Recommended

A large crowd gathered on the White House lawn recently to celebrate the passage of H.R. 5376, the Inflation Reduction Act (IRA). Among the IRA’s key provisions was an enabling of the Medicare program, the national public insurance scheme in the US for the elderly, to directly negotiate prices with prescription drug manufacturers for the first time in its nearly 60-year history. In the words of President Joseph R. Biden, Jr.: “for years, so many of us have been trying to fix this problem. But for years, Big Pharma blocked Medicare from negotiating lower drug…prices. But not this year. Not this year. This year, the American people won, and Big Pharma lost.”

There is much to celebrate in the IRA’s list of drug reforms; in addition to negotiation, Medicare now has the ability to impose controls on price increases over time, and Medicare enrollees will benefit from caps on out-of-pocket expenses for prescription drugs in general and insulin in particular. But price negotiation is the big hammer here. The nonpartisan Congressional Budget Office (CBO) estimated that this provision alone could amount to nearly $100 billion in savings over a decade, even though negotiations would be limited to just 10 drugs to start with.

Why are the savings projected to be so big? Well, the drugs that will be targeted initially will be those that have been on the market for a very long time, have enjoyed price increases multiple times per year, and have far outlived their originally intended patent life thanks to well-known tricks, gimmicks, and anti-competitive practices that the industry is known for. But that’s a story for another time.

Let’s focus again on the projected savings. It is not just the sheer size of the cost that Medicare bears for these older drugs, it is that the prices Medicare currently pays are not in any way aligned with the clinical benefit that they provide. The CBO appropriately applied cost-effectiveness and other techniques of value assessment to better understand what a fair price would be. And $100 billion followed.

It is these techniques that opponents of the IRA are targeting in their current rhetoric. All Republicans on the Senate Finance Committee sent a letter to the Secretary of Health and Human Services and the Administrator of the Centers for Medicare and Medicaid Services, arguing that use of value assessment techniques and the tools they use to summarize clinical benefit would discriminate against certain populations and chill future industry innovation (claims that have been challenged by CBO, the research community, and others). They have demanded that other approaches be used instead.

If these pressure tactics are successful, Medicare will have few options at its disposal. Yes, the law allows for price ceilings to be set based on the time a drug has been on the market, but these ceilings will still be far above the value that patients are realizing from these therapies. Medicare will likely turn to an approach introduced in failed legislation that predated the IRA—external reference pricing (ERP).

ERP is exactly as it sounds—a method of tying prices paid here to those paid in other countries. As has been documented exhaustively, drug prices in the US are routinely 2-3 times higher than those in other, economically-similar settings. This would also produce significant savings for Medicare—in fact, CBO’s scoring of the earlier legislation suggested even greater savings.

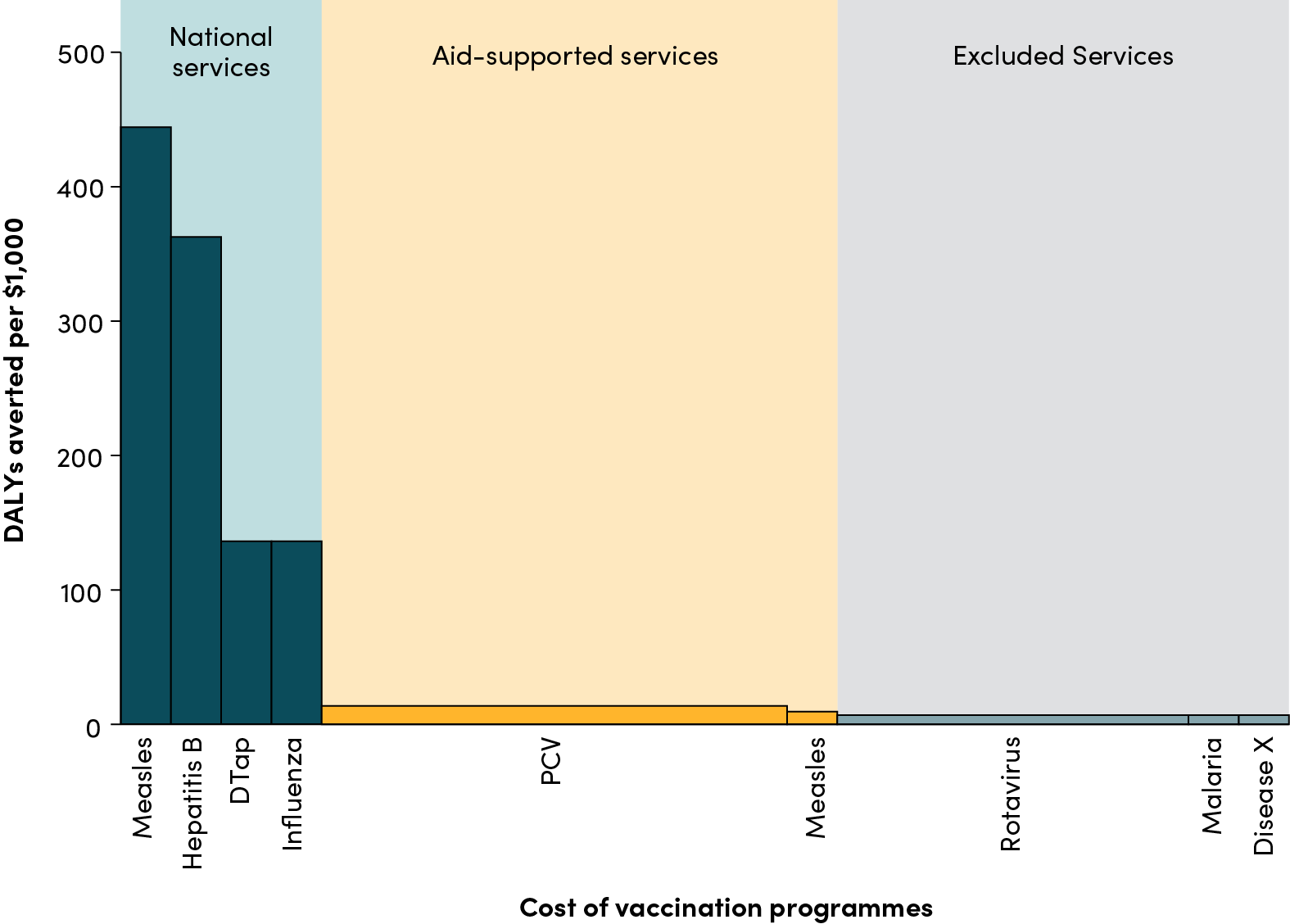

And how do these countries negotiate lower prices? In many places, it is the result of—you guessed it—value assessment. These countries explicitly integrate the results of cost-effectiveness analyses, often initially submitted by the manufacturers themselves, along with other considerations and contextual issues important to those societies, to negotiate a price. Other countries benefit from value assessment not only because it keeps prices down, but because it allows these health systems to prioritize the investments that deliver the most health for the money available. Formal priority-setting approaches are being implemented with increasing frequency in low- and middle-income countries (LMICs), for whom some of these decisions are literally life or death. Paying an exorbitant price for a rare disease treatment in an upper middle-income country might have meant foregoing the purchase of enough ventilators to effectively manage COVID-19 pneumonia, as just one example.

Use of a process like ERP to control drug prices in the US will effectively mean that all of the international analyses, considerations, and context will then inform the price that Medicare pays here. America will be importing value assessment from elsewhere. This is not in and of itself a bad thing. Indeed, many LMICs that lack the resources to conduct formal health technology assessment opt instead for an adaptive approach that translates rigorous analysis done in other settings to the local context and integrates this with domestic priorities.

The US does have the resources to develop its own approach, and can learn from these international examples to institute a domestic method for value assessment. One that is rooted in local epidemiology and costs, standards of practice, and willingness to pay for health improvements. But if the pharma industry and other opponents of value assessment stand in the way of its routine use in the US, rest assured that we will see it again—but it will be an imported product, not one Americans can call their own.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.