Recommended

There is an industrial revolution underway in sub-Saharan Africa’s most entrepreneurial economies—places such as Ghana, Uganda, Senegal, and Côte d’Ivoire. So far, it has failed to garner much attention, perhaps because it doesn’t fit the expected mould of large-scale structural transformation. But viewed through the kind of close-up ethnographic lens I describe in a recent CGD note, trends in these countries show that the growing engagement of smaller Chinese businesses is fuelling a new kind of industrialisation—what I call Alibaba industrialisation.

Reframing the discussion on China-Africa trade

For a long time, focus rightly remained on the spate of de-industrialisation, de-formalisation, and rapid growth of the low-productivity, retail-driven, informal sector, which was driven as much by the growth of the China-Africa trade boom as by any other factor.

In two decades, Sino-Africa trade expanded twentyfold, from $10 billion in 2000 to more than $200 billion today—the world’s fastest growing trade relationship in that timespan (over shorter stretches, both Russia and Turkey are contenders).

The composition of the Sino-Africa trade surge locked Africa into the status of commodities exporter and China into that of a hungry industrial power keen on a geopolitical lockdown of vital minerals. Links were quickly drawn between this unbalanced relationship and the plight of Africa’s increasingly beleaguered city dwellers, whose numbers have swelled from 140 million in 1980 to 520 million today.

International economists fretted over the fact that only large-scale, twentieth-century, “Fordist”-type industrial complexes could absorb these masses, but with China having raised the productivity benchmark so high, Africa’s patchy infrastructure and poorly trained workforce was simply in no position to compete, rising wages and other costs in China notwithstanding. Even should China shed its old-style industries, Vietnam, Philippines, and others in the region were just waiting on the side lines to jump in. Poor old Africa had missed the boat, sorry.

Such a framing of the situation called for emergency measures. One prominent Nigerian former central banker went so far as to describe China as a “competitor that must be taken out.” Others revived old debates about how Africa had allowed the neoliberal Washington Consensus to defang it through trade liberalisation. In places like Zimbabwe, the revered tropes of industrial policy became banners once more: subsidies, “import substitution,” “indigenisation,” and even “restrictions on navigation” got a look in. Whilst much of this ground has been covered by the likes of Chang, every resuscitation was done with an air of novelty.

Looking for the wrong effects?

Whilst the Washington Consensus and the IMF’s much-maligned “structural adjustment” policies in Africa deserve their rap for arrogance and intellectual highhandedness, the truth is that actual policy practice in Africa has been quite heterodox for decades.

For example, Africa has always had some of the world’s highest tariffs and domestic market barriers to entry. Even today, whilst composite, weighted, global trade tariffs average about 2.5 percent, sub-Saharan African rates are more than double at nearly 6 percent on average. For most of the 1980s, when East Asia was industrialising, African tariffs remained above 15 percent on average compared with about 6 percent for the East Asian region.

Drilling down illustrates the situation even more starkly. Effective import duties (considering all statutory charges) on manufactured goods in Ghana are nearly 40 percent of the CIF value on average, same for DRC and Kenya, and slightly lower in Nigeria. Taking Ghana alone, for instance, simple average duties on final consumer goods/manufactured items stayed around 25 percent during the most intense period of its Bretton Woods-inspired reforms, the 1990s. These rates are twice the prevailing contemporary figures for Asia and 50 percent more than during that region’s most intense protectionist phases.

Subsidies to favoured industries, tax breaks, and high institutional costs to non-favoured entrants were additional features of the protectionist system put in place for decades in Africa.

In short, the policy kit recommended to “developmental states” to protect “infant industries” and give meaning to “state-led” industrial management has always been close at hand in many presidential and ministerial palaces in Africa. They have been used to the hilt. Even today, Africa is one of the few places on Earth where almost every investor feels they need to meet a president or minister for special protections before they bother to invest.

Why have these tools apparently made so little difference? Perhaps because all along observers have been looking out for the wrong effects: large-scale industrial complexes, large drops in imported manufactured items, and massive booms in the export of final consumer goods.

Suffice it to say that no one is entirely sure why protectionist and state-led industrial policies of the type described earlier seem to induce large-scale industrialisation in Vietnam, South Korea, and Taiwan but not in Nigeria, Laos, or Uzbekistan. Every theory adduced is racked with contradictions and does not survive granular examination.

When one stops focusing on large-scale industrialisation, however, and takes a more ethnographic and open-minded view about the possibilities, some interesting developments in Africa’s entrepreneurial countries come to the fore.

The rise of Alibaba industrialisation

The unsung industrial revolution underway in places like Ghana, Uganda, Senegal, and Côte d’Ivoire is powered by a worldwide revolution in modular plant design, multi-purpose machinery, efficient small-batch production, global SME-SME engagement, new forex transfer practices, and the growing strategic transformation of China’s late-phase industrial players.

This is quite different from the outsourcing of intermediate inputs to China that McKinsey pegs at 12 percent of all Africa’s industrial production. Or the trend that has seen more than 3,000 Chinese firms set up in Africa to explore production outsourcing. It involves, instead, a growing shift in the technology content of Sino-African flows as Chinese producers fight for margins and African traders struggle to adjust, and, more critically, an interesting departure from the conventional ideas of transnational supply chain integration as a complement of industrial production.

When it became evident that large-scale industrial complexes were going to be hard to pull off in Africa, an alternative theory of cottage industrialisation and low-tech light manufacturing started to gain momentum. Instead, what happened, at least in the most entrepreneurial African countries, was a subtle trend of Alibaba industrialisation, wherein small and medium-sized Chinese suppliers provide major chunks of the industrial jigsaw and African hustlers and unconventional industrialists act as shuttle-brokers of the various factors of production between China and Africa.

China’s medium-sized machine manufacturing sector has been under the same strain currently squeezing the Chinese SME sector as a whole. Though many are late to the game, Chinese SMEs are becoming sophisticated global opportunity hunters, ditching the somewhat passive role they played as cogs in the Western outsourcing wheel three decades ago. These SMEs are acquiring “country-specific expertise,” tailoring solutions for individual African country terrains, complete with logistics, training, and support packages.

The effects of the modular transformation of the African industrial sector, whilst subtle, are already fascinating: reassembled knockdown luxury cars in Ghana; cutting-edge clay brick kilns in Uganda; and milk-vending now a thing in Kenya.

Even more striking is the realisation that the ripple effects of these shifts may already be reflecting in the macro picture. Recent economic rebasing data shows that in Ghana, the industrial sector has grown over the last decade from 25.2 percent to 33.2 percent, whilst the share of services has declined from 56.2 percent to 45.6 percent. In Uganda, the World Bank has recognised manufacturing as the fastest growing contributor to growth. Even low-profile Benin has quietly seen a 50 percent increase in the size of the manufacturing sector since 2012. In Côte d’Ivoire, a somewhat late but now enthusiastic Chinese trade partner, as much as 62 percent of industrial added value is contributed by manufacturing. The consistent pattern across these countries has been the growing scale of capital imports from China over the same period.

Is the main point then that Africa’s major economies are already well on their way to structural transformation, and thus that anxiety is misplaced? Not exactly. My point is rather that the old obsessions with structural composition may be less relevant now because subtle but powerful technology-dominant forces are at work in ways harder to capture with conventional analytics.

So, whilst the primary concern of African development continues to remain one of “not fast enough growth,” since African economies remain, on the whole, small, poor and weak, the approach to analysing the problem needs to change. Many of the structural definitions of the growth deficit no longer maps well to reality and must be updated with better ethnography and more open-minded investigations into on-the-ground trends to better guide policy.

Bright Simons is President of mPedigree and a member of CGD’s Study Group on Technology, Comparative Advantage, and Development Prospects. Learn more at cgdev.org/future-of-work.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

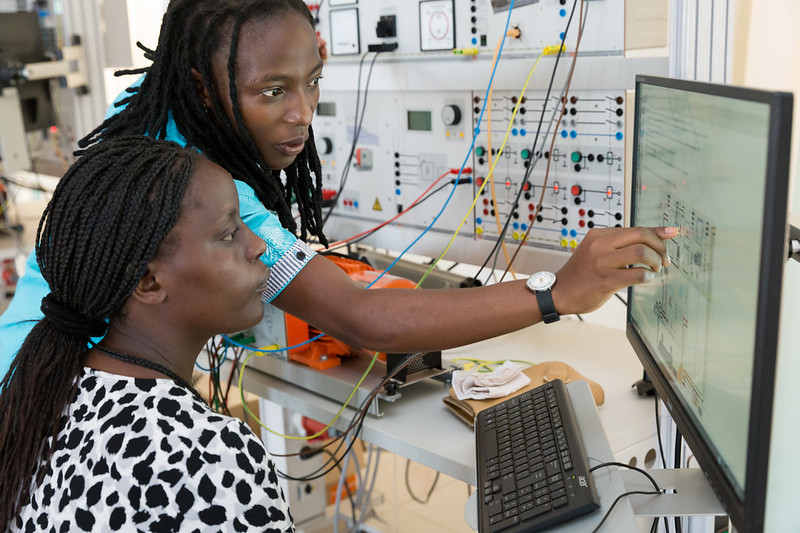

Image credit for social media/web: Simon Davis/DFID