This blog is part of a series by CGD ahead of the EU-Africa Summit which will begin on 17th February 2022. This series presents proposals for priorities, and commentary on whether a meaningful reconstruction of the relationship between the two continents is likely.

Climate and trade will be major issues at the sixth European Union (EU) – Africa Union (AU) summit on 17-18th February. One item on the agenda is the EU’s new proposal to apply a carbon border adjustment mechanism (CBAM) on imports in five sectors when those imports do not pay a carbon price in their domestic economy. The proposal is designed to lower carbon emissions globally, but at what price for African countries? Under the proposed CBAM, African exporters would face higher taxes even though emissions from African countries collectively will remain a fraction of EU emissions for decades to come. (By the start of the EU-AU summit next week, the average EU citizen will already be responsible for more emissions than the average Nigerian over the course of the year.)

The EU’s CBAM as currently envisioned will harm African economies, particularly Mozambique which our analysis suggests could plausibly lose over 1 percent of its GDP. We suggest a more equitable and collaborative approach to climate transition. We propose that the AU does not seek an exemption from CBAM but argue that instead, the EU lifts the share of its concessional finance to Africa from a fifth to a third, and offers technical support to help African countries introduce compliant carbon pricing, and committing to continuously review the impacts of the CBAM on the least developed countries.

What is the EU CBAM proposal?

The CBAM proposal aims to avoid “carbon-leakage” as the EU raises its own climate ambition. With strong environmental standards inside the EU, the bloc wants to prevent industries from transferring polluting production to non-EU countries or replacing EU products with more carbon-intensive imports.

In practice, this means that the EU is planning to establish a levy on imports from [p-EU-countries equivalent to the difference between the price of carbon inside the EU and the price of carbon in the country exporting to the EU. In the Commission’s proposal, EU importers will buy carbon certificates corresponding to the carbon prices that would have been paid had the goods been produced in the EU. If a non-EU producer can show that it has already paid a price for carbon, the corresponding cost can be deducted for the EU importer.

In its first phase, the CBAM will focus on five products with a high risk of “carbon-leakage”: cement, iron and steel, aluminium, fertilizer, and electricity. The adjustment is set to apply from 2023 on selected products before becoming fully operational in 2026.

The European Commission first proposed the CBAM in July 2021 and the European Parliament and the Council are currently considering it. The European Parliament, through the Committee on the Environment, Public Health and Food Safety, submitted a draft report on the proposal in December 2021.

What impact would it have on developing countries and on Africa?

For the five products initially subject to the CBAM, the EU is highly dependent on imports. With data from Eurostat COMEXT, we evaluate the impact CBAM would have on African countries exporting four of these products to the EU (the quality of the data on electricity imports is insufficient for our analysis).

We have analysed the EU import data and six African countries (Egypt, Mozambique, Algeria, Morocco, Tunisia, and South Africa) appear at least once in the list of top 10 importers most affected in each sector. No African countries are in the iron and steel top 10 but Egypt and Algeria are big exporters of fertilizer, and Algeria is also the EU’s fifth largest cement exporter.

Figure 1.Top 10 EU importers of fertilizer and aluminium (1,000 tons, 2019)

Notes: African countries in grey; middle-income countries in yellow

Source: Authors’ analysis of COMTEXT data

A notable exception is Mozambique, for its extraction and export of aluminium. As highlighted in the impact assessment of the EU, 54 percent of Mozambique’s aluminium exports went to the EU in 2019, amounting to around $1 billion or 7 percent of the country’s $14 billion GDP in 2020. As the CBAM could increase the cost of aluminium exports by 39 percent (based on 11.5 ton of CO2 per ton of aluminium multiplied by a current EU carbon price of US$102 per tonne, and adding to the current aluminium price of around US$3,000 per tonne), it’s not implausible that Mozambique’s GDP would fall by 1.6 percent if demand follows the price change (ie if the elasticity of demand is equal to minus 1). Although this is just illustrative it's clear that Mozambique’s economy would be materially affected.

The EU’s own analysis also reveals that the 46 least developed countries (LDCs)—33 of which are in Africa—are not well represented among the EU’s main sources of imports for three of the five products: LDCs account for less than 0.1 percent of imports of iron and steel, fertilisers, and cement to the EU. Nevertheless, as noted in previous literature, these industries still provide a significant source of employment and income for people in LDCs, and a carbon border tax has the potential to inhibit development of the middle-income countries that do export these goods. Mauritania, Sierra Leone, and Senegal each have sectors which are exposed to C-BAM and contribute more than 2 percent of their GDP.

Many African countries are striving to build nascent industries, but carbon-intensive industries are a double-edged sword. Steel, aluminum, and fertilizers are core ingredients to Africa's development trajectory—and essential to the construction and agricultural sectors. Imposing a blanket tax on carbon-intensive industries will most likely affect weaker economies and reduce their profit margins associated with goods from such industries. In addition, some of the products subjected to tax are also goods required to scale up renewable energies, such as cobalt, steel, and aluminum. A tax on these products could mean that the mitigative burden of industrialized nations is shared across developing countries.

BRICS impact and WTO compliance

Looking across the five sectors initially covered by the CBAM, non-African middle-income countries are the most affected, in particular China, Russia, India, Ukraine, and Turkey. The UN trade agency UNCTAD has examined the projected international trade dynamics following the introduction of the CBAM, and although the overall impacts are relatively limited, there could be a significant negative effect on welfare in developing countries. UNCTAD predicts that with a $44 per ton carbon tax, developed country income would rise by $2.5 billion while incomes in developing countries would fall by $5.9 billion.

BRICS countries have argued that the CBAM does not comply with the World Trade Organization’s rules, and they fear that transaction costs in achieving high ambitions at the same speed with EU countries will undercut other mitigation efforts and slow down investments in hard-to-abate sectors. For example, South Africa has increased its efforts to disinvest from coal, but by shedding jobs in such sectors, it may give an unfair advantage to EU countries that can produce similar products using all the requisite environmental and economic levers at home. In short, South Africa is displacing coal, but this will not happen overnight, and pressuring economies to accelerate the transition with record speed will have implications for their development.

The bottom line is that many lower-income trading partners perceive the CBAM as placing unfair economic and trade burdens on countries whose right to development is being denied even as they pursue ambitious mitigations domestically.

A tax on African industries already facing European climate externalities

A carbon border tax as a policy instrument is equated with losses on competitive African industries, especially in a context where the latter are already subjected to climate externalities created by long-industrialized nations like those in the EU. In addition, levying tax on products from carbon-intensive sectors will slow down an already chequered history of technology transfer. Indeed, new models of sharing knowledge are needed beyond simply pushing the technology transfer logic or finding a “home” for a technology good without due regard to broader socio-economic context .

Furthermore, there are concerns that the EU will expand its border carbon tax ambitions, further excluding countries engaged in carbon-intensive industries while those most able to comply with the regulations enjoy the benefits of trade and green development. Moreover, the CBAM is not necessarily a disincentive for industries that want to exploit weaker governance systems and a poorly regulated environment to grow their “dirty sectors.”

Some development thinkers have argued that the CBAM is good in its mitigative principles. It will force countries in Africa to be more stringent with standards and create a “rehearsal” space for green goods and services investments. Moreover, if African countries can introduce their own carbon price, they can avoid the CBAM and raise revenue to support new infrastructure, enabling more significant support to countries least able to race towards net-zero. Still, the implication then is that EU should take action to ameliorate the impact on its African partners with finance, and make support available in designing national carbon pricing.

What impact for the EU?

The CBAM is part of a package of new “own resources” for the European Union—that is, alongside tariff income and the EU’s Emissions Trading System, the revenue raised will be directly controlled by the EU, and is expected to contribute to the repayment of NextGenerationEU, the EU’s plan to support financial recovery from the pandemic. Based on the European Commission’s own analysis, the CBAM is expected to generate around €9.1 billion in revenues per year from 2030.

What impact on the reduction of GHG emissions?

The European Commission estimates that CBAM will help reduce CO2 emissions in the sectors it covers by 1 percent in the EU and 0.4 percent in the rest of the world in 2030. It also predicts that the CBAM will decrease carbon leakage in the five sectors by 29 percent in 2030.

However, the Commission recognise there are risks to these figures; the example of California’s carbon border tax shows that positive impacts on the environment are not guaranteed. Introduced in 2018 on electricity imports, California’s tax led to a “re-shuffling” of resources whereby low-emissions products were allocated to carbon-regulated markets, while more carbon-intense products were diverted to unregulated markets.

What should policymakers consider when finalizing the proposal?

Several proposals have emerged for mitigating the impact of the CBAM on lower-income countries. Some, like the Centre for European Reform have argued that, as with the EU’s trade preferences where LDCs pay no tariffs, LDCs should be exempt from CBAM. Others, including a group brought together by the Institute for European Environmental Policy, suggest limited exemptions, but emphasise an allocation of the resources raised.

As the European Parliament and the Council consider the CBAM proposal and ahead of the EU-AU summit, we argue for a collaborative approach with two key elements:

1. Limited exemptions for LDCs

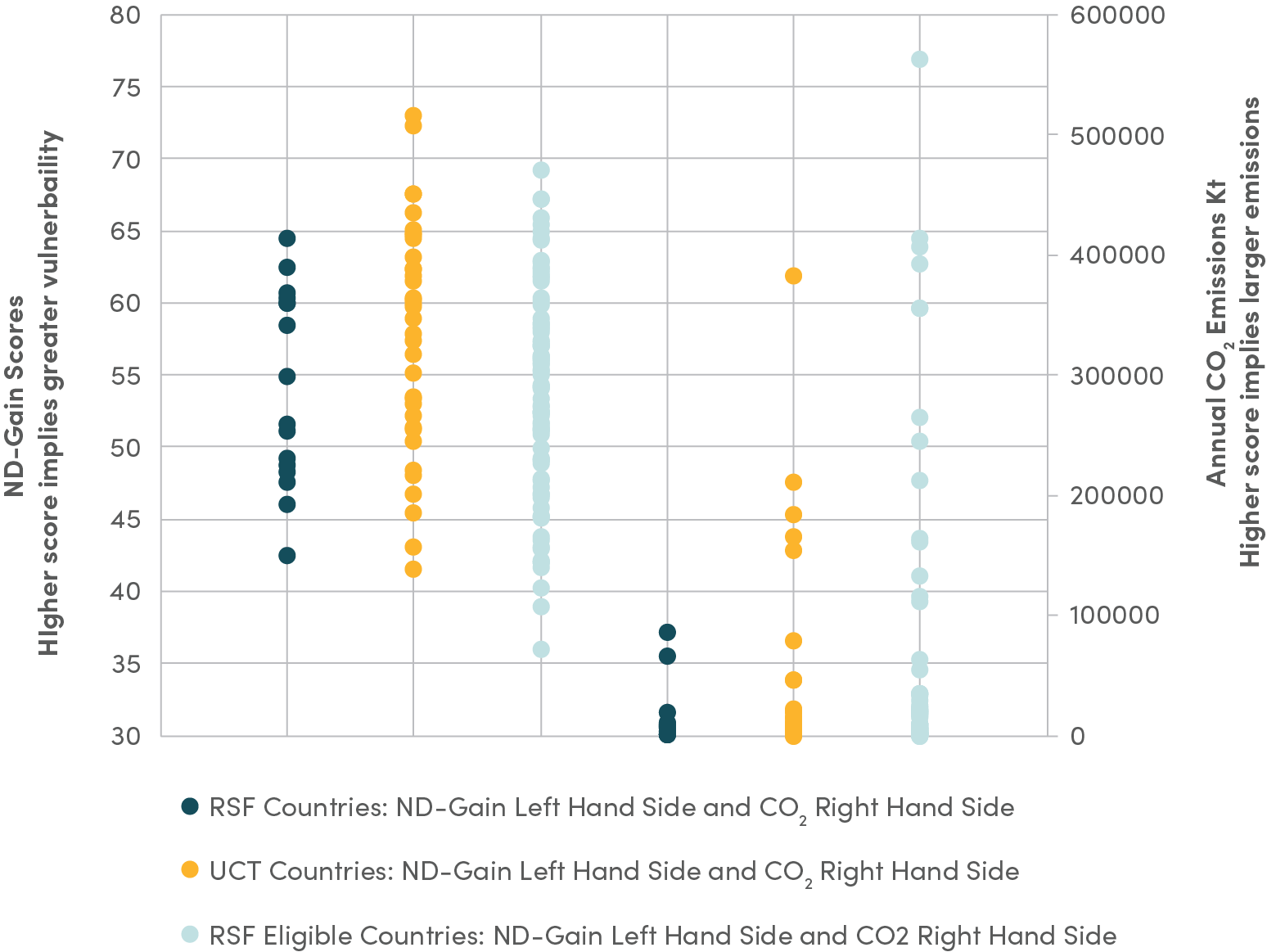

There is no doubt that there is some inherent inequity in the EU taxing African countries despite these countries’ very small carbon footprint (for the foreseeable future). However, a full exemption could be difficult to remove once established, and would create a risk that carbon-intensive industries could relocate to exempted countries.

There is a reasonable argument that the AU could request a delay in implementation which would allow its lower-income members greater time to adjust and transition to more environmentally friendly production methods.

But subject to an allocation of CBAM resources to lower-income countries (see below) it seems more consistent for all countries to be subject to the regime.

2. Allocation of finance alongside CBAM

A key objective of the CBAM is to generate resources for the EU and contribute to repaying the EU’s borrowing in the context of COVID-19. Nevertheless, as suggested by the European Parliament, the EU could use the proceeds of CBAM to support the LDC on climate—we see a good case for such an allocation.

The Commission and EU will need to think about the practicalities of sharing a portion of CBAM revenues. A larger issue is how the EU uses finance to support Africa’s climate resilience. Looking at the EU institutions’ official development assistance, just 19 percent went to sub-Saharan Africa in 2019, well below the US share (35 percent) and the UK’s (28 percent). The EU figure is expected to rise from 2021 in the EU’s new budget, and if the Commission aimed for at least a third of all ODA to be directed to sub-Saharan Africa, then based on 2020 spend, this would mean some €7.4bn per year (and over double the €3.4bn provided in 2019).

The EU-AU summit presents a key moment for policymakers to discuss the impacts of the CBAM on African economies and ways to mitigate these impacts. Despite significant potential benefits in the reduction of greenhouse gas emissions and carbon leakages, the current CBAM text proposed by the European Commission puts African industries at risk of falling behind in their path to prosperity. The summit must address the question of the CBAM’s negative impacts on welfare in the low-income countries that have contributed almost nothing to climate change but who will be most exposed to its impacts, including countries in Africa. We urge African and EU leaders to agree a substantial financial contribution alongside the introduction of the CBAM – particularly for Mozambique. In addition, the EU should offer technical support to African countries for introducing compliant carbon pricing and commit to keep impacts on LDCs under review.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Adobe Stock