If the UK leaves the EU (as unfortunately seems most likely), the single market, and customs union, it will need to decide on a new schedule of tariffs for imported goods from both Europe and other countries. One of the options being touted is the unilateral removal of tariffs on all goods, as Hong Kong and Singapore do.

There are three main possible objections to this approach based on UK interests, and one for developing countries, none of which are entirely convincing.

The first is that some tariff lines provide important protection to British industries. This may be true, and deserves further attention, but it doesn’t provide a strong ‘economic’ case for continued protection.

We’ve known since at least the days of David Ricardo that the benefits to consumers from removing tariffs on imports is greater than the benefit to British producers of the protection: the question is whether or not government chooses to compensate those hurt by the change (which it could, by taxing some of the gains made by consumers). Certainly the new government in the UK has explicitly stated its ambition to increase free trade.

Second, there is the argument that the UK would be throwing away its negotiating capital that could help it sign trade deals with other countries in which they would reciprocally reduce import tariffs on British exports.

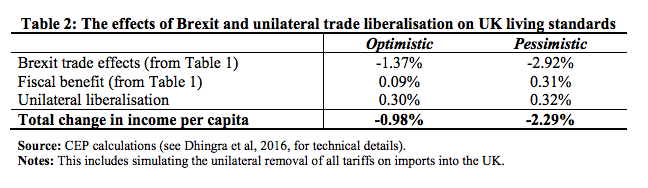

I’m not sure that this argument really stacks up though. In a paper published in March 2016, the LSE looked at whether unilateral liberalisation would help mitigate the negative effects of Brexit on living standards in the UK. They found that “unilateral liberalisation reduces the costs of Brexit by 0.3 percentage points [increases the level of GDP by 0.3 percent] … The reason that the benefits of such a radical move are small is simple. WTO tariffs are already low, so further reductions do not make much difference. In today’s world, integration is not a matter of lowering tariff rates.”

And there’s the thing—if the benefits of reducing tariffs are low, then their value as negotiating capital in signing trade deals is also low. Most trade deals are now focused on harmonising regulatory standards in order to allow access for trade in services, not cutting tariffs on goods, because most of the value is now in services.

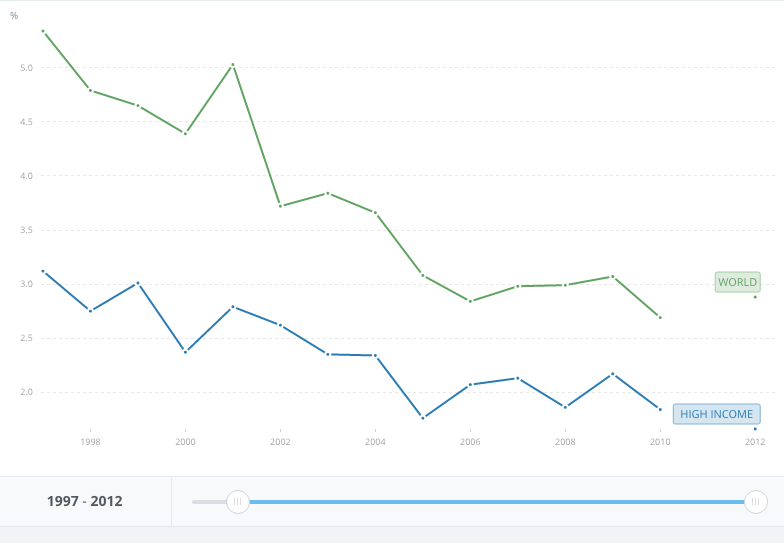

You can get an idea for why the benefits of further tariff reduction are relatively small by looking at average tariff rates. Globally, tariffs are low and falling. The average tariff rate levied by high income countries across all products (weighted by trade volume) is just 1.66 percent. The downward global trend in tariffs also suggests that the potential gains from getting other countries to cut their own tariffs is likely to diminish over time, as they will eventually decide to reduce them anyway.

Tariff rate, applied, weighted mean, all products (%)

World Bank staff estimates using the World Integrated Trade Solution system, based on data from United Nations Conference on Trade and Development's Trade Analysis and Information System (TRAINS) database and the World Trade Organization's (WTO) Integrated Data Base (IDB) and Consolidated Tariff Schedules (CTS) database.

Third, there is the fiscal revenue that tariffs earn. It might not be a huge amount, but in the context of continued fiscal deficit and an economy already weakened by the mere possibility of Brexit, the treasury may be reluctant to let any revenue go. This resistance should be tackled head-on. It could also be compensated for with a slight increase in other taxes such as VAT.

Finally, (and perhaps most importantly) for developing countries: reducing tariffs to zero on agricultural products would be great for many developing countries whose economies (unlike ours) are heavily reliant on agriculture. But there is a potential downside: reducing tariffs for all countries makes it impossible to offer preferentially lower tariffs for those developing countries that really need the support. At present the EU unilaterally offers zero tariffs for “Least Developed Countries,” and evidence suggests that preferential margins like this (the difference between tariffs for favoured countries and other countries) increases trade above and beyond a simple reduction of the overall tariff rate.

However, preferential lower tariffs were always intended as temporary measures in any case, with the full expectation that they would continue to be ‘eroded’ as all tariffs came down. And just as standards, regulations, and other “non-tariff barriers” increasingly matter for trade between high income countries, they are also critical for low income countries. The UK could compensate low income countries for the loss in preferences with additional “aid-for-trade” to help producers meet modern health and safety standards, and help governments develop the physical port infrastructure and administrative systems to allow for smoother trade.

Ryan Young, of the Competitive Enterprise Institute writes, “The logic of embracing free trade unilaterally, that is, no matter what policy any other national government adopts, is well expressed in an adage attributed to the economist Joan Robinson:

If the case against unilateral tariff reduction is to be made, it must be explained how these potential hurdles outweigh the overall gains to the UK economy, the gains to agricultural producers in developing countries, and the global leadership of taking such a bold step towards freer global trade.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.