Recommended

The UK government has announced that it anticipates a return to spending 0.7 percent of gross national income (GNI) on official development assistance (ODA) in three years’ time. It is confident enough in this that the just-published Spending Review, which sets departmental budgets up to the 2024/25 fiscal year, has set aside provisional funding to return to the 0.7 percent ODA target for this eventuality in 2024/25.

This sounds like good news, but in this blog we set out why it would be prudent to hold the celebrations for now.

The return to 0.7 percent is dependent upon the Chancellor’s two fiscal tests being met, so these plans are based on the Office for Budget Responsibility’s (OBR) latest forecasts, and subject to revision as new forecasts are published. Looking more closely at these forecasts, we identify two risks: that the return to 0.7 percent won’t happen at all, or it will happen far too suddenly to do it well.

The return to 0.7 percent is much less certain than it seems

Every year that the UK delays its return to 0.7 means at least £4.5bn of support is withheld from the world’s poorest in the immediate aftermath of a health and economic crisis. The timing of the return matters.

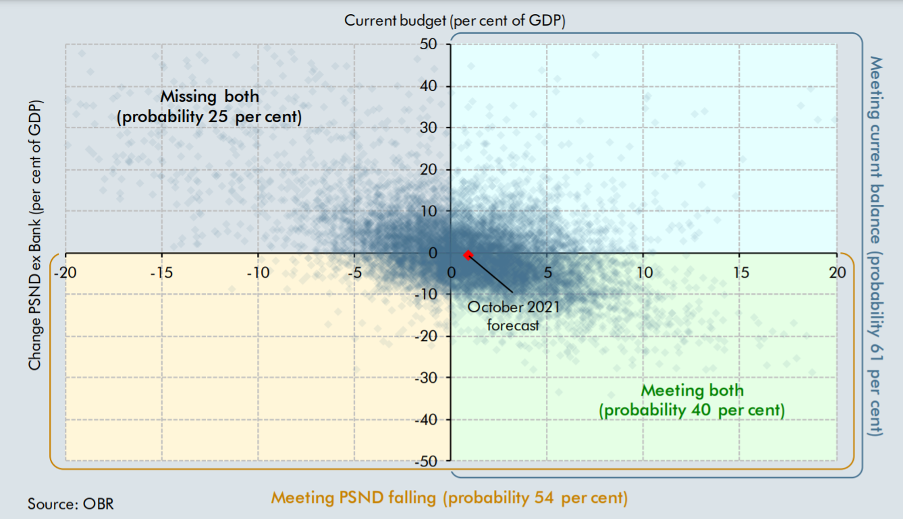

In July, the Chancellor outlined his two fiscal tests which must be satisfied for the UK to resume spending 0.7 percent of GNI as ODA, providing greater clarity over previous commitments to return to 0.7 “when the fiscal situation allows.” These tests require that the government not borrow for day-to-day spending (measured as a sustainable current budget surplus), and for its underlying debt to be falling (measured using Public Sector Net Debt, excluding the Bank of England). The OBR’s latest forecasts allow us to see which of these fiscal tests act as the binding constraint on returning to 0.7 percent, and how far the UK is from meeting these tests in the years prior to the return.

The Chancellor’s first fiscal test, for the current budget to move into surplus, is projected to be met in 2023/24—a year earlier than the planned return to 0.7 percent. This is an improved outlook over the OBR’s March forecasts, which anticipated the current budget to only just balance by 2025/26. However, the forecasted surplus is fragile, at only 0.9 percent of GDP in 2024/25. In fact, OBR simulations estimate that there is a 39 percent probability that the UK will remain in a deficit in 2024/25 (see Figure 2 below).

Figure 1. UK current budget deficit (% GDP)

Source: OBR Public Finances Databank – March 2021 & October 2021

It is the second fiscal test—for underlying debt to be falling—which acts as the binding constraint on returning to 0.7 percent. The Chancellor’s choice of measure for the second fiscal test is notable here, because it will delay the return: Public Sector Net Debt (PSNB), but after excluding the Bank of England (BoE). PSND (excluding the BoE) is not projected to start falling until 2024/25. If the BoE was not excluded in the choice of measure, the second fiscal test would be met sooner: PSND begins to fall from 2022/23 and therefore this choice means that the return to 0.7 is delayed by a year.

But this projected fall is also uncertain. The OBR estimates an almost even likelihood (46 percent) that PSND (excluding the BoE) will continue to rise in 2024/25. The probability of the two fiscal tests being met in tandem is surprisingly slim, at just 40 percent, which makes the Chancellor’s pronouncement a tad unusual—and perhaps premature.

The odds of returning to 0.7 on the timeline that Sunak announced is worse than a coin toss.

As the OBR (October 2021, p.197) concludes: "on average across all the simulated futures there are more occasions where one or both [of the Chancellor’s fiscal] targets are missed than there are where both are met [in 2024/25]."

Figure 2. 10,000 simulations by the OBR of the current budget and change in PSND (excl. BoE) in 2024-25

Source: Office for Budget Responsibility (October 2021) Economic and fiscal outlook, Chart C p.197

The odds of returning to 0.7 on the timeline that Sunak announced is worse than a coin toss.

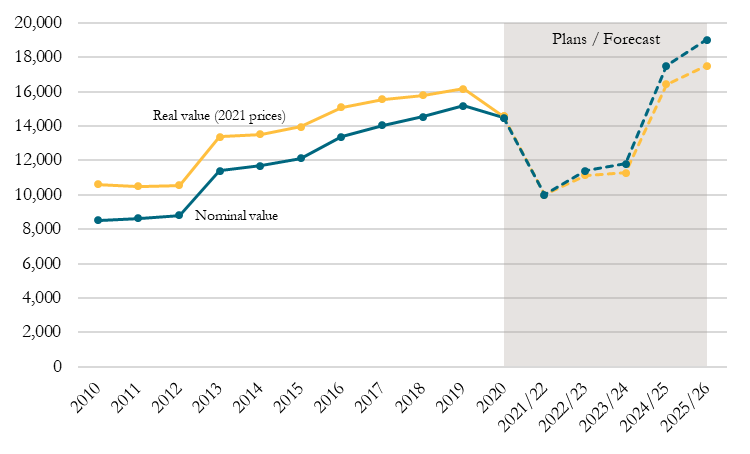

Current plans are for a dizzyingly fast increase in ODA

Even if the coin lands the right way for developing countries, the planned return to the 0.7 percent target set out in the spending review is extraordinarily abrupt.

Instead of a more gradual pathway back to the target, the government has opted to increase ODA by £5.7bn in 2024/25: jumping from 0.5 to 0.7 percent of GNI in a single year while GNI is also projected to increase. When the UK first set out to meet the 0.7 target in 2013, the Economic Affairs Committee cautioned that "the speed of the planned increase risks reducing the quality, value for money and accountability of the aid programme." Yet the increase they were so worried about was £2.6bn—that’s less than half of that what Rishi Sunak has planned in 2024/5.

Figure 3. UK official development assistance (£ millions)

Source: UK Statistics on International Development, HM Treasury (October 2021) Autumn Budget and Spending Review, OBR Economic and Fiscal Outlook – October 2021, ONS UKEA

It’s strange that a Chancellor so keen to establish a reputation for fiscal prudence has opted for such a sudden jump to 0.7. Although the government has three years to plan ahead and mitigate the value-for-money risks associated with such a rapid expansion of the aid budget, the Treasury has said it will continue to monitor the OBR’s fiscal forecasts, and based on these it will only commit to increasing ODA above 0.5 percent of GNI one year ahead. The FCDO will therefore need to begin preparations to return to 0.7 ahead of the Treasury’s official confirmation, despite uncertainty as to if and when it will actually happen.

A better approach

Concrete plans for the UK to return to the 0.7 percent ODA target in 2024/25 are a welcome sight.. But the speed and uncertainty of this return are both concerns.

We suggest an alternative approach that addresses both concerns. There will always be uncertainty about the future, and waiting for the latest forecasts to reduce this uncertainty comes with the trade-off of providing less time to carefully plan the return to 0.7 percent.

There is also no reason to treat the aid budget as discrete: stuck at either 0.5 or 0.7 percent of GNI. Instead, the aid budget could be increased by smaller shares of GNI each year, as long as the forecasts predict that the Chancellor's tests will be met. If the forecasts are stable, this achieves a smooth path back to 0.7; if they fall back below the benchmarks, it allows for a pause.

Such an approach has three advantages. First, it mitigates the value for money risks associated with a rapid increase in spend. Second, it helps poor countries by reducing the amount of aid they lose out on due to the Chancellor’s fiscal test. And third, it helps to alleviate the absurdity of a discrete—and massive—jump in ODA when fiscal measures only just creep over the line set by the tests. And it does all of this while remaining true to the spirit of the Chancellor’s initial reasoning: for aid to reflect the changing fiscal circumstances.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Adobe Stock