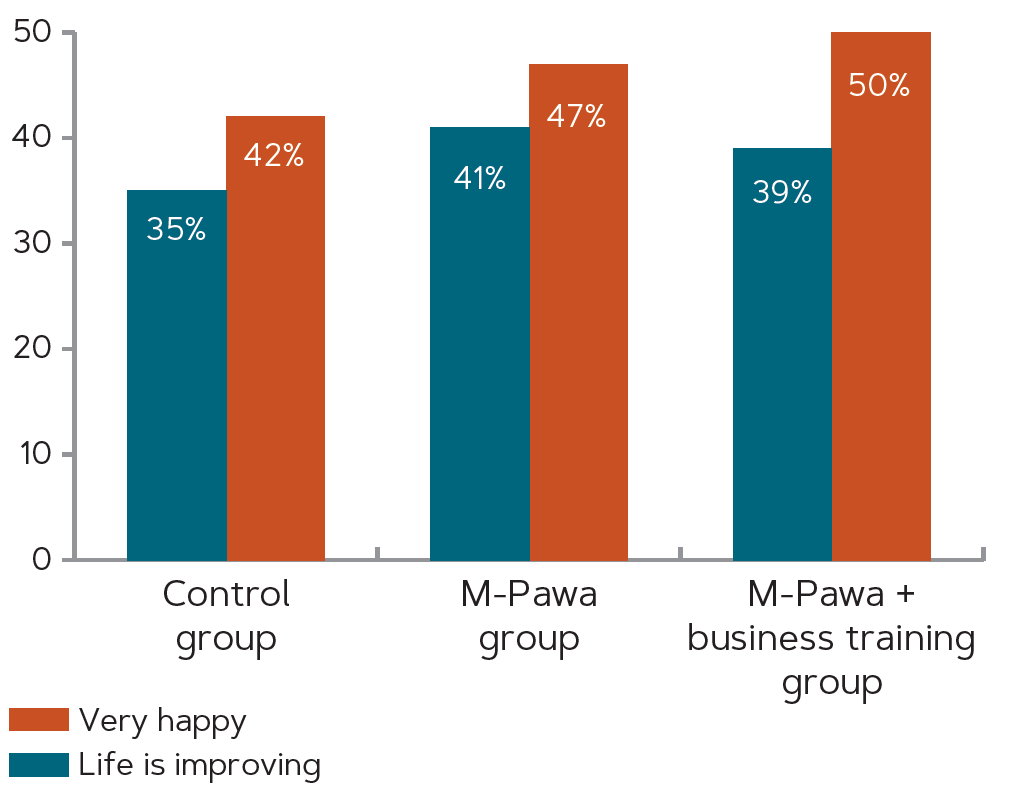

That being said, we know that We-Fi, with its small staff, has no capacity to run projects and programs itself if MDBs are not involved. So why not fund innovative proposals in a way that greatly limits the administrative burden: paying for outcomes? The AsDB project in Vietnam already takes this approach. We-Fi could, for example, offer payments for training that demonstrably boosts women’s business success, or for every women-owned business that is successfully linked to a profitable value chain, or for every women-owned startup supported by a business incubator that is operating profitably after three years.

The private sector could competitively bid for these payments so that the greatest benefits could be had at the least cost. Independent evaluators would assess whether outcomes have been achieved and payments should be made. We-Fi’s administrative costs, therefore, would be minimized. It would not be responsible for designing, implementing, managing, or measuring the results of projects and programs.

Outcomes payments would enhance We-Fi’s accountability for using its funds effectively. They would spur innovation and adaptation that lead to verifiable outcomes. Payments could be calibrated to incentivize scale. Financial structures like development impact bonds or social impact incentives or advance market commitments could be used as vehicles for the payments.

We-Fi may want to test this opening to private sector proposals with a relatively small share of its funding initially to identify and fix problems before committing large amounts of funding. But it is time to launch the pilot.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Marisol Grandon/DFID/Flickr