Recommended

Each year, millions of people depart poor countries to work in rich ones, where their wages rise by multiples, as study after study has found. What is much less clear—and harder to study— is how that cash affects long-run economic development in the areas those migrants come from. Say we observe that areas from which many people migrate are relatively poor. That could happen because a lack of opportunities in poor areas cause people to migrate, and not because the smartest people emigrating cause the area to become poor. In a new paper, we take a closer look at this question by using a natural experiment in the Philippines to isolate and measure the effect of migrants’ income on the broader, sustained development of the areas they migrate from.

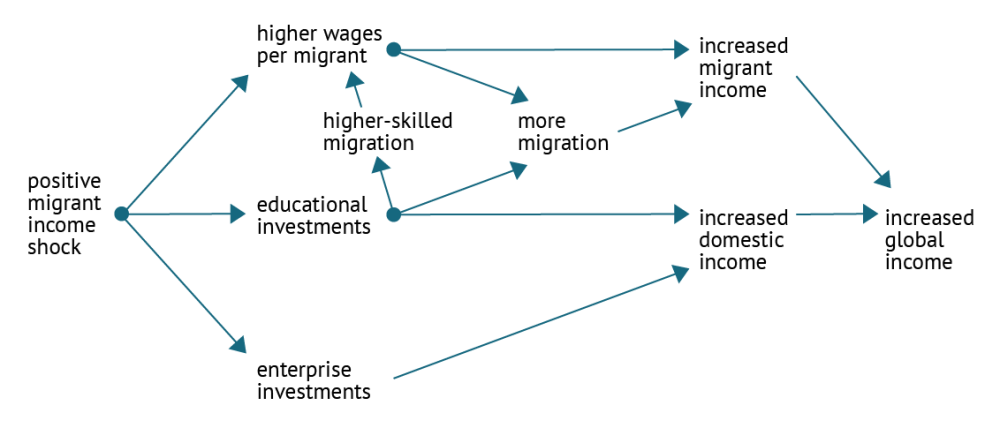

In theory, it is not hard to see how long-run economic development could arise through migration-fueled investment. Access to migrant income could allow households in origin areas to invest in education and household enterprises, leading to higher domestic incomes. This increase in education could, in turn, lead to an increase in emigration rates, and shift future migration towards higher paid overseas work. If so, an initial migrant income shock might have magnified effects in the long run.

But actually measuring such effects poses three challenges. First, it is rare to have individual-level data on international migrant incomes that one can compare with data on domestic income, to study the global income of origin areas. Second, we have to carefully consider how migrants and their families make decisions about whether and where to migrate, and how much to invest in things like education back home. Third, it is unusual to find a setting where a force majeure causes migrant incomes to change in a way that couldn’t, itself, be caused by the effects (like education) that we’re trying to measure. In this blog, we discuss how our paper does each of these.

Challenge 1: Exploring new data

We obtained new administrative data on migrant income from the Philippine government's migrant worker contract database, allowing us to estimate changes in migrant income in subnational areas. We combine these data with household survey data to analyze impacts on the global income (domestic and international sources of income) of migrant origin areas. This allows us to study long-run impacts of shocks to migrant income on global income, and its international and domestic income components.

Importantly, in the Philippines, migrant income is large enough in aggregate that migrant income shocks could be expected to have detectable impacts in the local economy. In our period of analysis, international migrant income accounted for 13.6 percent of the global income of Philippine households, and roughly one in four Philippine households received remittances from international migrants.

International migrant income accounted for 13.6 percent of the global income of Philippine households, and roughly one in four Philippine households received remittances from international migrants.

Challenge 2: Unpacking relationships between migration, education, and income

We are particularly interested in how much of the long-run gains in income are due to increased educational investments, which affect international income (via future migration and occupation choice), as well as domestic income (by making workers more productive). Figure 1 describes the broad framework and mechanisms that could amplify initial shocks to migrant incomes.

In our paper, we isolated the contribution of various mechanisms to shows the importance of education investments in migration-led development. Our framework is simple and intuitive, showing the overall changes in flows and incomes as a function of education investments and wages.

Figure 1. The impact of increased migrant incomes in the long-run

Challenge 3: Isolating the impact of exchange rate shocks

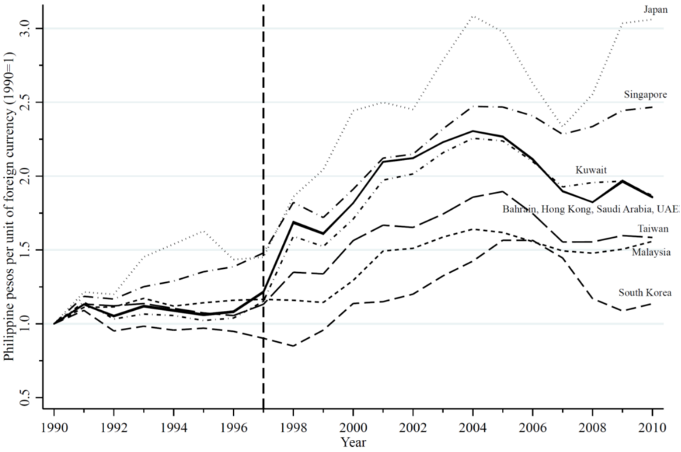

To separate causation from mere correlation, our paper leveraged changes in migrant incomes driven by the 1997 Asian Financial Crisis exchange rate shocks. Some currencies suddenly appreciated relative to the Philippine peso, meaning that Filipino workers in those countries saw the real Philippine peso value of their wages jump almost overnight.

At the time, Filipino provinces were sending varied numbers of international migrants to different destination markets worldwide. These markets saw differing changes in their exchange rates (see figure 2). This meant that different migrant-origin provinces had different degrees of exposure to these sudden changes in migrants’ peso-value earnings. By comparing provinces with more migrants in Japan, to provinces with more migrants in South Korea, for example, we are able to isolate the pure effects of additional migrant income on households in those provinces.

Figure 2. Exchange rate shocks generated by the 1997 Asian Financial Crisis

Our findings

On the international side, our paper found positive effects on migrant income that continue to grow over time. After a decade, the positive effect on migrant incomes are substantially magnified compared to the size of the initial migrant income shock thanks to higher participation and improved performance in the international labor market. The initial shock leads to increases in new departures for overseas jobs, and increases in migration for higher-skilled overseas jobs in particular. We find large increases in average earnings per migrant, reflecting that these higher-skilled jobs have higher wages.

These increases in origin-areas' aggregate migrant earnings add up to long-run gains in income that are several times the size of the initial shock to migrant income. In other words, after some migrants invested in migration, higher returns on that investment allowed other families to invest in migration, with even higher returns—a multiplier effect that cumulates over time.

In other words, after some migrants invested in migration, higher returns on that investment allowed other families to invest in migration, with even higher returns—a multiplier effect that cumulates over time.

On the domestic side, the positive migrant income shocks also have large impacts on income that households earn from work within the Philippines. Most of this comes from entrepreneurial activities, suggesting increased investment in household enterprises. By contrast, there is no indication that any of the increase in household domestic income derives from higher earnings as wage workers for other employers.

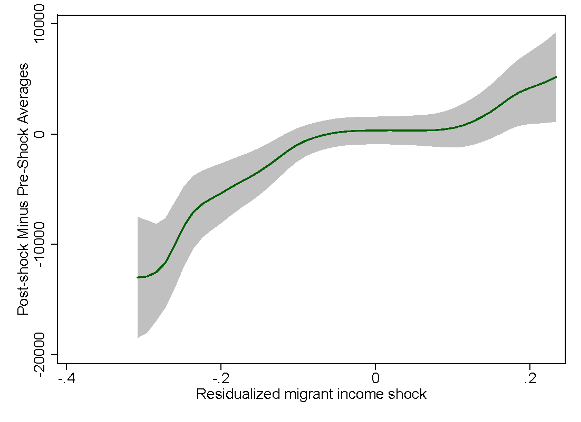

Figure 3. Changes in global income per person in response to the 1997 Asian Financial Crisis

While the initial migrant income shocks led to increases in both migrant and domestic income, we find that most of this increase (75 percent) came from the latter—over the course of a decade, the domestic income gains actually come to dwarf the international income gains.

Figure 3 describes this change in global income (vertical axis) as a function of the initial migrant income shock in origin provinces (horizontal axis). These gains in global income are also reflected in key measures of household economic well-being. The increases in migrant incomes lead to higher household consumption and higher asset ownership in origin areas a decade later.

Given the central role of skill acquisition in our model, we empirically estimate impacts on educational investments. We find large positive effects on educational attainment across age cohorts.

The real importance of education investments in amplifying the shock

We find that half (48.5 percent) of the increase in the international migration rate can be explained by changes in education levels: as higher shares of the population get more years of education, migration rates rise, and migrants increasingly move into higher-wage jobs. When it comes to the increase in migrant income, 42.3 percent can be attributed to increased education. Increases in education explain 17.9 percent of the increase in domestic income.

As higher shares of the population get more years of education, migration rates rise, and migrants increasingly move into higher-wage jobs.

All told, an improvement in migrant income in Philippine provinces caused long-run income gains in both the domestic economy and international migrant work. An important share of the global gains (24.4 percent of the increase in global income) can be attributed to educational investments.

In the Philippines, the jump in earnings when migrants depart is much more than just quick cash for them. It sets off a cascade of economic effects back home, rippling through migrant-origin areas for a decade or more.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: UN Women/Norman Gorecho