Recommended

For all its faults, Facebook does not lack ambition. The company’s announcement last week that it, along with other members of the newly-formed Libra Association, intends to create a new global digital currency is big news for global finance and the future of money. Even if the project ultimately fails to gain traction, it marks an important step in the ongoing discussion about the role of digital currency and will force national authorities to accelerate their pace of learning on the issue and determine their policy stance.

The case for a global digital currency

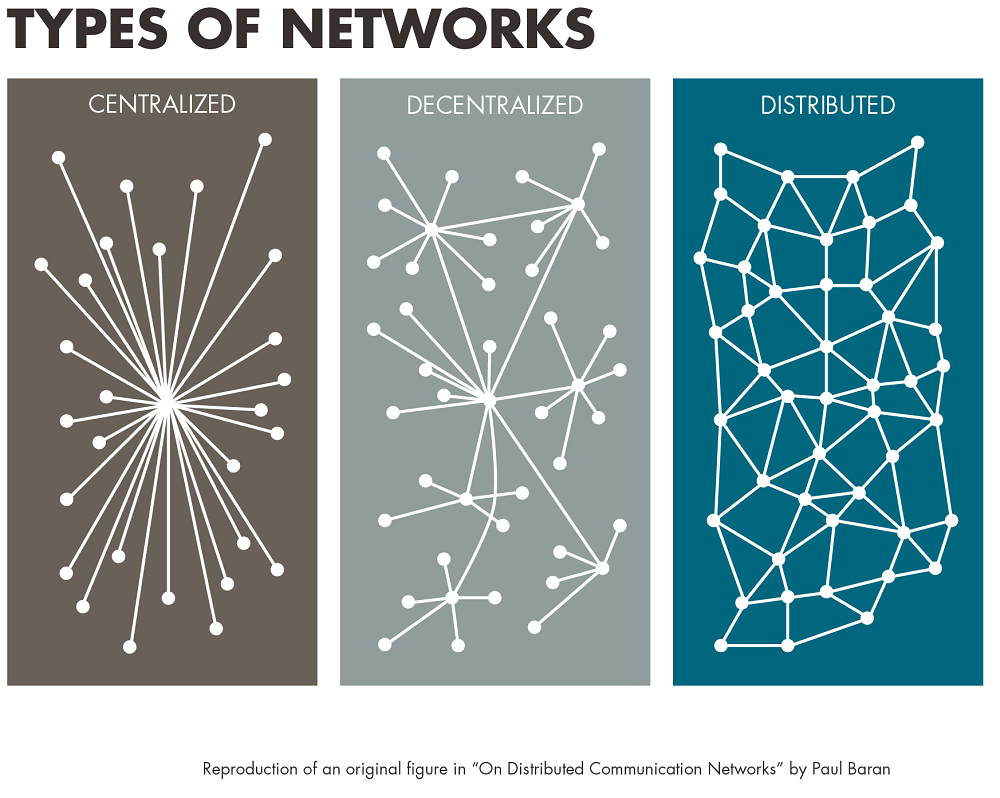

While the idea of creating a global currency is not new, most earlier plans (like John Maynard Keynes’ bancor proposal) focused on helping countries settle international accounts rather than facilitating peer-to-peer transactions. The creation of Bitcoin in 2009 represented a step towards achieving the latter goal by introducing a digitally native asset that used cryptography to control the creation of new units and secure a record of transactions on a distributed ledger.

From a global payments perspective, the exciting part about Bitcoin and cryptocurrencies more broadly was that they offered a way to conduct international payments outside of the existing correspondent banking system (though, to be clear, creating an efficient channel for cross-border transactions does not require the use of cryptocurrencies or blockchain, as evidenced by the increasing role of mobile money platforms for sending remittances).

As it stands, cross-border transactions must pass through a series of bilateral correspondent bank relationships before reaching their destination. This process can be particularly costly and inefficient for transactions between smaller countries, since they often pass through a higher number of intermediating banks and require the use of a major currency (like the US dollar, Japanese yen, or euro) to serve as a bridge. This inefficiency is a key reason why conducting remittances remains so costly in many corridors.

After generating manic levels of excitement earlier this decade (including a near-2,000 percent price spike in 2017), Bitcoin has failed to live up to its promise as a means of exchange for a variety of technical and legal reasons. While the technical barriers—such as excessive volatility, slow transaction speeds, and difficulty scaling—are significant, the more difficult hurdle has been financial regulators’ aversion to payment systems that allow users to mask their identity when conducting transactions, as many cryptocurrencies, including Bitcoin, do.

Despite these challenges, the holy grail for global payments remains the same: to allow people to send money both within and across national borders from their digital devices as easily as they send texts or photos. The creation of a single global payment infrastructure, like the one promised by the Libra Association, would be a step towards meeting this goal.

Why Libra is potentially a big deal

The Libra white paper lays out a grand vision for establishing “a reliable digital currency and infrastructure that together can deliver on the promise of ‘the internet of money.’” The approach draws on the unique properties of cryptocurrencies, while making several design choices intended to resolve the technical limitations faced by Bitcoin. This includes trying to ensure greater stability in the value of Libra by anchoring the currency to a basket of liquid financial assets, using a more flexible consensus protocol to increase transaction throughput, and making the infrastructure easier to govern by relying on a permissioned governance system in which only members of the Libra Association have decision-making authority (the Association now stands at 28 members but is expected to grow to 100 members by the first half of 2020 when Libra is officially launched).

While this last choice runs counter to the decentralizing ethos behind Bitcoin and other cryptocurrencies, the Association has stated that it intends to move towards permissionless governance within five years. But the white paper does not provide details on how this transition will be made and the Association admits that “as of today we do not believe that there is a proven solution that can deliver the scale, stability, and security needed to support billions of people and transactions across the globe through a permissionless network.”

The role of Facebook—and the controversy it brings

In the race to create a unified global payments system, Facebook has a major advantage over other payment providers in the size of its user base, particularly in low- and lower-middle-income countries. Roughly 2.7 billion people—a staggering 35 percent of the world’s population—use Facebook, Instagram, WhatsApp, or Messenger each month. As of 2017, over 45 percent of Facebook’s active users lived in Africa and Asia, and India recently surpassed the United States as the country with the most Facebook users (250 million).

But the advantage Facebook has in sheer numbers may be more than offset by the damage the company has done to its own reputation through a series of miscues over the last several years, including the company’s slow response to disinformation campaigns conducted on its platform and mounting concerns about how the “track and target” commercial model used by Facebook, Google, and other internet companies has left consumers vulnerable to exploitation through the misuse of personal data.

The Libra Association has tried to create a degree of separation from Facebook by emphasizing that the company will only play a leadership role through 2019, after which it will have no more control over the project than any other member of the Association. But there is no question that Libra is Facebook’s creation, and the swift and overwhelmingly negative media reaction to the project highlights how difficult it will be to drive a wedge between the two entities.

The idea that Facebook could one day operate both the biggest social media platform and the biggest payments platform in the world raises serious questions about how it would wield this power.

There is also no doubt that Facebook has more to gain from a successful Libra rollout than any other company. It will do this mainly through Calibra, the newly formed Facebook subsidiary that will provide a digital wallet for storing Libra on Messenger and WhatsApp, and in a standalone app. Facebook’s aim with Libra appears to be less about earning direct profits—the company reportedly will not charge transaction fees for peer-to-peer payments—and more about expanding the reach of the Facebook/Messenger/WhatsApp ecosystem by establishing it as a gateway for digital payments.

The idea that Facebook could one day operate both the biggest social media platform and the biggest payments platform in the world raises serious questions about how it would wield this power. And although Mark Zuckerberg has pledged that any information customers share with Calibra will be kept separate from Facebook and therefore not used to target ads, politicians and regulators have already voiced their concerns about the competitive advantage the company could gain from operating both platforms. Notably, this includes House Representative Maxine Waters, the head of the U.S. House Financial Services Committee, who has called on Facebook to suspend its plan to launch Libra until Congress can review it more closely.

Libra and remittances

While keeping these concerns in mind, it is also worth considering the benefit that a system that enables free peer-to-peer cross-border transactions could provide to families who rely on remittances. Consider a worker in the UAE who wants to send remittances back to her family in South Sudan: According to World Bank data, today that worker needs to spend roughly $7.50 for every $100 she remits back home. If she sent $100 every month using a free peer-to-peer transaction platform like Libra, the $90 she could save annually would equate to 37 percent of the average GDP per capita in South Sudan (which was $237 in 2016, according to the World Bank).

This is an extreme case that matches an expensive remittance corridor with a very poor country, but it illustrates the magnitude of the potential benefit. Given that remittances reached a record of high of $529 billion in 2018 (which was significantly larger than global foreign direct investment flows, excluding those to China), the aggregate size of potential savings among those who send and receive remittances is massive.

Financial regulators will have the final say

Much of the excitement that surrounded Bitcoin earlier in the decade stemmed from the notion that its users could participate in the formal economy without having to comply with existing financial regulations. This always dubious notion has been proven false by a growing number of governments who have squeezed much of the life out of Bitcoin by taking steps to regulate or, in some cases, outright prohibit the exchange of local currency for cryptocurrency.

Facebook and the Libra Association are trying to create a global digital currency that (whether they intend it to or not) could one day rival the role of national currencies and, in doing so, undermine the ability of central banks to control domestic monetary policy.

Although the Libra white paper pays due respect to the role of government regulation and Facebook has said that the Calibra wallet will abide by the same customer verification requirements that banks and credit cards must meet, this may not be enough to appease regulators. That’s because Facebook and the Libra Association aren’t merely trying to create a new financial institution. Instead, they are trying to create a global digital currency that (whether they intend it to or not) could one day rival the role of national currencies and, in doing so, undermine the ability of central banks to control domestic monetary policy. Given the high stakes, many governments are unlikely to permit the use of Libra within their borders without conducting serious due diligence and before being convinced that the currency can help them attain their own policy aims.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.